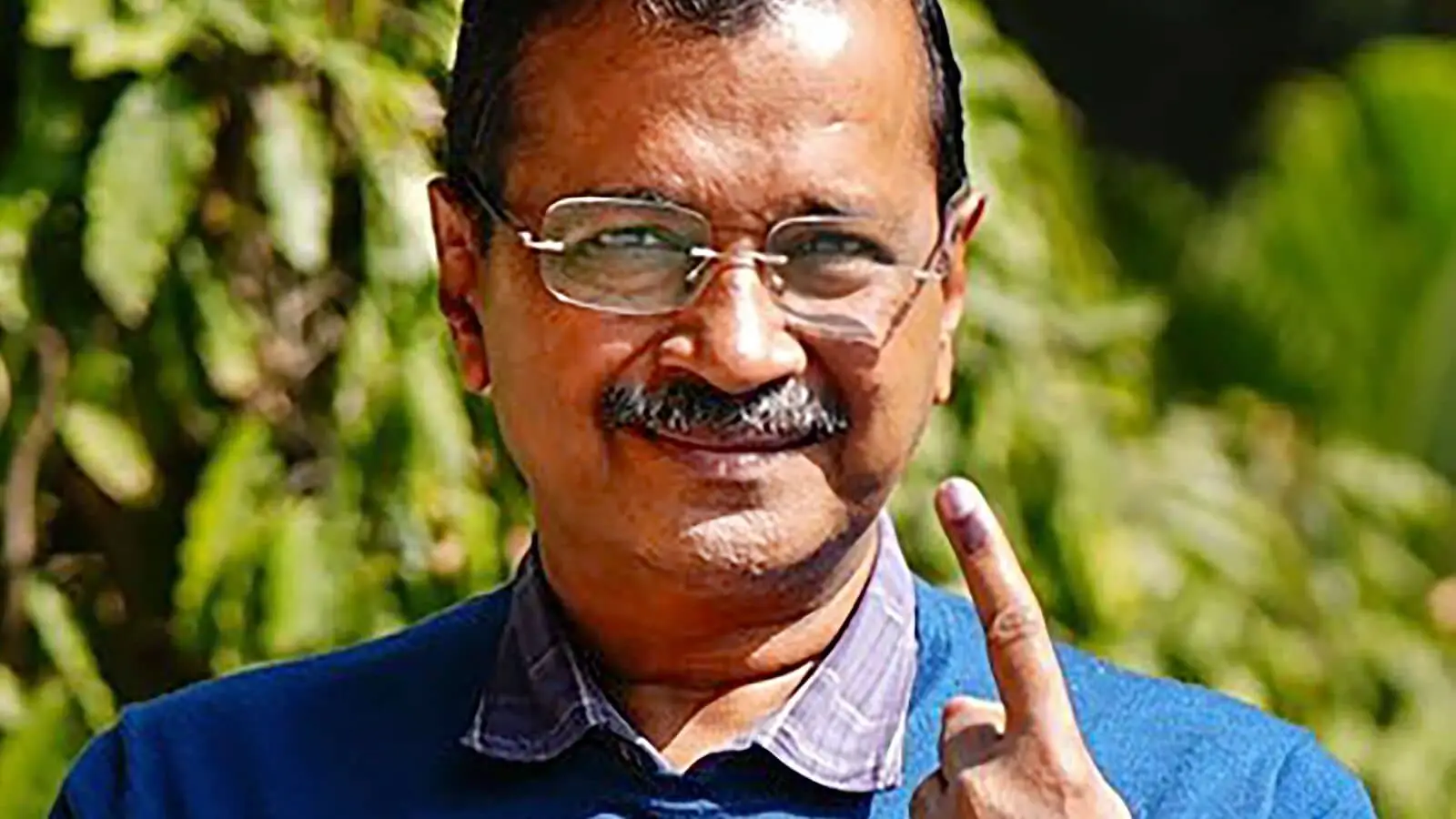

Delhi Exit Surveys: Arvind Kejriwal hit “fake surveys”; says “If the BJP is getting more than 55 seats …” star-news.press/wp

Delhi Exit Surveys: AAP The Nation Arvind Kejriwal hit the exit survey for the announcement of the survey survey, labeling the “false survey”. Delhi’s chief chief took X Microbogging and in the last two hours, 16 AAP candidates have received calls and join the BJP, it will turn off the saffron ministers and will give it E ₹15 of these crores to each of them.

Arvind Kejriwal asked: “His party (BJP) is getting more than 55 seats, then what is the need to call our candidates?”

“Some agencies are showing more than 55 seats. Of course, these false surveys have been made to break some candidates with a single goal. None of our men will break”, Arvind Kejriwal tweet The BJP as “gali-galoj party”.

2025 Election polls for the Delhi Assembly Bharatiya Eatata Party (BJP) indicates the potential of the AAM AADMI party (AAP) governance.

Seven out of ten exit envised the majority of the BJP, Aap hoped to ensure between 20-25 seats.

All departure surveys are expected to win more than three seats.

However, APE has revoked these output surveys. About AAP Sushil Guept has noted that outgoing voters historically underestimated the APA performance in Delhi elections and confidently in a beneficial result.

Several agencies have been released by the projections of departure surveys. The axis forecasts my India for a significant victory for the BJP, projecting 45-55 seats, and CNX has greater than 49-61 seats.

In contrast, Axis My India estimates AAP 15-25 seats and the CNX project will ensure 10-19 seats.

Historically, the polls in Delhi have not always been accurate. While an assembly hanging in 2013 they were properly announced, in 2015 and in 2020 they underestimated victories. In 2020, outgoing surveys projected an average of 54 seats for APAP, and the party was ultimately won 62.

2025-02-06 15:34:00