Despite the last slide, Ripple’s institutional payment targets $ 10 – what do you see star-news.press/wp

The XRP price is traded at $ 2.22 with neutral bias, although a slight decrease of 0.58 % in the past 24 hours. XRP/USD continues to trade at the support level of $ 2.20, backed by an aggressive Ripple payment to traditional financing. The company recently provided an American national banking charter with the Currency Observer Office (OCC) and is also seeking a major account of the Federal Reserve.

If it succeeds, these Ripple moves can merge directly into the US payment infrastructure-an unprecedented development of an original encoded entity. The optimistic news has revived the merchants, who are looking for a long -term increase to $ 10.

At the same time, institutional feelings improve, paid:

- Continuous speculation of XRP ETF files

- Digital Central Banking partnerships in Ripple (CBDC) in more than 50 countries

- A broader dependence on the cross -border infrastructure

These indicators reinforce a solid background in XRP, even with the coded currency markets remain in a cautious unification.

Institutional flows and rumors ETF fuel speculation targets

The XRP demand is increasing between institutions despite the uncertainty in the macro. The continuous Ripple participation with the organizers, including the definition of CBDC, has made the original a great competitor to consider ETF.

Traders and analysts refer to a scenario where ETF approval, along with organizational clarity and Ripple capabilities American bank licenseXRP can push towards a sign of $ 10 – a level that is once believed to guess but is increasingly discussed.

- Banking license: Ripple Direct Access may be given to Rails for American Payment

- Consider ETF: It can pay retail and institutional flows

- CBDC activity: It enhances global importance

Although the immediate path to $ 10 is not guaranteed, many of them are in the Ripple Ripple market with traditional financing as an incentive that may gradually close the gap.

XRP Technical Outlook – Watch a $ 2.23 barrier

From a technical perspective, XRP is still good. The two-hour graph shows the price that respects the growing trend line from the June 23 decrease, as it constitutes 50-SMA ($ 2.2281) and 100-SMA ($ 2.2079) a critical support area.

The prediction of the XRP price has been tightened and its prices in a wedge near $ 2.23, which is the level of resistance that was tested several times but has not yet been violated. Small formations are neutral to decisive, including spinning peaks, indicating the pressure of volatility.

If Bulls ran out over $ 2.2340 on a large size, XRP may target $ 2.2822 and $ 2.3400. On the contrary, a break less than $ 2.20 may call for a withdrawal of about $ 2.147 or even $ 2.084.

XRP Trade SETUP – Breakout in the Makeing:

- entrance: Above 2.23 dollars on the upscale confirmation

- Goals: 2.2822 dollars → 2.3400 dollars

- Stop: Less than $ 2.20

- prejudice: Al-Saudi while above 100-SMA

With the deepening of Ripple’s institutional alignment and prices above support, XRP remains one of the most closely seen heroes in 2025.

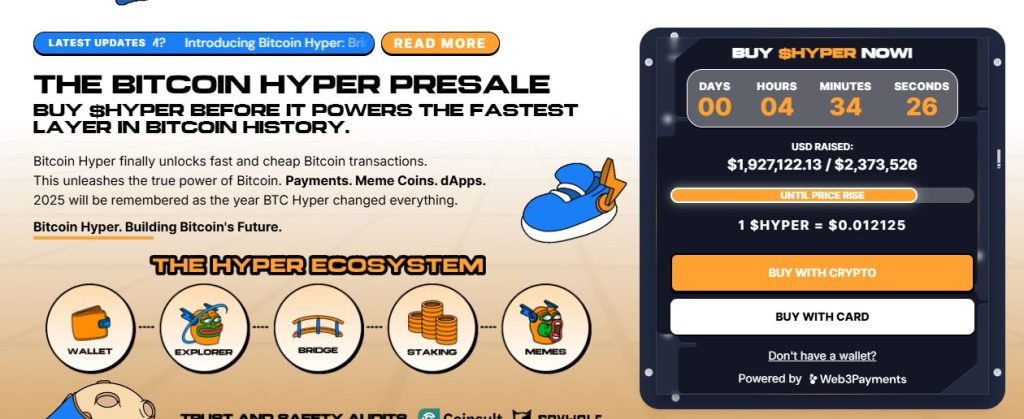

Bitcoin’s excessive precedents range in up to $ 1.92 million, as prices are approaching

Bitcoin Hyper ($ Hyper), the first original layer of bitcoin 2 supported by Solana Virtual Machine (SVM), exceeded $ 1.90 million in a period of between them, with $ 192712 of $ 2,373,526. The distinctive symbol is priced at 0.012125 dollars, with the next price layer expecting hours.

It is designed to integrate Bitcoin quickly Solana, Bitcoin Hyper enables fast -cost smart contracts, DAPS, and create a Mimi currency, all with a smooth BTC Dam. The project is checked by consulting and engineering for expansion, confidence and simplicity.

The Golden Cross was made of the charger and true benefit of the Bitcoin A Contenter 2 of the competitors to watch in 2025. With interest, simplified precedent, and a full expected offering by Q1, Hyper acquires $ serious attraction.

https://cimg.co/wp-content/uploads/2025/06/04143520/1749047719-xrp-price-prediction.jpg

2025-07-05 16:56:00