SEC Win can lead to the outbreak of science star-news.press/wp

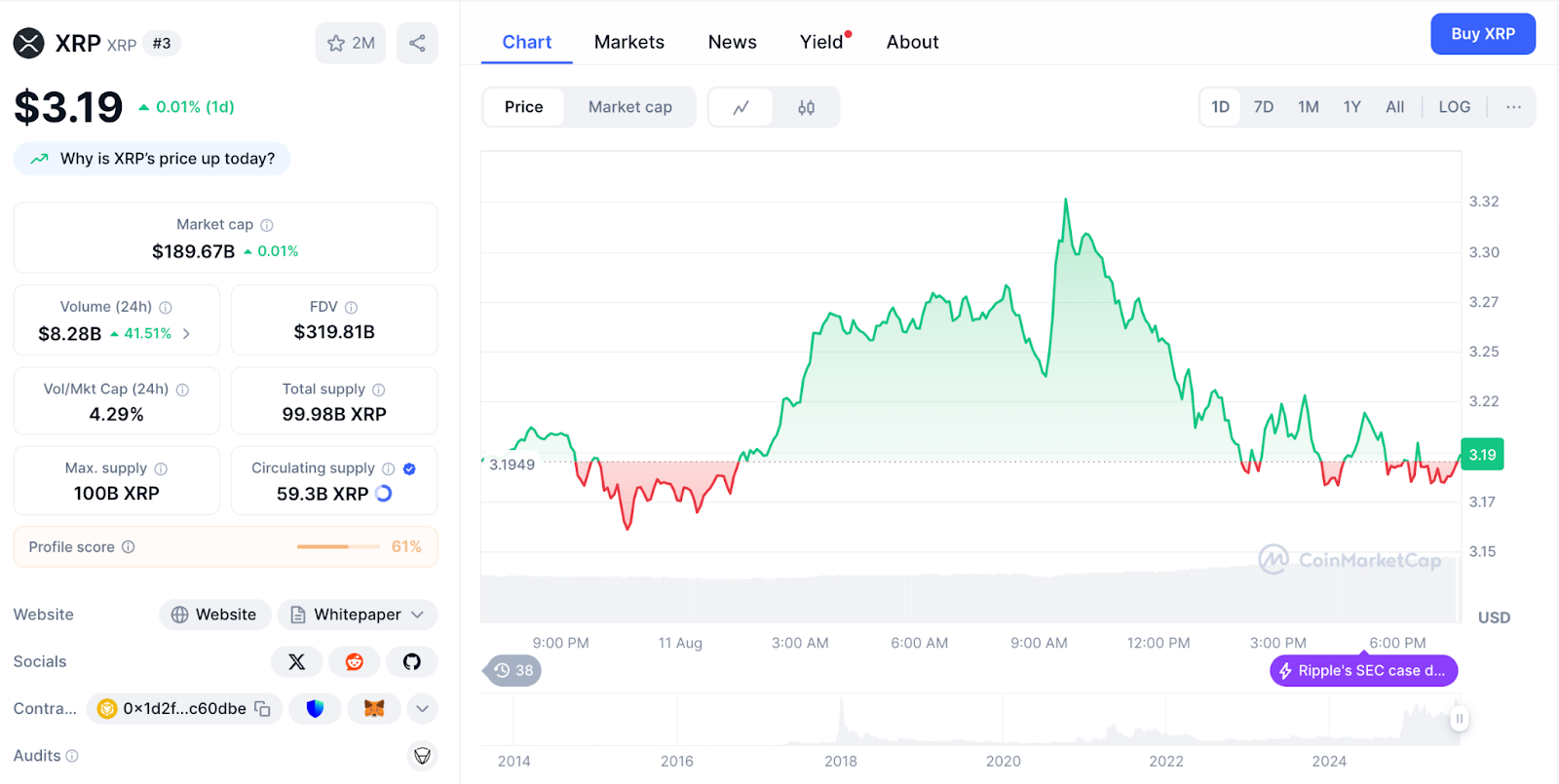

Chatgpt Xrp Analysis revealed the unification of the style of textbook science in $ 3.20, Distinguish the minimum Movement -0.52 %. This comes at a time when SEC gives a new concession from the D List, which effectively removes the main road barriers to collect donations.

