VC Funds in Ireland reached € 1.48 Billion, but in the early stages companies are facing “sloppy” water

Invested funds on Irish Technology SMEs have increased to $ 1.5 billion in 2021 or 5% in the previous year, reached the record Irish Venture Capital Association (IVCA) The Ventcharpus Report is published today.

This year, on its 40th anniversary, this association also increased $ 535 million in the fourth quarter in 2024, 162% at the same time of the previous year.

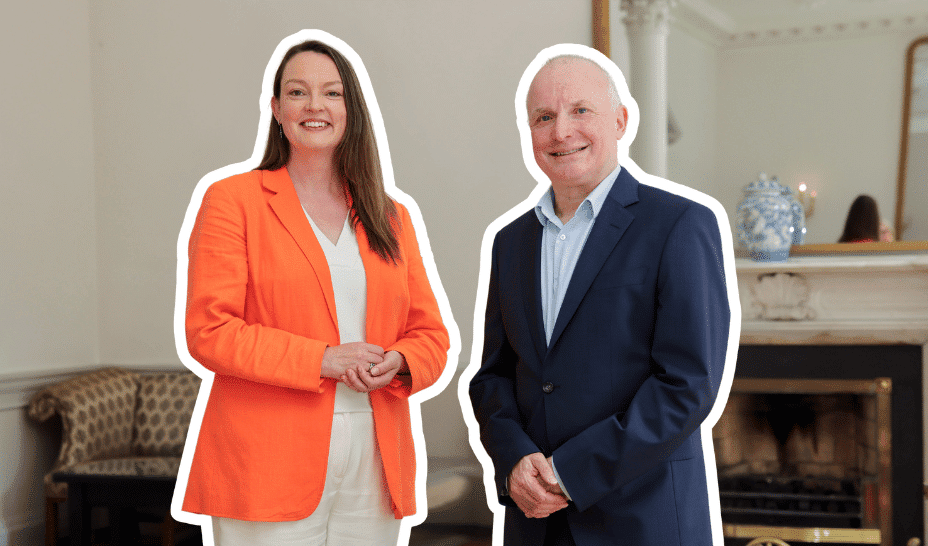

GirryThe Irish Venture Capital Association, the chairperson commented: “Years and final trimester growth was driven by large investment that shows that Ireland has the ability to create and scale world -class technology companiesThe “

However, he describes the funding environment for companies € is seeking to raise less than € 5 million “Sloppy“.”.Deals across all size below $ 5 million fall into 2024 and quartersThe “

According to the Venturepoles report, AI last year there was more than $ 100 million in total VC investment in Irish companies. Maguar It has been said that the recent impact of the Chinese operator DIPSC will not increase or decrease in the hunger of VC investors in this sector.

“The arrival of players like DEPSEC is likely to increase margin for AI start-ups and reduce development costs. We probably see the ease of democraticization and participation by the AI developers, in the same way that software-re-service or cloud computing transforms and disrupts the Traditional Software ModelThe “

He noted that DEPSC -powered Nasdak Stocks mostly affect large chip manufacturers, or Google, Microsoft and others’ AI platforms, not in regions that compete in most Irish AI. “Healthcare, climate, education and other sectors have great potential in AI applications and will be encouraged by low cost of development that represents a big opportunity for IrelandThe “

Sara-Zen LarkinThe Director General, IVCA, has commented that the fourth quarter and annual information has emphasized the possibility of supporting investment in the new Irish government initials. “For example, the AI company, Nuritas has raised $ 42 million in the quarter, but in 2015 its first round was only more than $ 100,000. Co Louth -based company, Josian has raised $ 115 million to this quarter and now the world leader of the sea drone technologyThe “

He added that the current global economic and political turmoil, originally driven by the new administration in the United States, means that the Irish government’s last is $ 250 million Seed and Venture Capital Scheme 2025-2029 “Could not come in good times“, Late this week (February 25) with the first call for the first call to submit the Enterprise to Ireland.

“It is very welcome since the funds for funds for € 5 million deals are marginalized and rapidly reduced throughout the yearThe “

The € 3- € 5-million deals are reduced to $ 82 million for the year by 57% and the fourth quarter has reduced to 56% for 2024 to $ 17.6 million, compared to the same period of the previous year.

Funds in € 1- 3 million categories reduced to $ 105 million for the year for the year and 63% for the marginalized by $ 23.6 million. Investments below $ 1 million have dropped to $ 28.9 million for the year for the year and for the quarter 19% to $ 7 million. The first rounds raised by the seed fund, or SME stood up to $ 127 million annually by 4% and at 55% in the quarter of $ 17.9 million.

The top five agreements in the quarter four 2024 are: Dublin headquarters Medical Device Organization, Fire 1 ($ 116 million); Louth-based C drone developer, Josian ($ 115 million); Dublin Headquarters Travel Software firm, Nuit (€ 46 million); Dublin headquarters AI Organization, Nuritas (€ 42 million) and Dublin -based Fintec Farm, Sample (€ 35.9 million).

Life Sciences was 5% (€ 552.9 million) raised in 2021, then software: 13% ($ 185 million); NVIrotech: 11% ($ 161.7 million); Fintech: 8% ($ 119 million) and data: 8% ($ 115 million).

217 deals ended in 2024, like the previous year (216). “In terms of global headwinds, we should be ambitious and notice to double it“Added LarkinThe

IVCA Venturepules Survey is recognized by Government and International Organizations with VC Industry and OCD, “as”Specific and maximum up -to -date source of fundraising activities in Ireland.“Data Covers the Equity Fund raised by the Headquarters Irish SME and other SMEs in Ireland.

This research is from the IVCA members to the latest details of the latest details and published information where the IVCA members were not involved. A list of funding rounds containing source data for total is available on the IVCA website.

[publish_date