The high prices of XRP are higher, but this is why the group can be a trap star-news.press/wp

Ripple’s XRP has increased by 4 % over the past seven days, and a wave of morale rides across the broader Altcoin market.

However, despite this upward momentum, key indicators indicate that the gathering may soon lose Steam as XRP owners rush to lock profits.

XRP increased by 4 % this week – but merchants quietly get out of the market

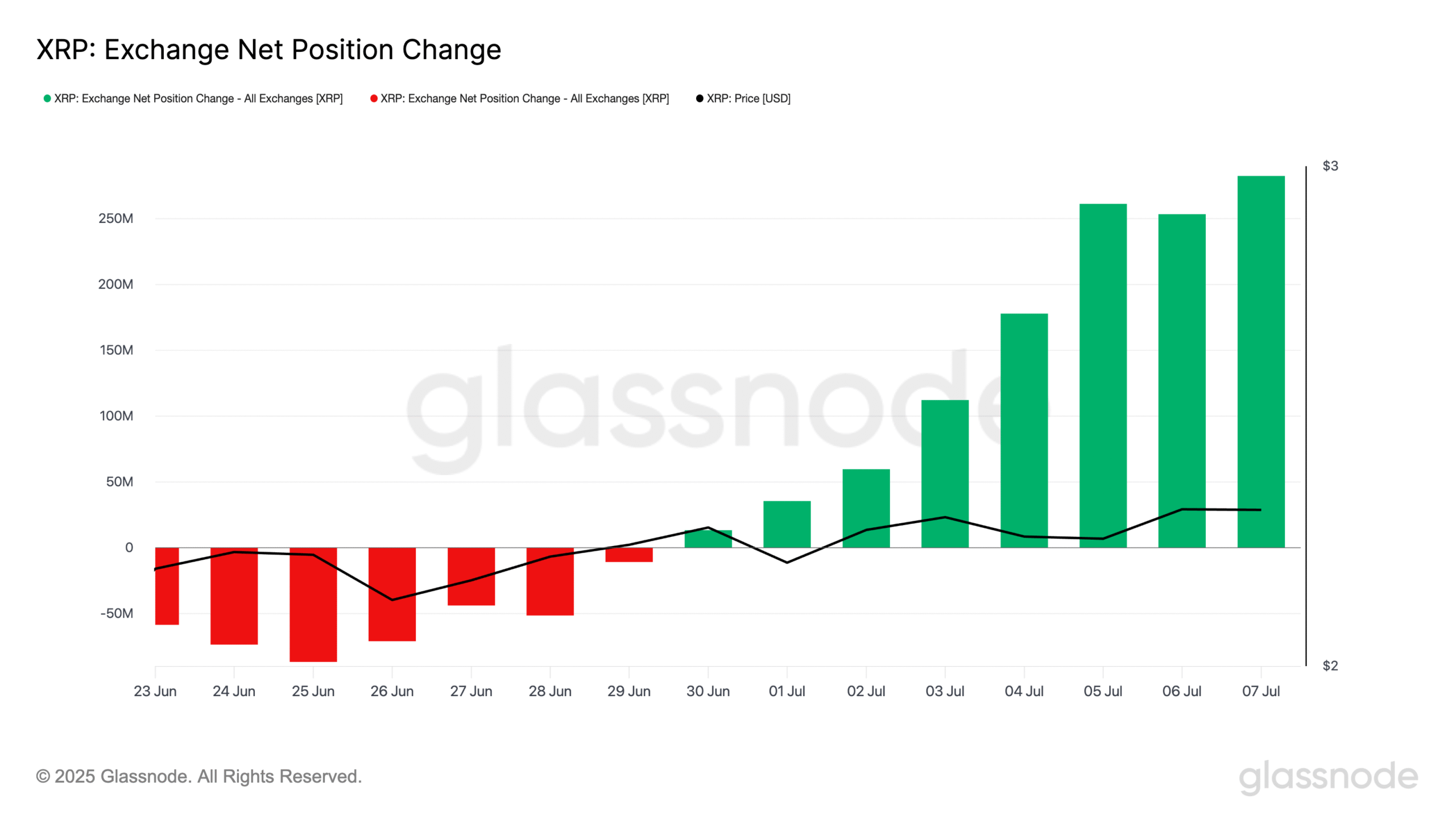

Glassnode data reveals a fixed increase in changing the XRP exchange during the past week. The data on the series shows that this scale, which tracks the net amount of symbols that are transferred to the central stock exchanges, rose to the highest level in eight months at 283 million XRP on July 7.

The timing is noticeable, as the rise in exchange coincides with the recent increase in XRP. This means that many merchants seem to use the assembly as an opportunity to get out of sites, and make some downward pressure on the distinctive symbol.