Meanwhile, the Blue Origen advertisement on the admission positions of the XRP XRP payment to achieve a possible outbreak towards $ 3.33 Or continuing the work related to the extent above $ 3.16 Supports.

XRP analysis from Chatgpt 18 The technical indicators in the actual time, the effects of the SEC assignment, the developments of corporate accreditation, and the institutional identification standards for the evaluation of XRP’s 90 days path.

Technical analysis: forming the unification of the ideal science

The current XRP price for $ 3.20 It reflects the minimum 0.52 % The daily decrease in the opening price $ 3.22Create a narrow trading range between $ 3.24 (High) and $ 3.18 (a little).

This controls it 1.8 % The INTRADAY scope shows the uniformity of the classic flag typical for the preparation stages before the main trend movements.

Rsi in 49.58 He sits in a completely neutral area with a large area of the explosive movement in either direction without maximum conditions.

Moving averages reveal a strong location with XRP above most of the main Emas: 50 days in $ 3.16 ((-1.2 %), 100 days in $ 3.12 ((-2.5 %) And 200 days in $ 3.07 ((–4.1 %), With only 20 days EMA in $ 3.21 ((+0.5 %Providing simple resistance. This structure indicates a healthy unification within the upper direction.

MACD displays mixed marks in -0135 Less zero, but a strong positive graphic drawing in 0.0344 Building momentum is suggested to a potential upward cross.

Size analysis shows a steady activity in 42.33 million XRP during monotheism, which indicates a continuous institutional interest.

In addition, ATR in 2.97 It proposes a high fluctuation environment with the ability to move, especially while accelerating organizational developments.

Historical context: fixed unification after the victory rally

The performance of XRP in August shows institutional patience after the SEC case won, with the unification of current confidence in the market despite the achievement of typical profits after excitement.

GPS above $ 3.16 Support maintains a height from organizational penetration.

February of a year of February $ 1.72 Low through the unification of the span spring in $ 2.18–$ 2.21 To the penetration of July in $ 3.10 It established a strong institutional institution.

The current monotheism represents a healthy digestion of victory gains.

August fixed work between $ 2.72–$ 3.38 The corporate identification that controls it appears before the next stimulus wave.

Maintains the current pricing 14.89 % Discount at the highest level ever with extraordinary insurance 113,000 %+ Gains from 2014 The lowest level.

Support and resistance: a narrow range with clear boundaries

Immediate support appears at the lowest level today $ 3.18With the support of the key 50 days EMA in $ 3.16.

This mixture provides the basic defense of the continuous upward budget with additional EMA support layers below.

The main support shows a solid basis 100 days EMA in $ 3.12 ((-2.5 % Insulation) and 200 days EMA in $ 3.07 ((–4.1 % Temporary store).

This multi -layer structure provides negative institutional protection during the stages of monotheism.

Resistance begins in 20 days EMA about $ 3.21Follow it high today in $ 3.24 And the major resistance in $ 3.33–$ 3.40. Fracture of the current narrow range can speed up momentum towards these higher goals.

The technical preparation indicates the minimum risk of the downside given the strong EMA support group, while the upscale collapse of the unification of science can produce quick moves towards $ 3.40–$ 3.50 On the basis of the momentum of institutional adoption.

SEC’s victory: unlimited access from private capital

SEC grants From a new ding list, the waiver removes a large barrier to collect donations for Ripple, allowing unlimited private capital lifting from accredited investors without a regulatory red strip.

Ripple is allowed to accelerate growth initiatives, product development and market expansion without previous regulatory restrictions.

The next time of the SEC case decision creates an ideal environment for institutional capital and strategic partnerships.

Chatgpt XRP analysis: Companies adoption momentum

Chatgpt XRP analysis reveals with companies x -accreditation speeding up Blue origin advertisement Accept the XRP payment, which represents the authenticity of the area of the area of the utility infrastructure in XRP.

