Lido acquires traction where Ethereum becomes one of the strategic assets star-news.press/wp

Lido (LDO) is presented as a major beneficiary of the continuous ETHEREUM growth in a strategic financial infrastructure.

Lido is the dominant Stokeing ETH protocol. It is characterized by an independent, decentralized institution (DAO) that enables users to share the ether and receive daily rewards while maintaining full control over the distinctive symbols.

Lido was placed as a profit engine behind Ethereum height

Participants in the encryption market regains the idea that the infrastructure to bypass technical plumbing and becomes a profit engine.

With the increase in institutionalism and ecological system in ETH, some analysts are now arguing that the original distinctive LEDO, LDO, can be less than its value.

Kyle Raidid, the co -owner of the milk road, recently highlighted a group of upscale stimulus that are formed around Ethereum. Crypto Executive Director pointed to the successful ETAREUM road map (L2), adoption by major companies such as Robinhood and OKX, and the increasing direction of ETH used in companies ’tank bonds.

“Eth creates to do what is good here IMO … I feel very classified on ETH,” it is He said.

Reidhead was martyred with the participation of ETHEREUM (EF) and the arrival next to Eth Staking Etfs as an additional accelerator.

This trend can be translated directly into profits from LIDO, which controls about 60 % of all Eth Staked.

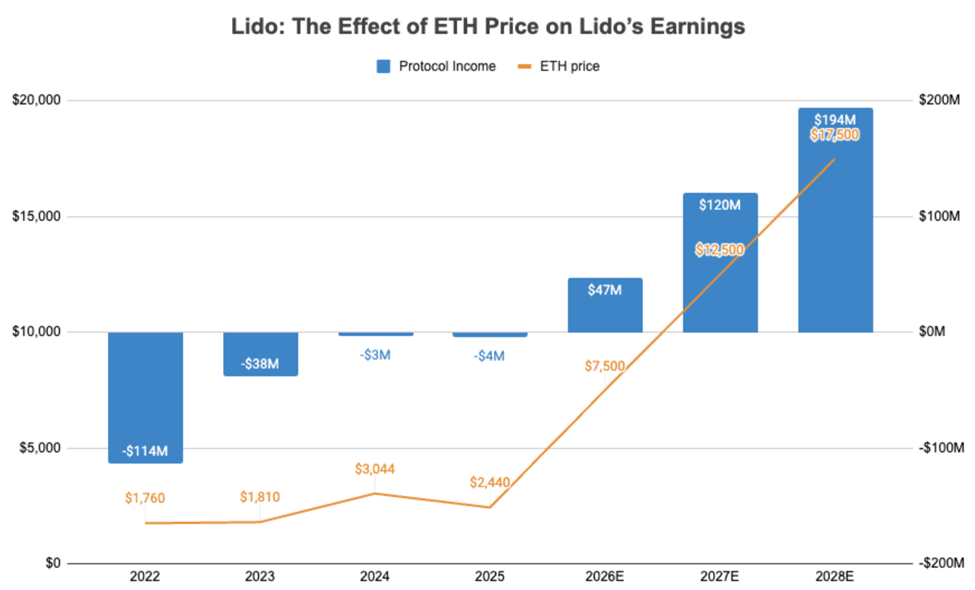

M0XT, an analyst at Milk Road, explained that the Lido’s revenue model with ETH itself.

“My boss on ETH? Then you should be bullish on LDO as well,” books.

This position depends on Lido’s bonuses in ETH and distribution only about 50 % of this income to auditors. Accordingly, the high prices of ETH enhances the LIDO profit margin without a similar increase in operating costs.

“But this is Kicker, not all costs with ETH,” Follow M0XT.

Over the past three years, the average liquidity costs of Lido have reached $ 13.5 million annually. Meanwhile, the operating expenses were hidden by about $ 40 million.

Assuming that these are flat, or even to $ 50 million, Lido can achieve tens of millions of profit purely from ETHEREM prices.

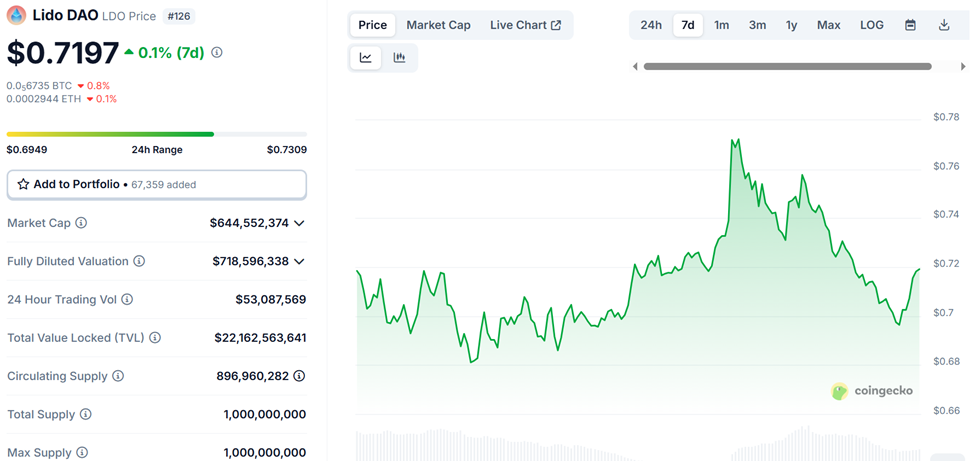

With 90 % of LDO’s Tokeen supplies already in trading and a maximum for the current market of $ 644 million, LDO may have prices for cash flow capabilities.

The increased investor’s interest in LDO with the speed of the ETH request

The investor’s feelings began to shift in line with this thesis. Trader Crypto Kcryptoyt emphasized the Lido’s dominant market share in the Eth Staking ecosystem.

The trader has admitted some doubts about the long -term “graphics key”, which can redirect protocol to LDO holders. It also admits that LDO looks like an attractive purchase.

“I didn’t pull the purchase operator because it is good … it’s the eth that we are talking about but I can’t lie to it, the LDO has started to look very attractive,” books Trading.

Meanwhile, the background of the broader market only strengthens the issue. With ETHEREUM starts in the “backup assets” of the encryption economy, which reflects the role of bitcoin in the institutional portfolios, Lido will benefit from the largest ETH gateway.

Ethereum Increased integration in cabinet bonds for companies, Defi infrastructure and ETF products Enhancing the demand for exposure to sincerity, most of which flow through Lido.

While the risks remain about protocol governance, organizational audit, or competitive exhaustion models, analysts point out that Lido’s position is uniquely firm.

As Ethereum is approaching inch to the state of backup assets, LDO can appear as one of the most unique ways to expose this transformation.

According to the data for Coingecko, LDO was traded for $ 0.7197, an increase of 0.1 % last week.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2024/04/bic_Lido_DAO-covers_neutral_bullish.jpg.optimal.jpg

2025-07-02 08:08:00