Tom Lee Rally expects Ethereum to $ 5500, $ 12,000 at the end of the year star-news.press/wp

Tom Lee, chief investment official in Fundstrat, predicted that Ethereum will gather in the short term to $ 5500, with an ambitious with the end of the year of $ 12,000.

During the appearance of his guest on August 26 in the Amitis Investment Program, Detect Wall Street’s institutional feelings towards Ethereum turned dramatically after the US Senate’s approval of the genius stablecoin legislation.

He assured me that ETHEREUM is the basic infrastructure of traditional financing (TadFi), which currently supports more than $ 145 billion in Stablecoin supplies.

This major dominance in the market is among the main reasons that ETH considers one of the largest total investment opportunities in the next decade.

Tom Lee’s Ethereum predicts a $ 7.65 billion in a treasury accumulation strategy

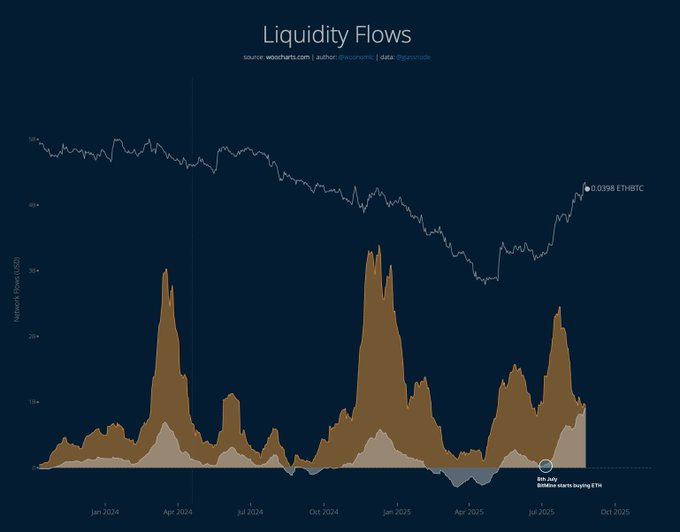

After LEE launched ETH Treasury BitMine, the big capital flowed to ETHEREUM.

Investment managers and retailers systematically re -customized money from Bitcoin to Ethereum, where daily rotation is 900 million dollars.

Between June 30, when Tom Lee started the ETHEREUM accumulation strategy in BitMine, the market value of Ethereum expanded by more than $ 255 billion.

Standard Legal Analyst Jeff Kendrick It was recently noticed The ETH Treasury companies have become increasingly large in terms of capital flows compared to their bitcoin counterparts.

From an organizational arbitration point of view, Kendrick believes that the treasury entities focusing on ETHEREUM possesses larger expansion capabilities compared to Bitcoin.

Tom Li’s inner analyst, who accurately expected Ethereum to drop last week to $ 4,075 before the subsequent gathering to the highest level ever at $ 4,900, presented a new analysis of the driving image driving.

On August 26, Tom Li expected ETHER prices within hours, coinciding with BitMine Gemersion Technologies acquisition of an additional $ 21.28 million in ETH, increasing the total property to 1.72 million ETH by $ 7.65 billion.

These expectations are in line with the technical evaluation of the analyst from the interior, Mark Newton, indicating that ETHEREM will advance to new tops near $ 5100 before targeting the level of $ 5500.

In a later interview from CNBC, Lee strengthened its ETH expectations with bold targets ranging from $ 12,000 to $ 16,000 per ether, He says his faith “Ethereum is witnessing the moment of Bitcoin 2017.”

Tom Lee received an estimate in 2017 When it is ApPear CNBC should invite the Bitcoin goal worth $ 55,000, while the cryptocurrency was traded for $ 2000.

Wall Street professionals initially refused to drop it as unrealistic.

It now applies a similar condemnation to Ethereum, and many investors notice his analysis.

Ryan Adams, an investor and an analyst in Bankless, considers the fillings of Lee eth completely unusual.

He pointed out that Tom Lee has raised nearly $ 10 billion in ETH over the past fifty days, which represents about 1.4 % of the total ETH supplies.

If it achieves a 5 % accumulation goal and exceeds ETH 12,000 dollars, Adams’s projects can exceed the strategic point as the largest digital asset asset asset company in the world.

Adult holders are now taking advantage of the ETHEREUM momentum and capital flows to ever setting its new levels.

Detecting intelligence on the series from Arkham This whale recently bought a large amount of $ 456.8 million through BITGO and Galaxy Digital services that need a prescription.

Technical Analysis: Why to overcome $ 4,800 can lead to an enormous gathering

From the perspective of technical analysis, the ETH chart for an hour is shown in a short -term momentum with the main support areas clearly defined.

The price measures have been frequently taken from the demand zone ranging between $ 4200 and 4,460 dollars, with additional long situations of about $ 4,500, indicating confident accumulation during the low prices.

The scheme’s analysis indicates that ETH expectations to penetrate the resistance area, which ranges between $ 4950 and $ 5,000, with potential targets of the developing consensual pattern structure.

Currently, ETH is combined near $ 4580 after withdrawing, while momentum indicators offer a newly upscale intersection, indicating the continued recovery capabilities.

Provided that the demand area maintains support during any decline, expectations remain positive. The next key resistance level is $ 4,950- $ 5,000.

However, the failure to maintain support above $ 4,600 can lead to a deeper correction before the next upward attempt.

https://cimg.co/wp-content/uploads/2025/08/27133130/1756301489-stock-image_optimized-2025-08-27t143111-896.jpg

2025-08-27 19:45:00