Was Justin? XPL rises by 200 % on hyperlessuid, while the whale wipes the request book star-news.press/wp

A big port rocked the Hyperleliquid market when it deposited $ 16 million and opened millions of long XPL situations in just a few minutes.

This step immediately “sweeps” the request book, liquidating all short positions and leading the XPL price to more than 200 % of a scope of $ 0.58 to a peak of $ 1.80.

Liquidity shock

according to Data From Lookonchain, this portfolio partially closed its location in less than one minute and got a $ 16 million profit. Some merchants speculate that this portfolio belongs to Justin Sun, the mastermind of TON (TRX).

“Justin Sun is only saved $ 16 million in less than 60 seconds. Millions of $ XPL have been examined, and he visited the entire order book and wipes the traders immediately. He sent $ XPL to $ 1.80 (+200 % in two minutes). It still holds 15.2 million dollars ($ 10.2 million). Stuck.

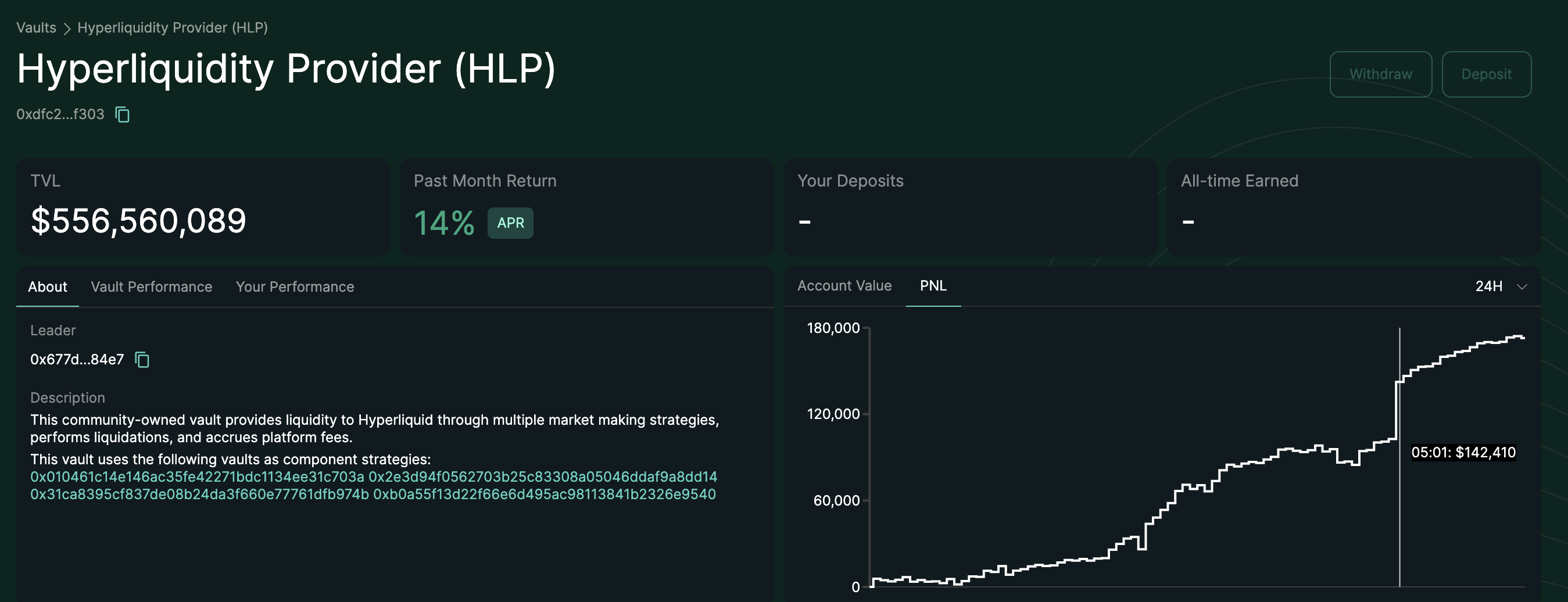

Not only did the whales benefit, but also to win the HLP VAlt Hypleliquid also about $ 47,000 of this volatility. Nevertheless, the burial suffered from a loss of approximately $ 12 million in a similar event. This reflects the dual -risk nature of liquidity providers: they can earn fees while facing great losses when volatile strikes.

Before XPL, Hyperlequid has seen a similar event with the gel symbol. At that time, extraordinary fluctuations in HLP cellar caused a loss of approximately $ 12 million. This loss occurred because a cellar was discovered in providing liquidity in the “Wipeout” orders.

Hyperliquid responded to the pressure of gel by recovering the affected merchants and implementing more striking security measures to prevent future accidents. The common denominators in both cases arising from the movement of a strong whale in a thin arranged market, which leads to large -scale short pressure.

Retailing risk of retail traders

The XPL price explosion is evidence of the “sweeping book sweeping” mechanism on the exchange of decentralized derivatives. When liquidity is somewhat thin, it can penetrate a large enough arrangement through multiple price levels, which leads to a series of filtering. This procedure causes severe fluctuations in a moment. In this case, the request for branching in Hyperleliid was almost devouring, leaving retailers unable to respond and face the collective qualifiers.

This style reveals the risk of trading in limited liquidity markets. Whales can manipulate short -term trends, and convert profits into huge losses for most other investors.

For individual investors, the XPL event on hyperliquid has three main meals. First, investors should avoid high financial lever when the market liquidity is limited, as “pressure” can give accounts in seconds.

Second, the depth of the monitoring and flow orders notebook on the chain is necessary before entering a site to avoid the areas exploited by whales.

Finally, for those participating in liquidity cellar such as HLP, it is important to realize that short -term profits may come with a great loss risk during unexpected volatility.

The post was Justin? XPL rises by 200 % on hyperlessuid while what appears What PIPED Order Book first on Beincrypto.

[og_img]

2025-08-27 03:00:00