What does the possibility of a 92.2 % federal backup rate mean in September in the encryption market? star-news.press/wp

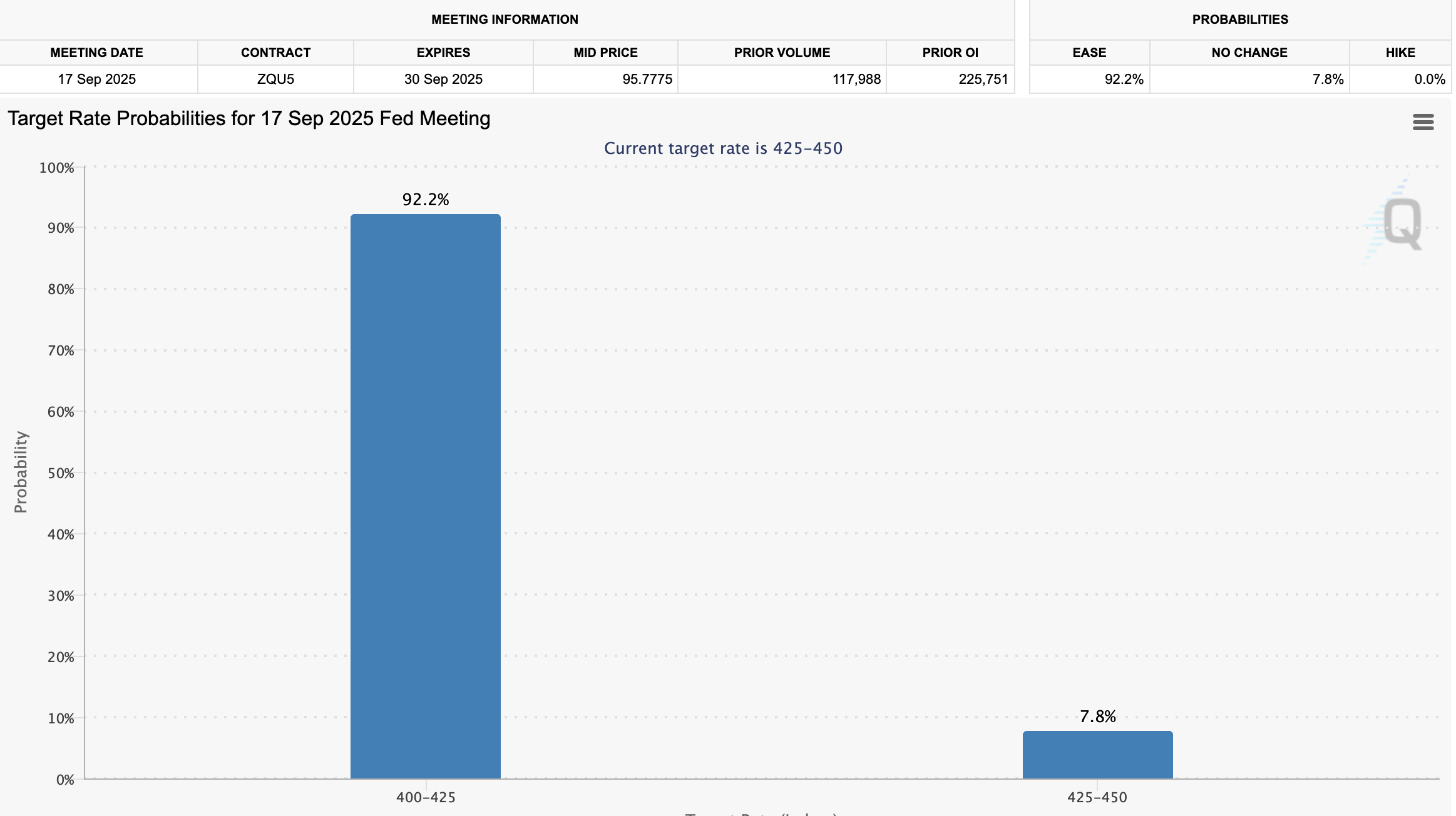

According to the latest data from the CME Fedwatch tool, the probability of reducing the interest rate in the Federal Reserve jumped in September to 92.2 %.

This transformation, driven by the weakest labor market data and the effects of the smaller tariffs expected, have sparked optimism between the cryptocurrency community. They expect that low prices can push capital to digital assets, which enhances demand and possibly increased prices.

The market is witnessing 92.2 % opportunity for discounts of the Federal Reserve Prices by September 2025

Since December 2024, the Federal Reserve has kept fixed interest rates between 4.25 % and 4.5 %. However, market monitors are increasingly optimistic that this trend may finally be broken in September.

This shift is reflected in increasing the possibility of average discounts. At the time of the press, the possibility of reducing the Federal Reserve in September 92.2 %, which is a large jump of 41 % probability At the end of July.

Moreover, four major financial institutions expect prices to start in September. Goldman Sachs recently raised her expectations, and now expected three discounts at 25 Basis.

Prices are predicted in September, October and December. The company has also modified its expectations 2026, and expects additional discounts, which target two ends from 3.00 % to 3.25 %.

“We previously thought that the effects of the summer tariff on monthly inflation and the recent great increases in some of the standards of household inflation will make it embarrassing and controversial sooner. Early evidence indicates that the effects of the tariff seem a little smaller than we expected,” male.

Other institutions, such as Citigroup, Wells Fargo and UBS, expect price discounts this year, as UBS expects a 100 -point reduction.

The increase comes before the American action report. Beincrypto mentioned that the labor market slowed in July, with an increase in the unemployment rate to 4.2 %.

However, Peter Chef, an economist and drawing expert, has raised concerns about the accuracy of data.

“Many people now expect the Federal Reserve to reduce interest rates because the previous job numbers that have been strictly estimated were revealed. However, inflation data was also inaccurate. The labor market is much weaker, but inflation is much stronger than the supported federal reserve.” He said.

Evolution in focus: How will the cuts affect interest rates on the market

But how will the reduction of interest rates on the Federal Reserve affect the encryption? Usually interest rates reduce borrowing costs, encouraging investment in more dangerous assets such as cryptocurrencies.

Historically, these transformations in monetary policy have prompted capital flows to digital assets, which often leads to increased prices. Likewise, the absence of expected cuts in July in bitcoin drops and other cryptocurrencies contributed to the link.

Current feelings in the comments are reflected in prominent voices in the encryption community, who express the upcoming expectations of market horizons.

“As I mentioned yesterday, I am very optimistic about the fourth quarter. The main engines include discounts in the potential federal reserve rate, the ongoing economic power, and the increase in regulatory clarity,” analyst Ted Bodes books.

Therefore, the high probability of reducing the September rate, with the support of revised expectations and labor market trends, places the cryptocurrency market for potential growth.

The shift from previous pessimism to the current optimism highlights the sensitivity of the market to monetary policy expectations, which paves the way for a possible transformation moment in 2025.

The post means the probability of reducing the Federal Reserve by 92.2 % in September in the encryption market? He first appeared on Beincrypto.

[og_img]

2025-08-05 07:25:00