Since Nasdaq, the S&P 500 has achieved its highest level – does BTC earn a week by 3.8 % signal for $ 112,000? star-news.press/wp

Bitcoin (BTC) was trading of about $ 10,7343, with a modest increase of 0.28 %, while American stocks rose Standard records. The S&P 500 was closed at 6,173.07, and Nasdaq Composite reached 20,273.46, supported by progress in trade talks between the United States, speech and optimism across global risk markets.

The reaction of the encryption market was combined with this bullish feelings. Bitcoin has kept more than $ 107,000 for most of the week, and has gained about 3.8 % over the past seven days. This gathering coincides with positive observations by US Trade Minister Howard Lottennik, who alluded to the final trade agreements with China and ten other countries.

While President Trump’s sudden statements about the end of Canadian trade talks that were temporarily overlooked the market, the shares have received their gains, and so did Bitcoin. This behavior indicates that BTC is currently acting more like a macro risk than external speculation.

- BTC profit: 3.8 %

- Nasdaq, S&P 500 has ever struck new levels

- BTC is trading within a range ranging between 100 thousand dollars and 110 thousand dollars

The risks of inflation and the federal reserve policy keep the bulls under the check

Although the broader market rises, the upward bitcoin momentum faces the opposite winds of the macroeconomic. PCE basic USA The inflation rateThe preferred scale of the Federal Reserve increased, to 2.7 % annually in May, slightly higher than 2.6 % estimate. The monthly basic inflation increased by 0.2 %.

Federal Reserve Chairman Jerome Powell has multiplied a cautious approach that depends on data, repeating that the price cuts are far from the guarantee. Trump’s introductory speech added to inflation fears, which in turn keeps the federal reserve hesitant.

This cautious situation was weighing as speculative risks, especially in the encryption markets. Even with the support of more than $ 105,000, it seems that the upward trend has been directed until strong inflation or cash axis appears.

Low bitcoin and technology suggests monotheism

Bitcoin’s latest basic procedure indicates signs of monotheism, rather than expanding. The immediate trading volumes decreased, as Glassnode reported a decrease in the daily transfer volume from $ 76 billion in May to $ 52 billion. Meanwhile, futures data data also indicates the cooling market, on a 3 -month trading basis, and the financing rates are both low.

Technically, it is possible that the prediction of the bullish bitcoin is as soon as it is able to penetrate the resistance level of 108,250 dollars. It appears to be a symmetric triangle or bullish banner on the graph for 4 hours. 50-Daya at $ 105,970 provides support in the short term, while Macd has turned caution, indicating caution.

The main technical levels to watch:

- Resistance: 108,250 dollars, 109,257 dollars, 110,448 dollars

- Support: 105,970 dollars, 104,991 dollars (FIB 0.382), 103,984 dollars (FIB 0.5)

Commercial preparation:

- Buy above: 108,300 dollars

- Goals: 109257 dollars and 110,448 dollars

- Stop: Less than 105,970 dollars

- An alternative entry: Withdrawal to 104,991 dollars for the region to decline

Currently, merchants are advised to monitor size and wait for a decisive collapse. Without an increase in participation, the Bitcoin’s path to $ 112,000 is a difficult rise.

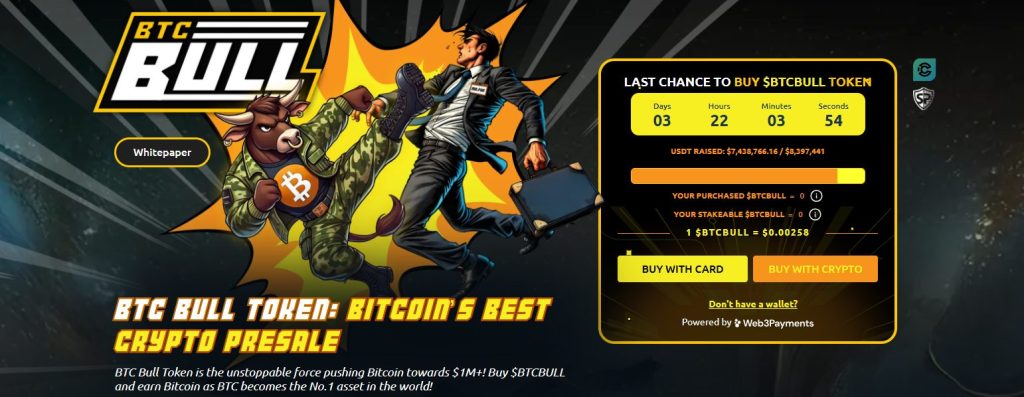

BTC Bull Token is approaching the maximum steel of $ 8.4 million, as government representation enters the final hours

With Bitcoin trading near $ 105,000, the investor concentration turns towards the distinctive BTC Bull ($ BTCBLL), which is almost allocated almost allocated during the pre -primary period. As of today, the project raised 7,438,492.88 dollars from its goal of $ 8,397.44, leaving less than a million dollars to be collected before the distinctive code price moves to the next layer.

Its price is currently at 0.00258 dollars, the first buyers have a limited time to enter before the subsequent price increases.

The features associated with bitcoin and the burning mechanism

BTCBULL connects its value directly to the Bitcoin price through two smart systems:

- BTC Airdrops: Distributed to holders, with priority for participants before prior acting.

- Burn supply: It is running automatically when BTC rises with $ 50,000 in increases.

- APY: 55 % annually

- insurance: no one

- Liquidity: direct

- Total gathering: 1,925,149,417 btcbull

This model appeals to both old warriors and new arrivals looking for hands income. With only hours and almost solid cover remains, the momentum returns quickly. BTCBLL Mix of the value associated with Bitcoin, scarcity mechanics, and flexible trick provides strong demand. The first buyers have a limited time to enter before activating the next pricing layer.

https://cimg.co/wp-content/uploads/2025/06/16113221/1750073540-bitcoin-price-prediction-2.jpg

2025-06-28 12:39:00