One of the bullish style can launch the ETHEREUM (ETH) price of about $ 4,770 star-news.press/wp

Ethereum has spent an approximate week, as nearly 6.2 % has slipped in the past seven days. Most analysts call for more correction, but the distinctive symbol managed to stabilize itself. Over the past 24 hours, the ETHEREUM price has increased by 0.1 %, trading in a neutral area.

Although this step alone does not change much, a mixture of plans and plans indicates that something more interesting may be built.

Her holders decline in the short term

One sign of renewable power comes from short -term portfolios. These are titles that usually carry ETH for a few days or weeks before the sale. After weeks of pruning exposure, this group started buying again.

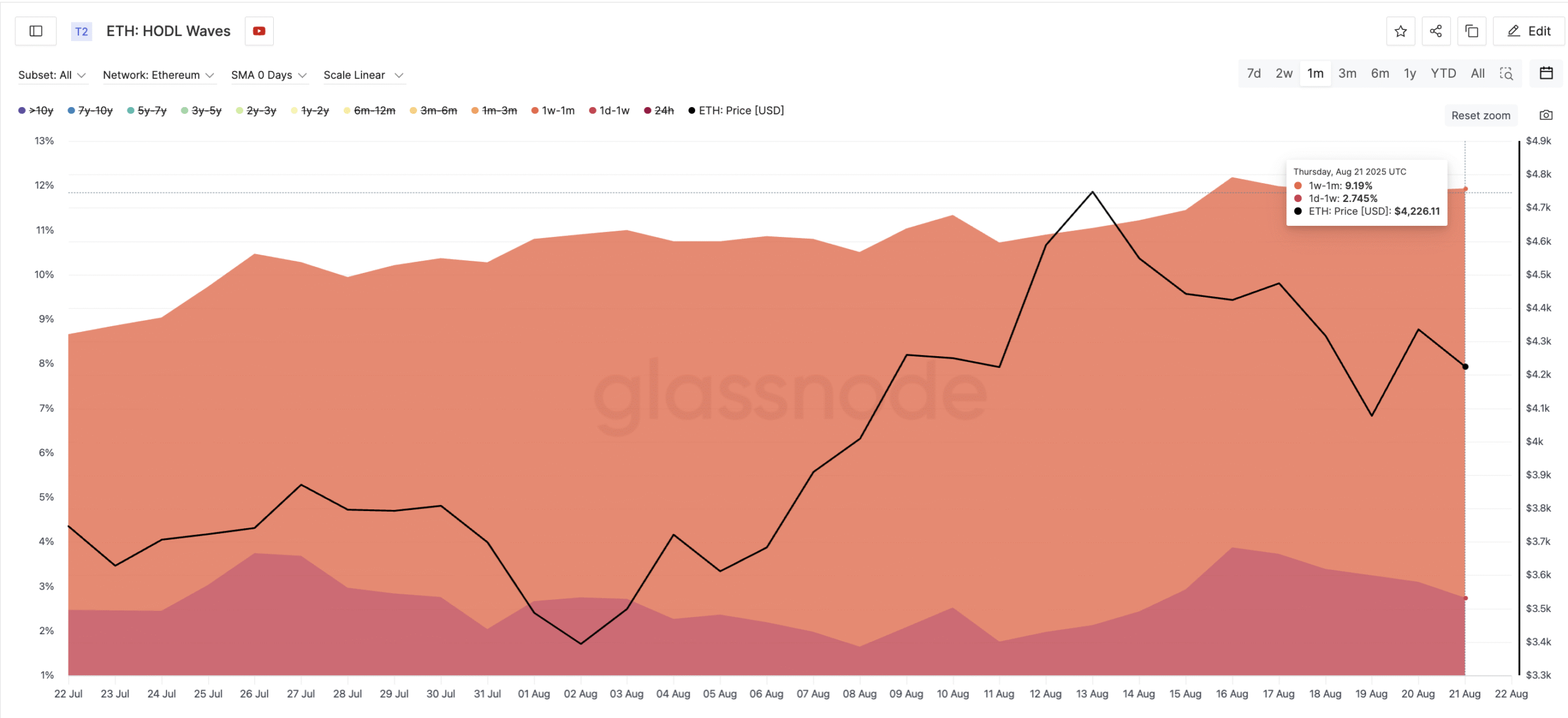

The data indicates that holders for a week to one months have grown from ETH from 6.9 % on July 22 to 9.19 % on August 21. At the same time, one -day holder rose to one week from 1.64 % on August 8 to 2.74 % on August 21. This represents an increase of 67 % in just two weeks, which indicates the pressure of fresh purchase.

Hodl waves show the coins share that is held through different time teams, from a few days to several years. It helps to reveal whether traders in the short term or their long -term holders lead market activity.

