Tether and Circle now hold more US debt more than several countries star-news.press/wp

Previously, a specialized tool for encryption, Stablecoins gradually became a basic player of the prevailing financing. Circle and Tether now has more American debt governor than many sovereign countries.

The last accommodation in Act Genus Act is the legitimacy of Stablecoin, and the benefits of high charging from banks, payment processors, and Fortune 500 companies.

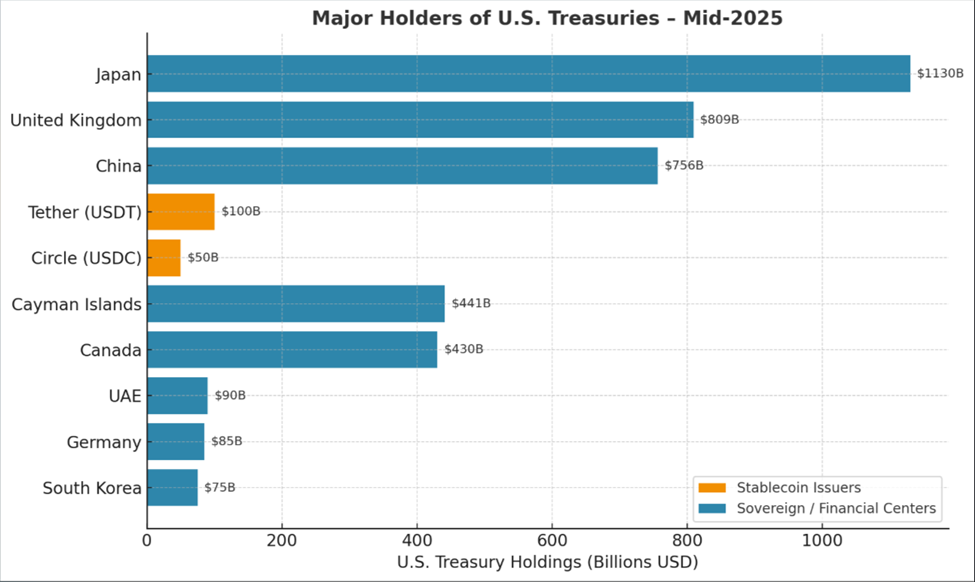

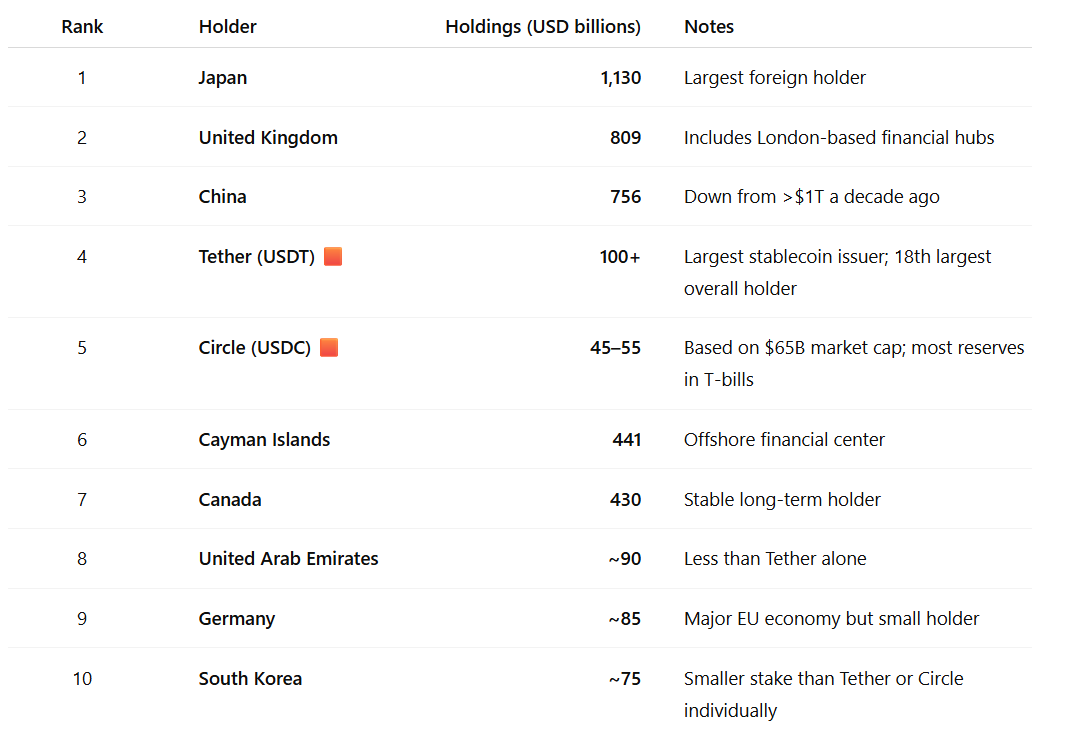

A circle and tense quietly collecting the debts of the United States more than Germany, South Korea and the United Arab Emirates