The expansion of the adoption of companies explains the practical tool for XRP to exceed speculative trading, with companies recognizing the efficiency of payment and cost benefits.

Modern developments, including bank licensing speculation and development of institutional infrastructure, XRP position for prevailing financial integration.

Talking to Cryptonews, Ray Youssef, CEO of Nunes, stressed that.Projects such as Solana and Ripple have a real bullet to hit market hats several times, which moves them from the “altcoin” category and exit from Ethereum shadow.“

This evaluation is completely in line with the current XRP location, as the combination of SEC’s victory with the adoption of companies ’payment and organizational normalization creates the accurate conditions that Ray describes to estimate the basic value.

Unlike speculative symbols, the interest of XRP in the real world provides the sustainable basis for survival in market courses and a state of institutional degree.

Market basics: stable standards during monotheism

XRP maintains the third largest place where coded currencies with a 189.76 billion dollars The maximum market, which indicates institutional stability during the standardization stage.

Humble 0.2 % Increase the maximum market, accompany health 25.41 % Increase the size to 7.61 billion dollars.

the 4.0 % The maximum volume rate indicates moderate trading activity, indicating the identification of institutional sites instead of speculative activity.

Involving supplies from 59.3 billion XRP represents 59.3 % From the maximum 100 billion Supply the distinctive symbol, with the release of the control support.

Market dominance 4.74 % XRP jobs as a major institutional coil with organizational clarity feature.

Lunarcrush data reveals stable social performance with Altrank from XRP in 143Which indicates the continuous participation of society during monotheism.

AA Galaxy Score of Of 53 The construction of momentum on institutional developments and the adoption of companies reflects.

Participation scales show a great activity with 13.02 million Full connections and 62.8k Mention (+21.98k).

Social domination 4.45 % It shows continuous attention during the narrow trading range.

In addition, the feelings appear strong 80 % Positive despite monotheism, which reflects society’s confidence in long -term horizons after organizational clarity.

Modern topics focus on science patterns, 4 dollars–11 Price goals, and institutional adoption.

XRP price scenarios for three months

Science acceleration (50 % probability)

A successful break above $ 3.24 Resistance, in addition to the continued adoption of companies, can pay appreciation for 4.00 dollars–$ 5.00He represents 25–55 % The upward trend of current levels.

This scenario requires a sustainable size above 60 million The momentum of daily and institutional partnership.

Unification of the extended flag (30 % probability)

The status of continuous institutional sites can lead to extensive unification between $ 3.10–$ 3.30Allow the technical indicators to reset as the adoption developments continue.

This scenario provides accumulation opportunities without great danger.

Correction on the overall opposite winds (possibility of 20 %)

Weakness of the broader market can lead to the sale towards $ 3.07–$ 3.12 Support levels, representation 4–8 % The downside.

Recovery depends on institutional purchase in support of EMA and the continued adoption momentum.

XRP analysis from Chatgpt: Organizational Normalization meets technical perfection

Chatgpt XRP analysis reveals the optimal rapprochement of organizational normalization, speeding up the adoption of companies, and unifying technical science.

The next target price: $ 4.00.00.00 within 90 days

The immediate path requires a decisive break above $ 3.24 Resistance to verifying the validity of science from the rule of monotheism.

From there, speeding up the adoption of XRP companies can push towards 4.00 dollars Psychological teacher, with continuous institutional integration in driving towards $ 5.00+, Represents a strong estimate.

However, failure to break $ 3.24 It will indicate an extended unification of $ 3.10–$ 3.16 It ranges from market developments, which creates an ideal accumulation chance before the next adoption wave pushes XRP towards $ 11+ Objectives, and verify the validity of the global payment infrastructure with regulatory and full operational normalization.

https://cimg.co/wp-content/uploads/2025/08/11202807/1754944086-chatgpt-image-aug-11-2025-03_27_23-pm_optimized.jpg

2025-08-11 20:36:00