Futures in the United States have achieved a record future – can Bitcoin be next to separation? star-news.press/wp

- The Wall Street Rally reinforces Bitcoin’s hopes at all amid optimism about the nutrition rate.

- 95.69 % of BTC holders in a profit, indicating strong ups in the strong upward upward market.

Wall Street witnessed a wide gathering on June 26, as all three major American indexes rose amid geopolitical tensions and promising economic signals.

The ongoing ceasefire between Israel and Iran, as well as data that supports potential interest rate discounts by the American Federal Reserve, helped pay the S&P 500 and NASDAQ index to its highest levels in the records.

American stocks break the records

It is worth noting that S&P 500 is a future Rise To the highest new level ever at 6,145, it excel receipt New height in 2018.

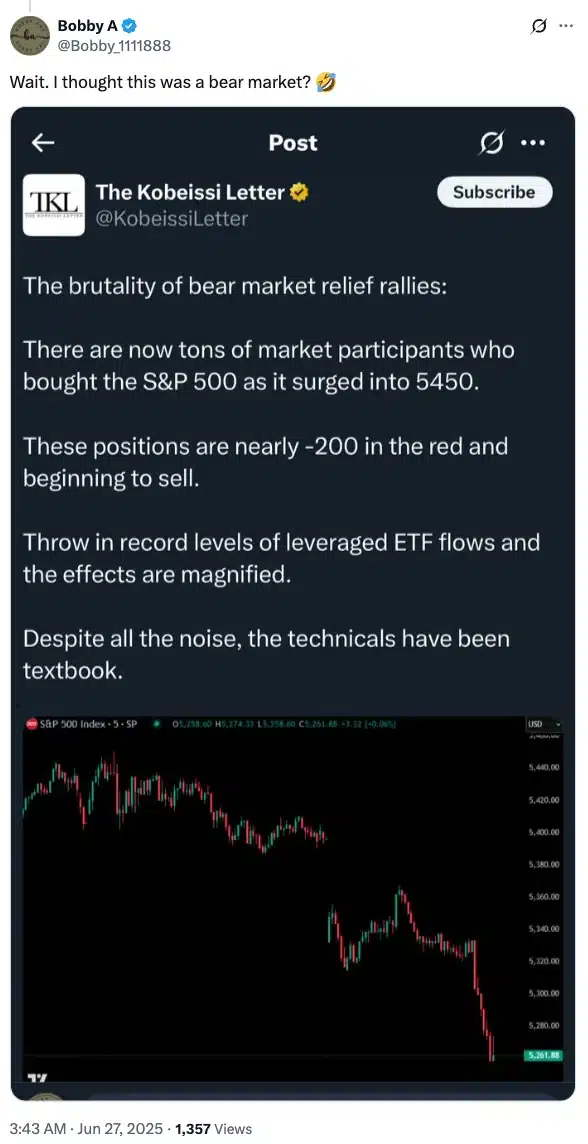

Source: Kobeissi/X Message

These upward feelings reflected a recovery in the market, as the S&P 500 increased by 23 % since its decrease on the eighth of April, as fears of the collective tariffs and fluctuations that depend on the conflict began.

What is more

As expected, the recent increase in American stocks has fueled speculation that the Federal Reserve may start discounts in interest rates early in July, a step that activates both traditional markets and encryption alike.

Similar resonance Feelings He was Bill Nurzy, Chief Investment Director in the United States of America for Ronger Management, Bilings, Montana, who added,

“It is clear that clouds forward from price cuts in 2025 is one of the most important factors. Expectations now indicate three price cuts this year.”

In response, many in the encryption space expect a bullish outbreak of Bitcoin (BTC), with expectations that it may soon follow the progress of the stock market and draw it at the highest new level ever.

Mixed society reaction

Eching this feeling, founder of Bitmex Arthur Hayes with confidence Propagate Bitcoin Aths is on the horizon, as the Crypto path is closely connected to a standard gathering in Wall Street.

He said ,

Source: Arthur Hayes/x

However, not everyone chants Bitcoin to reach the highest new level ever. As one X user indicated, doubts remain.

Source: Bobby A/S.

