Warning credit card, launched a new line of credit to deal with large banks star-news.press/wp

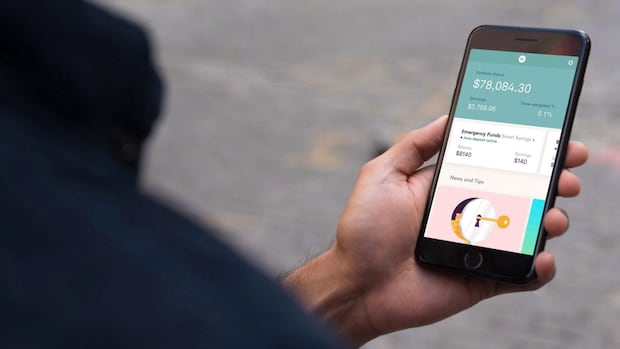

Wealthsimple Inc. announced his first credit card and a line of credit on Wednesday, efforts to question the dominance of major Canadian banks.

Extensions also includes mobile check deposits, wander transfers and bank drafts when it was launched in 2020 when the financial suite offered by banks began to be promoted.

Wealth, more than a decade ago, began to focus on automatic investment management, has long stressed that he does not want to become a real bank, and Paul’s main commercial commercial is still not at all.

“What we want to do is continue to continue to keep a bank license, we can do interesting and different cases of use,” he said.

- Have you had problems to send money abroad? Tell us your experiences in an email ask@cbc.ca.

WealthSimple Organization 10 stated that having customer deposits, Canadian deposit insurance coverage for Corp., as one of these benefits.

Bank draft delivery now, check the delivery order

The new offer of WealthSimple is translated on two percent of their credit card, and when its line of credit launches the end of the year, it will be as low as 4.45 percent. (The current rate is 4.95%.)

Customer new credit cards do not charge money or charge additional FX fees when spending money in foreign currencies.

The wealth also intends to provide customers the ability to use their investment account balances as a guarantee of credit lines.

Everything is not pure digital. Customers can also have bank drafts sent to recipients at no cost.

Users can still use the application of traditional paper controls, financial institutions to print and deliver the receiver check.

“There are some people who use checks,” said Teshim in a conversation with CBC news. “We don’t expect what we don’t want customers don’t do these things that do today.”

The wealth is also being held in a pilot project that is launching in the Toronto area, which will be delivered to the real cash door.

“For these urgent moments, we will send the right to cash in cash, and eats Uber,” He explained that the Teshim, warning the pilot eventually the US dollar can be delivery.

Most active banks in Canada

But, as the wealth adds features, there is no clear market that can take the company from RBC, TD, BMO, CIBC, Scotiabank and national bank.

Canadians know being reluctant to change from large banks – they are managing more than 90% of six control bank assets.

“Our competitions are the biggest,” said Teshim, but thinking that there is an alternative demand, the results of a survey about the rich survey showed the quarter of the respondents.

Gearsimple has already shown that people are possible to achieve retirement accounts, some were previously skeptical.

“I think we’ve shown investment in technology and working to our customers, that we do this process easily as possible, and so we’re making a very similar approach with the chequining account.”

Highly Application for Credit Card Hope the wealth has flipped in the test phases in the last year, as they will require the most demanded products requested by customers.

The company has also shown that there is an application for combined expenses and savings accounts, and more than three million customers have registered.

Activities on high interest accounts exceeded four percent of the rates in recent years, but Teshim says that there are still rates to decline.

“Chequins Foundation is, but then you can move quickly to where you want to get more profit, it is a platform to locate together.”

2025-06-11 20:56:00