Stablecoins are digital symbols linked to the US dollar and supported by reserves, and are often in US Treasury bills (T-BILS). The structure guarantees that the distinctive symbol can be reliable for one dollar.

This stability makes it attractive to border payments and as a settlement layer of the ecosystem for encryption.

Two leading exporters in Stablecoin, Tether (USDT) and Circle (USDC) maintain more US government debts than many major national economies. This includes Germany, South Korea and the United Arab Emirates.

Tether, the largest stablecoin source, now owns more than $ 100 billion in T-BILS. According to Treasury data, it ranks eighteen, the largest American debt holder, over the United Arab Emirates (85 billion dollars).

Circle, the USDC source, owns between $ 45 billion and $ 55 billion in T-Bells, which provides it in South Korea (about $ 75 billion) if measured individually.

Combated, the two companies exceed the three countries, with a recent APOLLO report highlighting the rapid rise in the sector.

“Nearly 90 % of Stablecoin’s use is encryption trading, which is likely to continue to grow. The large penetration will be if the US dollar is used for global retail sale payments. Read Excerpt in the Apollo report.

The Stablecoin industry is now eight, the eighth largest external holder of the Treasury Treasury, as expectations indicate that it may grow from the current market value of $ 270 billion to $ 2 trillion by 2028.

The market value of USDC alone increased by 90 % last year to $ 65 billion. It was fueled by institutional adoption and prominent public subscription in Surke in June.

Transactions folders competing with traditional giants

Meanwhile, the story of adoption exceeds the reserves. In early 2024, the sizes of Stablecoin’s transactions exceeded Visa, largely due to the use of encryption trading. The increasing use of global funding operations also contributed to traction, as the Beincrypto report indicates that 49 % of institutions use Stablecoins.

With a semi -fixed settlement and low drawings, stablecoins is placed as a faster alternative and cheaper for Swift and other old -wheel drive bars. StableCoin Startup Bridge, which cost $ 1.1 billion, acquired the Stablecoin Bridge in October, one of the first major technology bets on this technology.

The rise of the stablecoin exporters as a main T-Bill buyer when traditional foreigners expand. China’s holdings fell from more than 1 trillion dollars a decade ago to 756 billion dollars.

Although the largest foreign holder of $ 1.13 trillion is still a more cautious approach. This creates an opening for Stablecoin Exporters to serve as a fixed source of demand for American debt.

“The presence of Stablecoin exporters are always a huge batch in terms of giving confidence to the Treasury (the department) around the location of the debt,” Fortune. I mentionedQuoted from Yasha Yadaf, Professor of Law College at Vanderbelt, who studies the intersection of encryption and bond market.

Supporters argue that Stablecoins can help consolidate the dominance of the dollar worldwide, as happened to a large extent “Eurodollar” in the twentieth century.

They also suggest a growing demand for T-BILS from Stablecoin companies that can help reduce long-term interest rates and enhance US sanctions abroad.

However, skeptics of cautiousness of increasing the numbers, with the American Capital Fund Sector (MMF), for example, kills the dwarf stablecoin by about $ 7 trillion.

Meanwhile, bank pressure groups warn that stablecoins can drain the sediments from banks, which may reduce lending capacity.

“City expects to put Stablecoins among the best holders of the United States, if the American debt climbs and fluctuates T-Bells, as well as confidence in the digital dollar. Create a temporary transformation into other currencies,” booksQuoted from Citibank.

CEOs in the industry contradict that similar concerns about MMFS decades ago have proven to be unfounded.

However, if Stablecoins continues to absorb large quantities of short -term cabinet, the Wall Street managing liquidity and risk may be disrupted.

However, the growth of Circle and Tether indicates that the American debt market has a new category of heavyweight buyers who were born in the volatile encryption square instead of traditional banking halls.

The circular and the circle now holds more than the debts of the United States more than many countries that first appeared on Beincrypto.

[og_img]

2025-08-09 14:16:00