Stocks investors rated in the rate plan star-news.press/wp

This week’s world investors sent Trump to his new fare policy, announced as a trace of economic order.

They don’t like them.

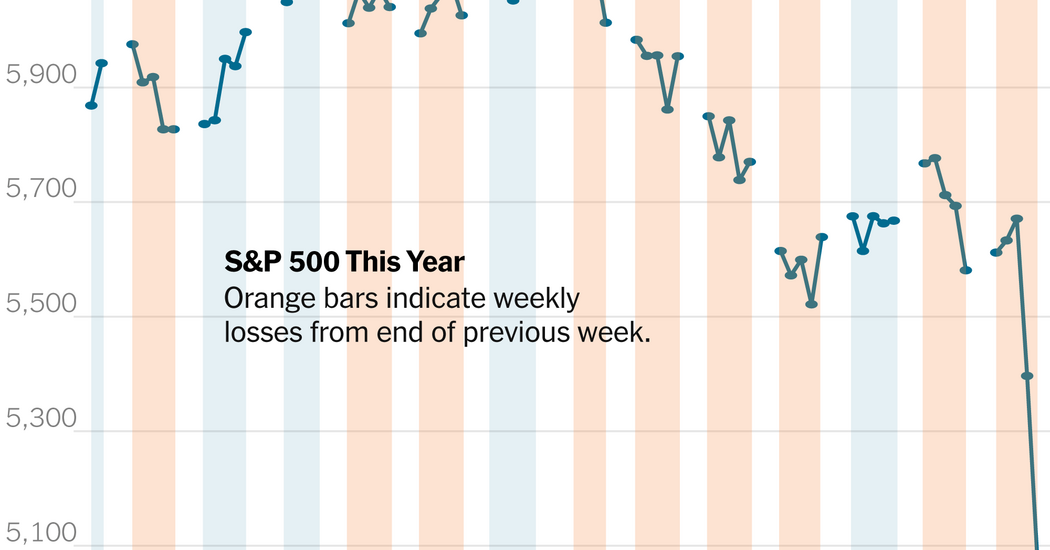

S & P 500 percent fell by 6 percent on Friday, bringing 9.1 percent a week. Stocks were not very distant this time the initial times of the Pandemia Coronavirus – It was the hardest decrease in the weekly since March 2020.

Then the S & P 500 is fast approaching the Bear market territory, a 20% drop in the last highest highest that marks extreme pesimism among investors. On Friday, the index fell by more than 17 percent from the summit of February. A heavy technology compound and Russell 2000 smaller companies index, more sensitive to change in economic perspectives, have already fallen in a bear market. Stocks have fallen around the world.

But this melting was not caused by the creation of new and dead viruses, as he eliminated the values in 2007 and 2008 when he turned the worst economic crisis as a result of the great depression.

The President promoted a policy decision.

“I hope the stock market is listening to the message being sent to Administration,” he said in the TV market. “The market gives the tariff policy below that.”

Analysts and market historians pointed at another time that a President caused directly affected by another at a time. There are some latest parallels: Liz Truss Budget proposals made by the British Prime Minister of 2022, which led to the days of market chaos and resigned for a few weeks.

But Mr. Trump has no interest showed back. “My policies will never change,” he wrote on Friday on social media.

Therefore, investors, economists and business managers are hurried by new policies and economic damage to these unprecedented policies.

“We’re talking about what he can say,” said Lindsay Rosner, a fixed fixed income head of fixed income investing in the management of Goldman Sachs. Added the rate of tariff “that increases the probability of a recession.”

It’s a notable turn of feeling. After choosing Mr. Trump, and in the first month of his administration, investors were eager to be inherited by a healthy economy. They also hoped that the impulsive of the radical economic change of the President could receive the stock market itself – that he can convince suddenly.

Although stocks were highly valued, they continued to climb in February.

This week, the EPRR Global data showed that investors took $ 25 Billion for the funds investing in U.S. stocks for two weeks, when the Trump was announced by the Lord. Since then, JP Morgan has done over the next 12 months. Deutsche Bank has given Deutsche Bank this year for the American economy, and others of Wall Street reduced growth expectations and reduced inflation expectations.

Investors have also significantly raised the options that have more interest rate reduction this year, as the Federal Reserve envisages the need to promote the economy. Selling to Wall Street eliminated 5 trillion dollars in two days in the S & P 500 business market, according to Howard Silverblatt, S & P Dow Jones indices.

S & P 500 was as bad as the last decline in the market, other measures on the market are worse. Russell 2000 lost a quarter of its value from the summit of November. The NASDAQ compound that loaded with technology stocks that had a hammer this week, almost 23% fell from the summit of December.

“This said that it is very bad,” Liz Ann Sonders said, Charles Schwab’s main strategic investment. “This exceeds anything I saw in anyone’s worst case. This made the spirits of the animal more, something they revived the immediate descendant of the election.”

Dan Ivascyn, investment in major assets of PIMCO, said that this week would lead to a rate of fare-ads “to represent the massive monument of the global trading system” and a “bang for global economy”.

“In recent decades, the economy has trend to drive political decisions,” he said. “The policy may be included at a time when driving the economy. That is a very different environment to invest.”

Some said the Lord Trump offered him a precedent. In 2018, he established rates on global steel and aluminum imports, solar panels, washing machines and 200 million dollars from China. But these taxes are pale compared to those thrown on Wednesday, and the impact of the markets was much more.

The Lord Trump promised that he had used fares again in an effort to restructure the borders of the country. To bring the limits of the country and prevent the United States not depend on foreign trade.

The new taxes increased to a level that has not seen the average average US import rate since the 1930s, S & P analysts said the rating agency.

Some investors have hope that the rates are starting point for negotiations that will reduce time.

While Trump suggested that the Mr., China has already reacted to China with its 34 percent additional fees. Canada quickly introduced its fares, and Europe is also expected to respond.

“The basic line is so high right now that the rates negotiated right now,” Adam Hets said, Janus Henderson’s global multi-asset header. He was afraid that damage has already been made.

“It is harmed because the rates are teeth and have begun to change consumer and company behavior,” Mr. Hettts, also other investors, has a cold business talk activity.

Few directors have talked about the rates, but those expressed the alarm.

As fares are announced, Gary Friedman, executive RH furniture of the furniture vendors, made the call with investors. The curse was heard after checking the price of RH shares. RH achieves many Asian products, Mr. Friedman explained.

On Thursday, the Director General of Sean Connolly Conagra Brands said the food company is trying to follow sudden turns in fare policy.

“Things are moved weekly or every day, but in an hour, right now,” he said.

From the White House, however, the message is exaggerated. If investors are just patient.

“Markets will go to the boom,” and “the country will go to the boom,” said Trump on Thursday. Howard Lutnick, Trade Secretary, said in a conversation on Thursday, “American markets will do very well” in the long run. “

History shows that the worst crisis of the market will also come, when investors are satisfied, prices are far enough to reflect new reality, or another change of policy gives you the reason to start again. On Friday, much stronger than expected in March, the economy was still strong torment in the last month, failed to recovery in the market.

Business managers responded to surveys by saying that they plan to slow down their plans for their investments. Directors by the airlines, banks, retailers, energy companies, and more were reviewed by their business ratings this week. Consumers, trying to move on to some of the big cards, say they intend to spend less.

“I’m not sure what businesses we’ve achieved greatly trust,” Charles Schwab’s Schwab’s Schwab. “I think this component of uncertainty doesn’t relieve it.”

2025-04-05 08:01:00