XRP “winner between Altcoins” as ETF excites, says the report star-news.press/wp

XRP is a “winner between Altcoins” according to a new report-where “founders and retail investors turn into retail into the fourth largest encrypted currency in the world.

Bybit says that the number of users who hold this altcoin in its exchange has doubled between November and May with high prices.

During this period, prices accelerated from $ 0.50 to $ 2.19 – an amazing increase of 338 % – with a decrease in tensions between SEC and XRP ripp.

Another major moment came when Donald Trump announced that this symbol would form part of the United States encryption reserve, but these plans were not ended in the end.

And if this is not enough, the Polymark suggests that there is an 85 % chance of ETF XRP approval at one time this year, which may likely lead to billions of dollars to purchase pressure with the flow of money to Wall Street products.

Bloomberg analyst James Sevart recently argued that the possibility is greater than this – as it has put up 95 %.

In the report – Bybit indicated that the percentage of reservation from XRP jumped from 1.29 % to 2.42 % in only six months, adding:

“The purchase investment industry view is that ETF Spot Spot’s approval is likely to be before this approval on ETF Solana Spot. As such, we have noticed the allocation of partial capital from SOL to XRP.

However, bybit pointed out that BTC is still the most popular digital assets for encryption investors by a rustic mile – among the stock market users, 30.95 % of assets are allocated in the largest encrypted currency in the world.

Other major trends include a significant increase in the demand for ether. A low detention rate was recorded by 3.89 % in April 2025, but this increased twice to 8.43 % after only one month. However, the report’s authors noted that this remains much less than the height of 11.12 % seen last November.

Here is another major title: The enthusiasm of Solana decreased significantly, with a 35 % Sol ratio decreased in only six months. This is undoubtedly linked to a huge bubble that explodes in the Meme Coin market.

The BYBIT report – which covers the period in which the trading platform fell victim to a bold attack of $ 1.5 billion at the hands of North Korean infiltrators – said:

“The BTC and ETH concentration started by 55.2 % in October 2024, and decreased by 48.2 % in February 2025, and he recently recovered to 58.8 % as of May 2025. Although the demand for ETH in Q1 2025, the BTC and ETH concentration continued to grow in the same period, and indicate flexible demand for flexible requests.”

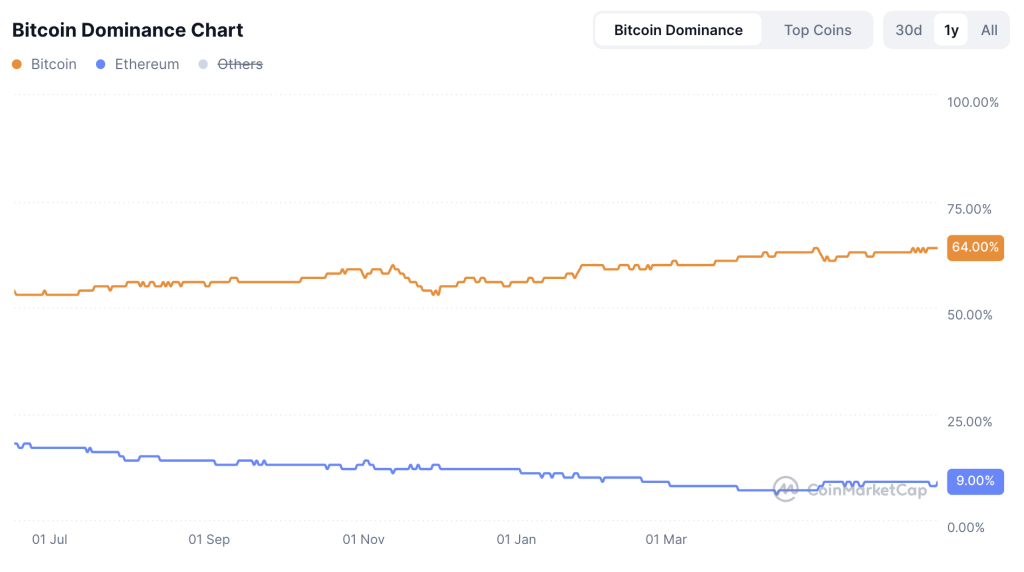

Statistics of one of the statistics puts Bitcoin’s popularity in a sharp context: for every one dollar in ETH that the investor maintains on BYBIT, they are likely to have $ 4 of BTC in his portfolio. This marries well through CoinMarkcap data that shows that Bitcoin dominated 53.2 % to 64 % over the past 12 months, as the ether share in the market has decreased from 18 % to 9 % in the same time frame.

There are also signs of a clear gap between the strategies that consumers publish every day and professional investors.

“As of 2025, retail merchants continue to keep Bitcoin and the ether much lower than institutions, with a percentage of BTC and ETH Celsius by 11.64 % and 6.8 %, respectively. Bitcoin and ETHER retailers represent about half of the institutions during this period.”

Perhaps this is not surprising. Retail investors are more likely to be more adventurous as they are exposed to billions, but strict regulations mean that institutions are limited when it comes to what they can invest in. Another possible novel is: Smart money adopts bitcoin, but the audience has not yet noticed it.

What’s more, there are statistics to support the idea that the traditional “altseason” has been canceled – or at least delay. The percentage of reservation from smaller cryptocurrencies from 35.2 % collapsed in November to 23.5 % in May, “but Meme, Layer 1S and Defi currencies were better than other categories.” The same cannot be said about symbols of artificial intelligence and bitcoin layer 2, as well as Gamefi and NFT sectors.

“When the broader market reaches the highest new level (as happened in November 2024, it usually indicates the arrival of the Altcoin season. However, when Bitcoin reached another ATH in May 2025, Altcoins did not follow its example, indicating that May Bull Run did not lead to wider international feelings.”

Report report It is accurately wrapped in the main topics of 2025 until now – and it can give us an indication of what awaits us in the rest of the year.

https://cimg.co/wp-content/uploads/2025/06/24190423/1750791863-xrp_optimized.jpg

2025-06-25 08:07:00