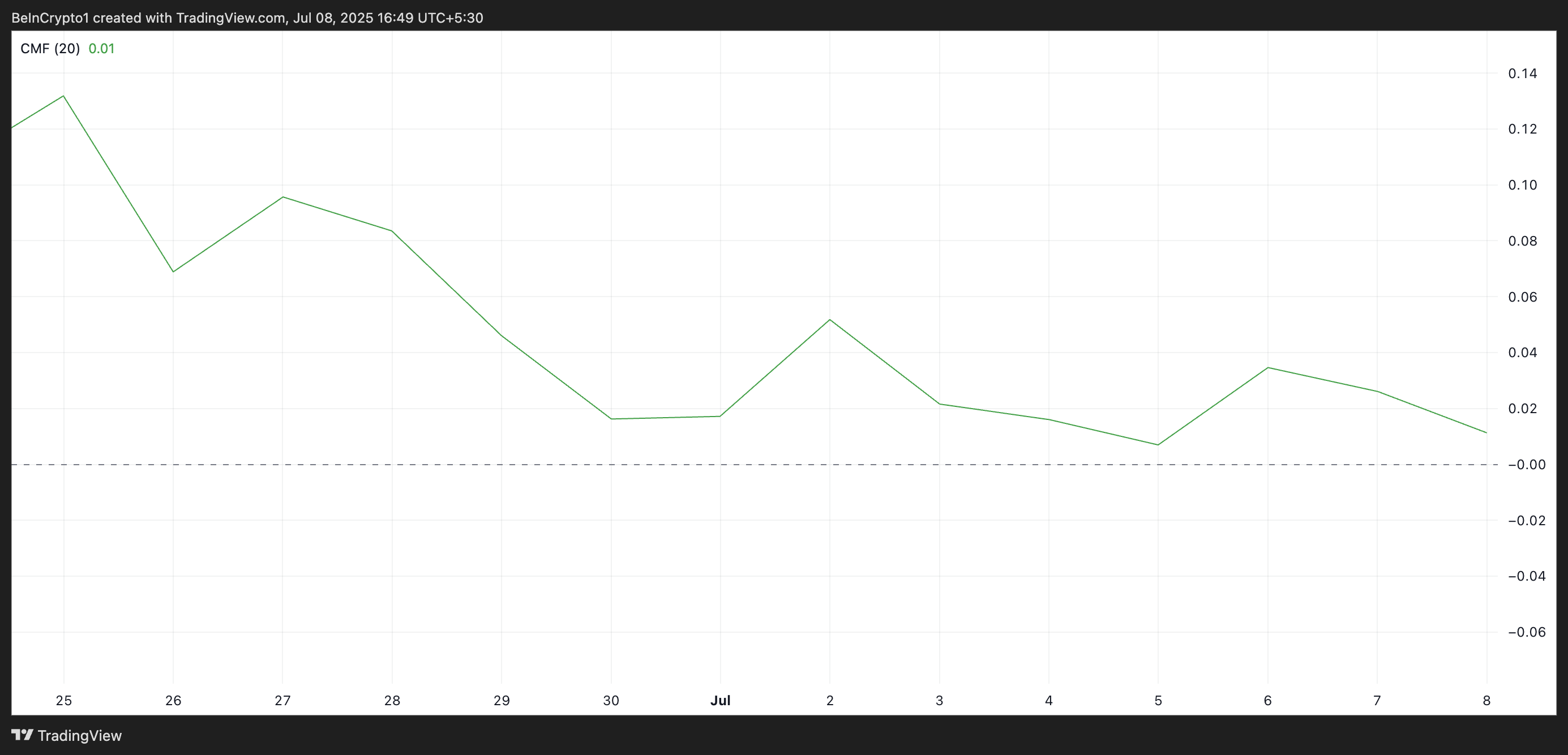

Moreover, despite the height of XRP, the flow of Chaikin (CMF) has gradually directed to the bottom, which is a negative difference with the distinctive code price. As of the writing of these lines, this indicator is at 0.01, ready to break down the zero line.

The CMF indicates how the money flows inside and outside the assets. When its value is positive, it indicates high demand and upward price. On the other hand, the negative CMF readings indicate promoting the pressure pressure and the height of the bondy feelings.

While the XRP CMF has not yet decreased from the zero line, the continuous decline signals weaken their accumulation. This trend is often a declining reflection, and in the case of XRP, this result appears to be possible unless the new demand enters the market to accommodate the increasing supply.

Loss of this support may lead to a decrease to $ 2.14

On the daily chart, XRP re -testing the bottom line from the emerging canal it directs during the past week.

This channel is formed when the original price is constantly making its highest levels and its highest levels in the upscale parallel trend lines. The upper line acts as a dynamic resistance, while the bottom line acts as dynamic support.

Therefore, when the price begins to test the lower borders, especially after a strong gathering, it often indicates fatigue in ascending momentum.

This decisive rest is considered a decisive signal, as it indicates that buyers can no longer retain this direction. If this happens, the XRP risk a decline to $ 2.14.

However, if the bulls regain control and climb demand, they can pay the price of XRP to $ 2.35.

The post XRP price rises higher, but this is why the assembly can be a trap that first appeared on Beincrypto.

[og_img]

2025-07-08 18:30:00