The current trend of Bitcoin and what awaits us

Meanwhile, at the time of writing this report, Bitcoin was trading at 106,996.63 dollars after a minor decreased by 0.38 % over the past 24 hours, according to what it said. Coinmarketcap.

While the bulls and bears index showed a close role model, with bears slightly forward at 122 compared to bulls in 120, the data on the chain indicated a more optimistic look.

Source: IntTHEBLOCK

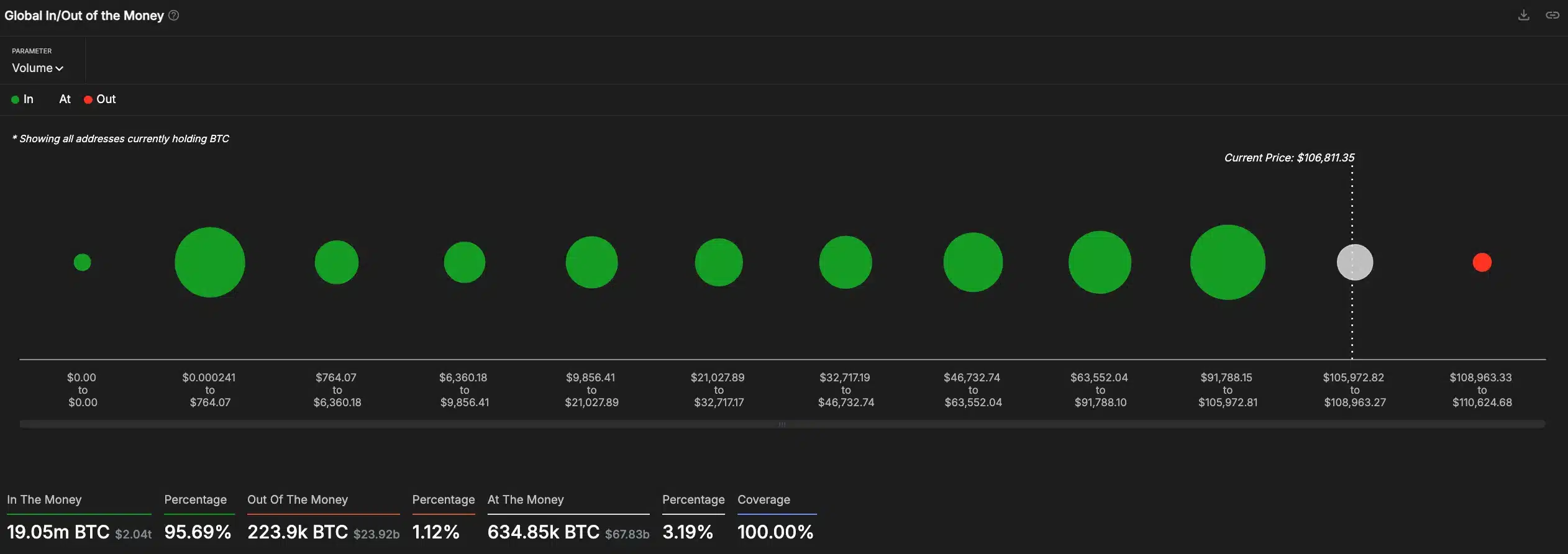

Ambrypto analysis of INTOTHEBLOCK data revealed that approximately 95.69 % of BTC holders were in profit, indicating a strong bullish feeling and the possibility of more upscale movement.

Source: IntTHEBLOCK

However, seasonal trends can reduce expectations. Historically, the Q3 was the weakest quarter of Bitcoin, with only 6 % revenue, according to Coinglass.

While July often challenges this trend with an average gain of 7.5 %, while August and September are weak.

Analysts attribute this seasonal decrease to reduce trading volume during the summer holidays.

Therefore, while historical patterns indicate a cautious approach, the current profitability of the market holders and the feeling of the market can tend to balance in favor of additional gains.

But investors should remember that previous trends are not a guarantee of future performance.

https://ambcrypto.com/wp-content/uploads/2025/06/US-Stock-Futures-Hit-Record-Highs-1000×600.webp

2025-06-28 06:00:00