WLFI jumps by 8 % after freezing Justin Sun, +400 million dollars from the market star-news.press/wp

WLFI, the distinguished symbol of World Liberty Financial, WLFI, rose 8 % on Tuesday, adding about $ 400 million to the market value after the project leaders froze the property of Raed Chipir Justin Sun.

The move closed approximately 3 billion symbols, which resulted in the symbolic liquidity profile a few days after its volatile launch.

The price of WLFI rises above $ 0.18 after the Black Justin Sun portfolio

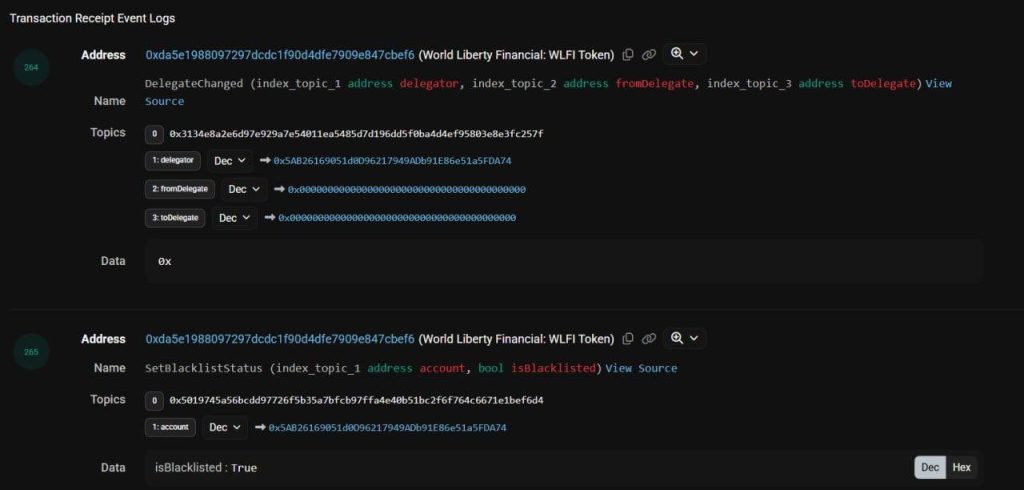

According to the project, SUN’s portfolio address was listed in the blacklist540 million WLFI symbols of about 101 million dollars and 2.4 billion symbols filled with a value of about $ 452 million. In total, freezing was applied to 2.94 billion icons.

The decision followed allegations that the stock exchange systematically sold the user’s deposits in a way that pressed the market. According to what was reported, leaders of basic projects and many major exchanges in the decision -making process participated.

The freezing stressed on the Fur Trading, and the potential sales pressure and the price increased above 0.18 dollars. The Gurge provided a temporary reduction to investors after the launch of bruises that saw the outskirts of nearly 700 million symbols within hours of the opening of the trading.

World Liberty Financial appeared in the distinctive symbol on September 1, when it was initially $ 0.46. Within two hours, heavy sale raised Binance, OKX and Gate the price to $ 0.25.

The first supporters, who bought the symbols in priority tours at a price of $ 0.015 and $ 0.05, with gains of up to 20 times their investments, while retail investors absorbed losses.

The economics of the symbol attracted criticism. Nearly 56 % of the offer was controlled by the informed, while the entities associated with the Trump family retained 22.5 billion symbols along with rights to 75 % of the project revenue.

Although it is being marketed as a centralized initiative supported by Trump, critics said the structure referred to centralization.

Sun participated earlier this year, as she invested $ 75 million and after she was appointed as a consultant. Data from Arkham showed intelligence He recently claimed $ 178 million, which gave him a total of $ 900 million before freezing.

Movements on the series also Transactions revealed Between his governorate and htx, an exchange is related to it. These activities have fueled the market manipulation accusations, although Sun has rejected them.

In a statement, he is He argued that his addresses “Public exchange deposit tests were performed only with very low amounts” and refused that any activity could affect the price of WLFI. However, the blacklist of its wallet was characterized by a great escalation in the conflict.

The official WLFI account tried to calm concerns, and clarify that the symbols in the project controlled by the project are governed by the voices of society instead of the team’s appreciation.

The group confirmed that the allocations can only be published through the proposals on the series approved by the holders. Freezing also raised questions about investor recovery.

Analysts note that If HTX sells WLFI deposits while Sun’s Tokens is now as unprocessed, users who seek to restore their assets may need to be repumented in the open market.

The controversy was crowned with a turbulent opening of WLFI. Before the launch, derivatives related to the distinctive symbol, as Coinglass reported an increase of 530 % in 24 -hour trading volume to $ 3.95 billion.

Open interest increased by more than 60 % to 931.9 million dollars, as traders speculated on Trump assets. By the time when immediate trading began, WLFI has briefly touched a completely diluted rating near $ 40 billion, which placed it among the top 50 encrypted currencies.

However, the continuous sale quickly paid the price. By September 2, WLFI was traded at $ 0.24 with the maximum market, just less than $ 7 billion. According to CoingeckoThe distinctive code has decreased about $ 0.18, which represents a decrease of 41.7 % of launch and a decrease of 18.8 % over the past 24 hours.

Although market turmoil, the WLFI team confirms that its governance framework will allow society to direct future decisions.

WLFI BURNS 47m symbols with low price, whales absorb heavy losses

World Liberty Financial 47 million symbols in the first week of trading burned, in an attempt to stabilize the market that is vibrating due to severe decline losses.

The data on the series shows that the distinctive symbols, which are equal to 0.19 % of the circulating offer, were sent to a burning address that was verified on Wednesday. This step followed a sharp decrease of 31 % of the WLFI launch price of $ 0.33 to a little more than $ 0.23.

The team also suggested a broader program for re -purchase, to be funded by protocol fees and is subject to the community’s vote.

WLFI appeared for the first time a general list, and opened trading in the center for the first time after the investor vote in July. Trading volumes amounted to one billion dollars per hour via Binance and other stock exchanges.

The prices for a short period of $ 0.30, as the Trump family’s share of approximately 25 % was evaluated by more than 6 billion dollars. This wealth has decreased since then as the WLFI value has decreased by 41 % in less than a week.

The whales have endured the burden of retreat. Blockchain data shows 0x432, lost more than $ 1.6 million after WLFI re -entered the leverage, wimputing a profit of $ 915,000 just hours ago.

There was another large holder, a portfolio of 854ra, $ 650,000 decreased at a location of $ 2 million, while the wallet faced 0x1527 more than $ 2.2 million in unrealized losses. Some traders have benefited from the sale, including Wallet 0x92BB, which gained $ 1.8 million in a short period.

Burning failed in contrast to momentum. WLFI decreased by an additional 18 % in 24 hours after the announcement, with the tightening of the homosexuality. Critics argue that the strategy may reduce pressure in the short term, but it shows the fragility of the encryption projects that celebrate celebrities.

While WLFI tries to switch from noise to benefit, the investor’s confidence remains fragile, and leaves whales and is considered heavy losses.

https://cimg.co/wp-content/uploads/2025/09/04212751/1757021270-stock-image_optimized-7.jpg

2025-09-04 21:23:00