Why is this important? This short -term dust is often the first to interact when they see an opportunity. Their renewed activity indicates confidence that the price of ETH may have found a local floor and may prepare for the next movement higher.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

SOPR hints at the bottom of the market

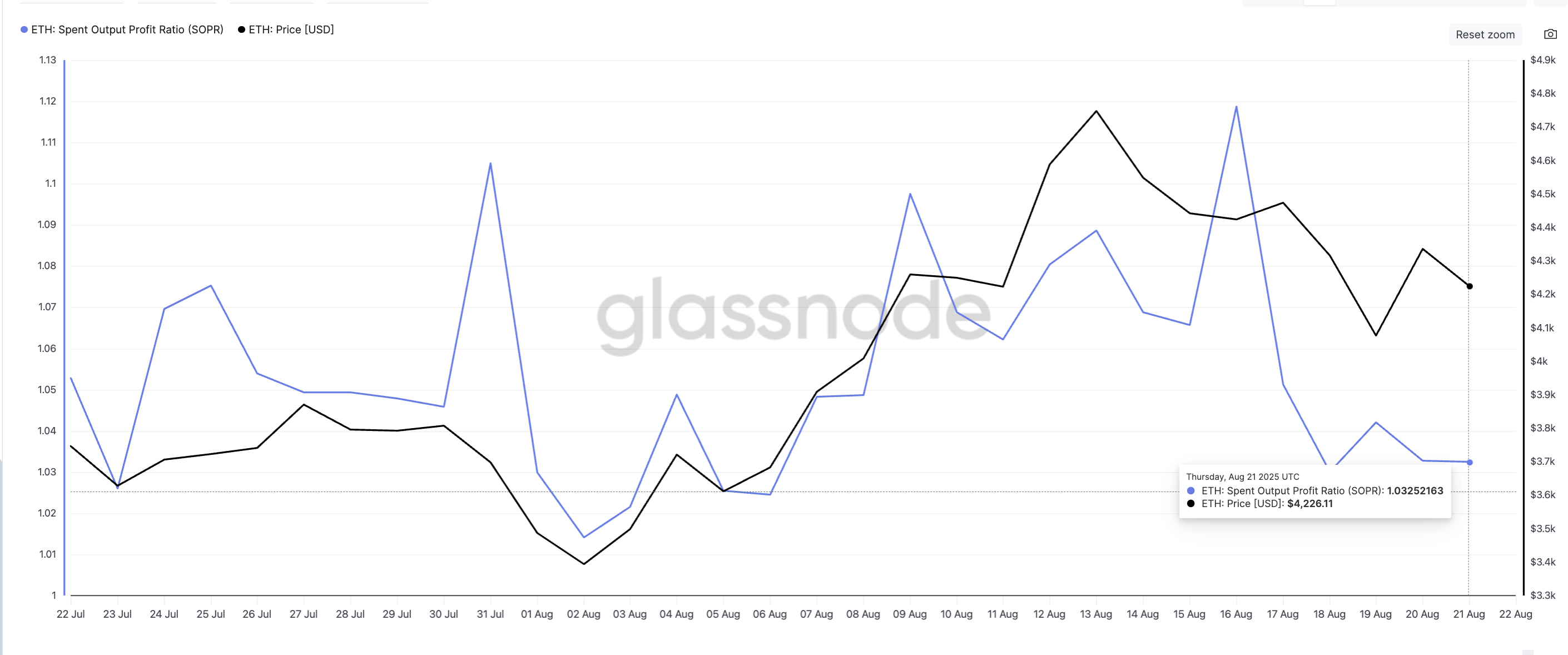

Another part of the puzzle comes from the proportion of the consuming output (SOPR), a measure that tracks whether the coins move on the chain are sold with profit or loss. When SOPR is high, this means that profit holders get profit. When you approach more than 1 or less, with the price correction, it shows that sellers get less profits, often near the local bottoms.

Last week, SOPH fell from ETH from 1.11 to 1.03. Another similar step was observed on July 31, when the ratio decreased from 1.10 to 1.01. At that time, the decline represents the market bottom. ETH wore $ 3,612 to $ 4,748 in the following days – 31 % raised.

A similar setting may be formed now. SOPR decrease indicates that dryness of profit dries while the sellers weaken, creating the conditions of buyers to decline. If the date is repeated, this early signal may be another equipment at the ETHEREUM price.

