Is SPX6900 (SPX) or a possible recovery? star-news.press/wp

Meme Coin SPX fell 22 % over the past week to trade at $ 1.30 at the time of the press, raising concerns about more negative risks.

Technical indicators indicate that the capital flows outside the market, which suggests that the distinctive symbol may face more severe decreases.

Spx decrease where traders reduce exposure

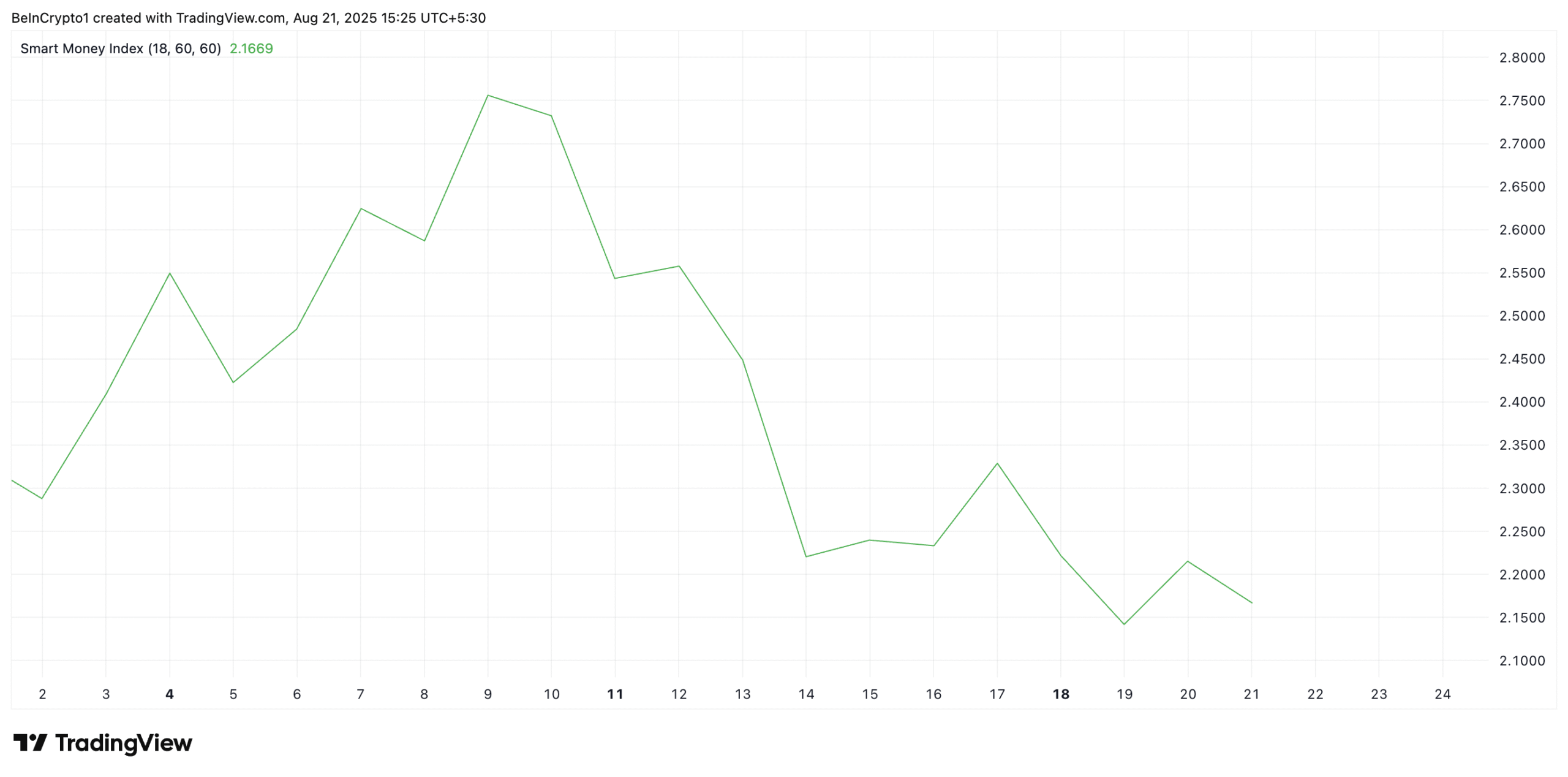

Readings from the SPX/USD chart showed a fixed decline in the smart money index in the distinctive symbol (SMI) since August 10. To this writing, it is located in 2.16.

Do you want more symbolic ideas like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

Smart funds refer to experienced investors or institutions such as hedge funds, investment capital owners and professional traders who are believed to have better visions than a regular retail investor.

SMI tracks the behavior of these investors by analyzing price movements within the day. Specifically, selling in the morning (when retail merchants dominate) is measured for purchase in the afternoon (when institutions are more active).

The increasing SMI indicates that smart money accumulates on assets, often before the main prices. On the other hand, when this indicator falls, the main assets distribute symbols.

This indicates that SPX may face more severe decreases if these investors continue to sell.

Moreover, the equivalent stopping of SPX and the opposite (SAR) currently constitutes a higher dynamic resistance than its price at $ 1.93, which gives credibility to the Habboudi expectations above.

The equivalent SAR index determines the direction of the potential trend of asset and repercussions. When its points are placed under the original price, the market is in a bullish direction. It indicates that the assets are witnessing a bullish momentum, and its price may continue to gather if the purchase continues.

On the other hand, when the points fall over the price of assets, the pressure on the sale is the dominant. Traders often explain as a sale signal because they alluded to a potential continuity of a declining momentum.

SPX can slide to $ 1.19 if the sale continues

SPX is trading at $ 1.30 at the time of the press, hanging higher than the support that was formed at $ 1.27. In the event of a decrease, the support hall can allow the road to a fall to $ 1.19.

On the contrary, the rise in accumulation can lead to a recovery of about $ 1.51.

The post is the SPX6900 (SPX) or is waiting for a possible recovery? He first appeared on Beincrypto.

[og_img]

2025-08-21 21:00:00