Bitcoin regains 107 thousand dollars – what is the following as 3 factors aligned for BTC star-news.press/wp

- Miners seem to be preparing to gather Bitcoin in the upcoming trading sessions.

- Market behavior of whales and derivatives is also compatible with the continuous upward feelings.

Bitcoin (BTC) maintained its upward path, restoring the area of $ 107,000 after obtaining 1.89 %.

This continues in its upward momentum from last week, although BTC is still in a wider corrective stage, a decrease of 2.45 % during the same period.

Mines activity indicates a strong possibility of further bullish direction, with the support of liquidity from whales and increased activity in the derivative market.

The activity of the mining factor reflects the historical style

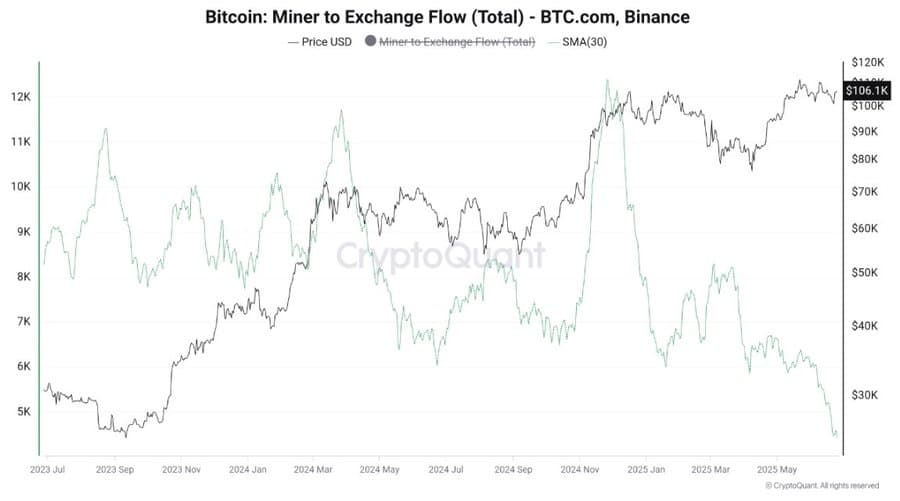

Cryptoquant analysis The behavior of miners revealed the formation of an upper preparation, indicating that Bitcoin may be ready for another crowd.

According to the data, BTC.com – the mining group responsible for 98 % of mining workers’ flows has gradually reducing their exchange flows during the past month.

Source: Cryptoquant

Historically, low mining workers’ flows are often preceded by Bitcoin, and vice versa.

As of the writing of these lines, these flows decreased, indicating that miners prefer to keep BTC with a crowd expectation, just emptying when they believe that the market has reached its climax.

Ambrypto has also analyzed Bitcoin’s total mines reserves and found a similar pattern.

The reserve decreased from 574,678 BTC to 1.807 million BTC, indicating that miners in all fields keep long -term expectations.

Source: Cryptoquant

Trading whales and derivatives in support

It seems that whale and derivative merchants support the upscale trend seen in mining activity.

At the time of the press, whale -controlled liquidity increased the exchanges. The percentage of whale exchange increased to 0.59 – a relatively high level – an increase in the presence of the whale on exchanges.

Source: Cryptoquant

Although this is not bullish by nature, Bitcoin’s restoration of $ 107,000 means that whales may buy.

In the derivative market, the financing rates have become positive after two consecutive days of sale, indicating that more long contracts are open.

This shift in the financing rate is great, confirming more long bets on Bitcoin in PAT 24 hours.

Source: Cryptoquant

If this trend continues, this may mean that derivative traders will join whales and mine workers in locating for a large upward price movement.

Activity on the series confirms the increasing momentum

Nansen data shows an increase in the activity in the series over the past 24 hours, which enhances the upscale view. The active headlines increased by 21.3 %, reaching 535,900, confirming the increase in the use of Bitcoin.

Source: Nansen

Transactions related to transactions increased, indicating the highest benefit from bitcoin protocols.

The continuous high use of Bitcoin on the chain would enhance the capabilities of the origin to continue the trend of the upper market.

https://ambcrypto.com/wp-content/uploads/2025/06/1000001592_1-1000×600.webp

2025-06-26 06:00:00