Reverse head and shoulders style ETHEREUM price in play

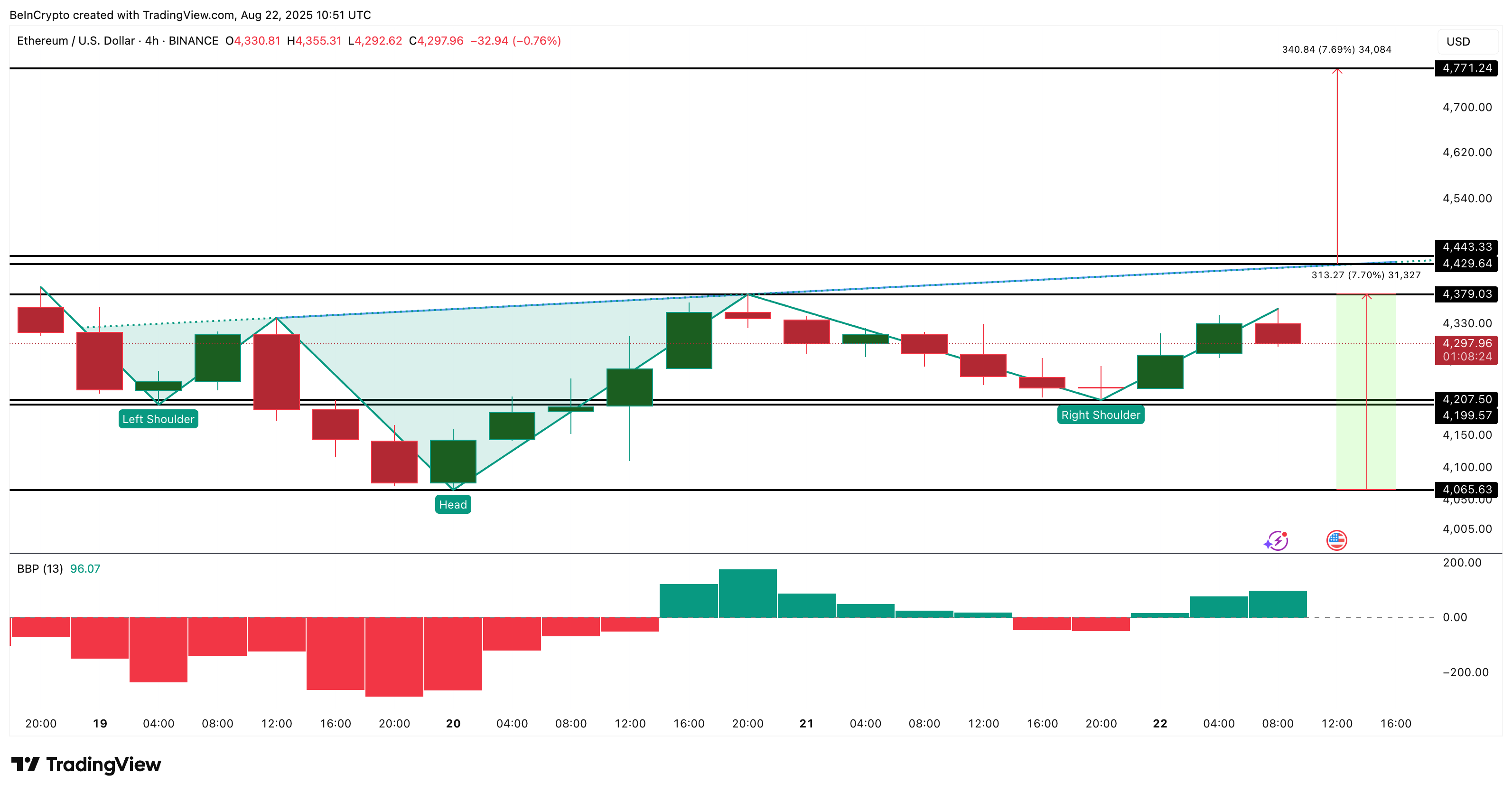

Beyond the signals on the chain, the price chart of the same price is strongly prepared. On the graph for 4 hours, ETH creates a back and shoulder head, which is a classic upright reflection. The neckline of this style is located near 4,379 dollars and is slightly tilted up, which often enhances the hacking.

To confirm, the ETH price needs to scan $ 4,443. If this occurs, the technical goal indicates about $ 4,770, which is calculated from the distance between the neck and head line. This is lined with the broader upward signals of short -term buyers and SOPR. Even the increase in the upscale momentum, while Ethereum prices with the pattern of collapse are strengthening the upscale issue.

The increase in the bullish momentum can be shown through the emerging green bars in the Pull Bear Power, which measures the gap between the highest price and a moving average to show whether buyers or sellers control.

However, merchants must see the nullity level. If the ETH slides to less than $ 4,207 (right shoulder base), the pattern fails and weakens the upholsome thesis.

Post One Bullish Pattern (ETHEUM) can launch about $ 4,770 for the first time on Beincrypto.

[og_img]

2025-08-22 14:39:00