Iran’s revenge and the main ads star-news.press/wp

This week, there are many news stories for encryption in the pipeline, with a high possibility to move the market. For some, the effect will be specific to the ecological system, with related symbols associated with width fluctuations.

Traders looking to benefit from the expected volatility must monitor the encryption news and the main headlines of this week.

Iran’s potential revenge against the United States

After US President Donald Trump, who attacks Iranian nuclear sites, the market expects revenge. Indeed, Iran has taken a bold position after the attack, with the closure of the Strait of Hormuz, and effectively restricted the main oil portal.

Revenge will be surprising, given Iran’s last step that struck the Israeli Stock Exchange building in Tel Aviv. The attack was revenge, after the electronic attacks associated with the Israeli affected the Iranian banking system and destroyed tens of millions of dollars in digital assets.

Iran’s revenge can send the origins of the risks In free fall, with analysts who speculate a 20 % decrease in bitcoin price. The effects of Bitcoin price can be extremist with countries’ support amid escalating tension.

The summit of injection

Another encryption news to see this week is the summit of injection, which kicks off on June 26, 2025, in New York. This pivotal event for the Blockchain financing system.

It is expected to reveal the injection, which is a high -performance layer 1 (L1), about a major advertisement, which is likely to be linked to the EVM unit or world origins (RWA), which will enhance institutional adoption.

“Prepare to watch the game change ads, reveal the Migor and develop the following funding,” the network He said newly.

Focusing on decentralized derivatives and inter -operation, the summit may highlight DAPPS or new partnerships, and build on daily trading volume of $ 137 million.

The attendees expect updates about protocol governance or burning auctions, which enhances the ing contraction model. The event will unify the developers, investors and innovators, which leads to an amplifying the role of injection in Defi Without Borders.

the the audience Thomas Kwan, the head of the distinguished symbol at Galaxy Digital; Kyle Dacruz, Director of Digital Asset Product at VANECK; Josh Olzwich, head of trading at Canary Capital. Federico Brokate, US Business Chairman on 21 shares, It will also come.

Great Infinex Advertisement

Infinex Ecosystem is also among the encryption news headlines this week. It is a Defi protocol built on Synthetix and the base chain.

Infinex is expected to issue an important advertisement on Tuesday, June 24, which is likely to reveal the Infinx Connect.

This feature can simplify the reactions across the series across EVM and Solana chains, which enhances the user experience for its non -guardian wallet. Infinex Connect may integrate protocols such as Synthetix Perps V3 or AAVE, which provides smooth, effective or lending trading.

After 67.7 million dollars NFT saleInfinex aims to compete with the central exchanges with UX -like web2. The advertisement can also clarify the references of the governance point, though this Ken Warwick Anti -bird position.

The launch of Synthetix Dex

Synthetix, a derivative liquidity protocol, has been set to launch its permanent, decentralized future exchange on Ethereum Mainnet soon, which is a return from optimism.

This step aims to integrate liquidity and reduce the retail problems it faces on class 2 networks. The stock market will benefit Synthetix’s Perps V3This provides low -publication trading with SUSD and SNX side.

The proposed acquisition of the DERIVE Off-Chain engine (SIP-415 was later pulled) hints to high-speed derivative aspirations.

With 170 million Snx Staped and 19.83 % APY YieldThe launch can be attracted by a large TVL.

23 million dollars open the distinctive symbol

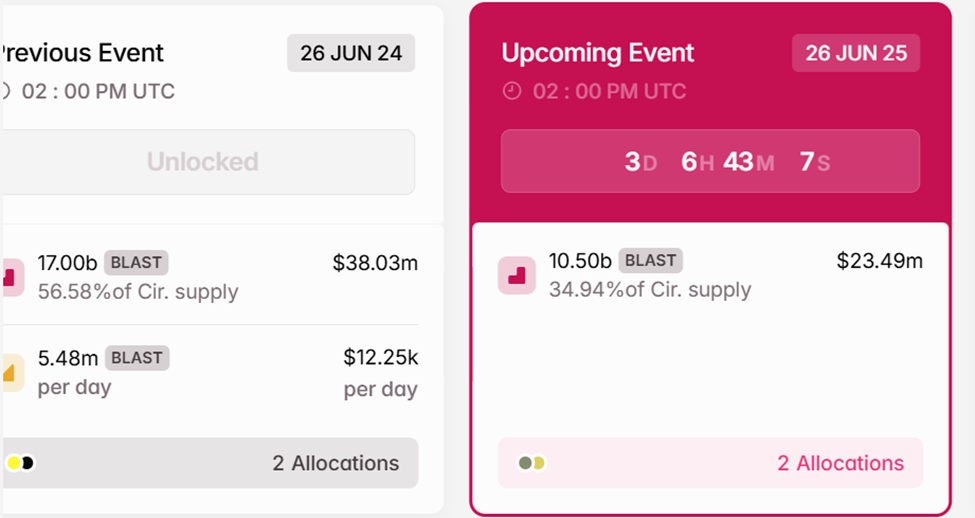

One of the most prominent news in Crypto News this week is that on June 26, the distinctive symbols will open at a value of $ 23.49 million, which represents 34.94 % of its circulating supplies. This is unleashed in large size, which is 10.5 billion symbols of the explosion, market fluctuations.

The explosion, associated with slicing, follows Ethereum L2, as a trend of large holes, as it appears with $ 46 million of Taiko It happened.

Historical data indicates that the large cancellation often leads to sales, especially if the first receivers top the early gains. Data on Tokenomist.ai shows that symbols will be allocated to shareholders and basic investors.

The opening of the opening price, which was trading for $ 0.00223 to this writing, could affect more than 3 % in the past 24 hours.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2023/02/bic_roundup_weekly_news_2.png

2025-06-23 10:00:00