Bitcoin $ 107,000 and $ 110,500 are set as decisive goals in the short term star-news.press/wp

Bitcoin (BTC) continues to hover about $ 108,000 after a simple profit by 0.33 % in the past 24 hours. The leading cryptocurrency continues to continue in a wider unification range between $ 100,000 and $ 110,000, which reflects a period of frequency in the market. In the midst of the current market status, the famous trading expert with X Username Daan Crypto highlighted the main liquidity sets that can play an important role in forming short -term bitcoin procedures.

Instant Bitcoin Battle fronts: $ 107,000 and $ 110,500

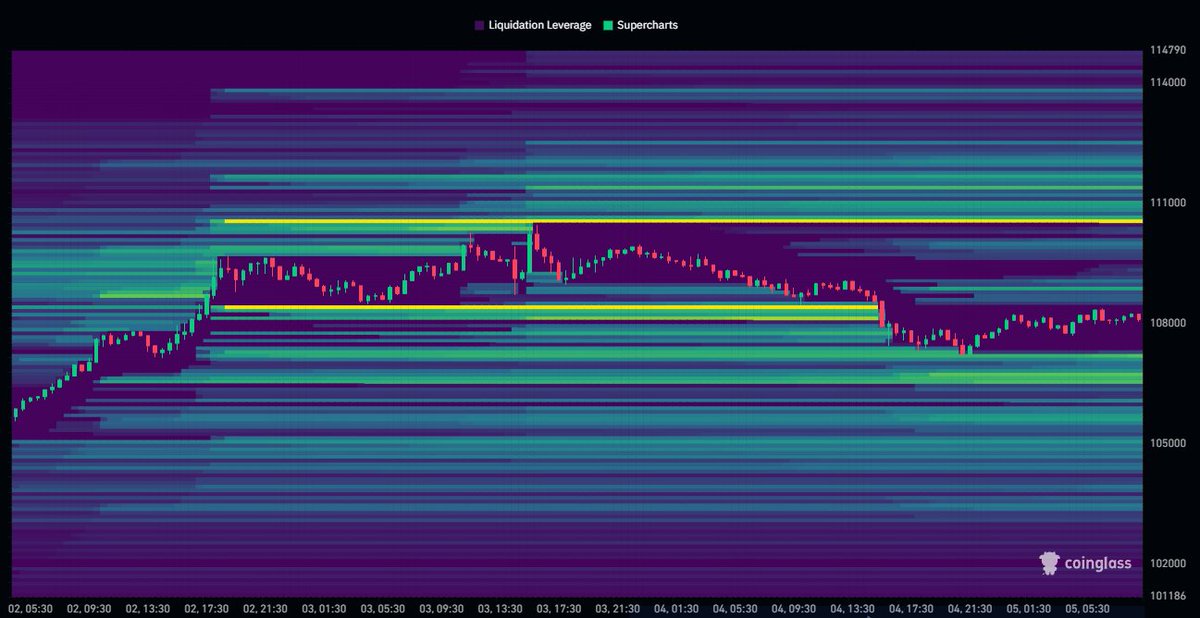

in X post On July 5, Daan Crypto shares a closer look at the possible bitcoin procedure for liquidity levels. With data from Coinglass, the famous analyst shows that Friday’s price activity led to a large -scale liquidation of the 108,000 dollar area. After this development, the interest of investors is now focusing on new liquidity areas, forming about $ 107,000 and $ 110,500.

Among the distinctive areas, the area of $ 107,000 is working as immediate support, as some traders defend the positions that survived the last liquidation. Therefore, BTC is likely to have a short -term recovery when re -testing this level. However, the decrease in prices is less than 107,000 dollars would lead to a large -scale number of references to areas of $ 100,000 in line with the modern move.

Meanwhile, $ 110,500 appears as resistance in the short term as it can accumulate possible pressure for sale or short entries, especially if Bitcoin tries another outbreak. Closing the successful price above this level would eliminate many short situations that urge a short pressure that can lead to bitcoin move quickly across its highest level of $ 111,970 to an unknown price area.

In general, the BTC market appears to settle in the area of 107,000 to $ 110.5,000 after the sharp filtering process on Friday. Side price movement usually determines this stage for a rapid collapse or collapse.

Bitcoin’s financial lever reaches a new rise

In other developments, Cryptoquant data Reveal Bitcoin traders display the high market appetite, as the estimated leverage rate in all stock exchanges reached the highest annual level of 0.27. This scale, which tracks the extent of the open interest in relation to Excination BTC reserves, shows a high behavior of risk as traders are increasingly publishing borrowed capital in anticipation of the largest price movements.

Meanwhile, the first cryptocurrency continues to circulate about $ 108,232, which reflects market gains by 0.70 % and 6.41 % on the weekly and monthly graph, respectively. A maximum of $ 2.15 trillion, Bitcoin maintains a 64.6 % market dominance as the largest virtual asset in the world.

Distinctive photo of Pexels, tradingView graph

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

https://bitcoinist.com/wp-content/uploads/2025/07/pexels-photo-14354113-1.jpeg

2025-07-06 12:30:00