SPX6900 earns 18 % – but merchants, be careful, this danger can spoil everything star-news.press/wp

- SPX6900 jumps by 18 %, but does whales come out quietly while everyone accumulates on the trip?

- Unless $ 1.2 has support, SPX risks withdrawal to $ 0.95 despite the short -term bullish momentum.

After declining to the lowest level at $ 0.92, SPX6900 (SPX) I wore again with a re -test of the support level of $ 1.

Of course, this recovery came with the improvement of the broader encryption feelings after cooling geopolitical tensions. In sync, the SPX claw again, on the occasion of a sharp rise.

The future Spx6900 wakes up with high prices

This recovery wave rides, SPX rose to a local height of $ 1.26 before slightly dilution. At the time of the press, it hovers near $ 1.24, an increase of 18.78 % over 24 hours.

This was not the only number that jumped.

SPX increased 85.8 % in trading volume to reach $ 161 million. Such an enormous increase in signs of size increased activity either on the side of sale or purchase.

Source: Coinglass

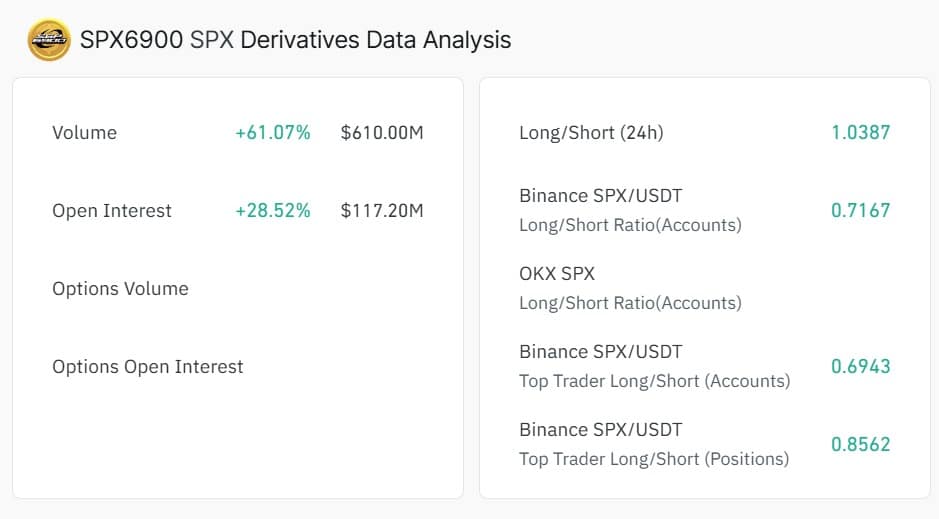

Interestingly, most of this activity stems from the derivative market. The open interest of SPX6900 (OI) is 28.52 % to $ 117.2 million, indicating the flood of new contracts.

Such a rise in OI indicates that with the start of prices, investors have rushed to the market to take strategic locations.

In fact, the long/short percentage remained higher than 1, which confirms that the majority of merchants have long bets.

Market signals are not synchronous

Despite the high prices, size of SPX6900 and activities in future contracts, they appear to be the main market players who are not convinced. This is also because the SPX6900 investors sell strongly.

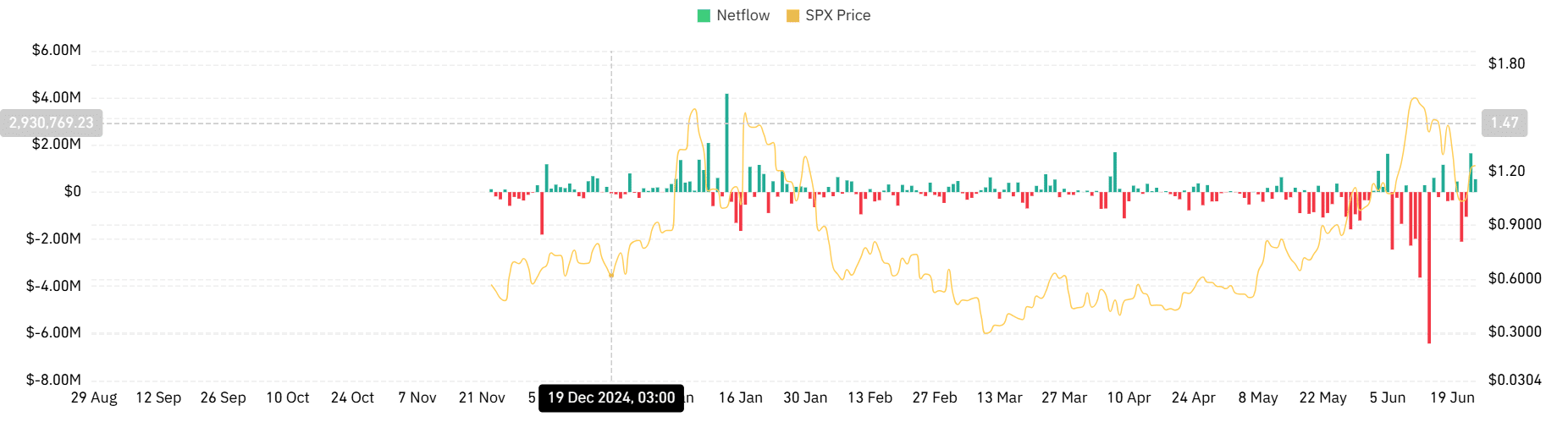

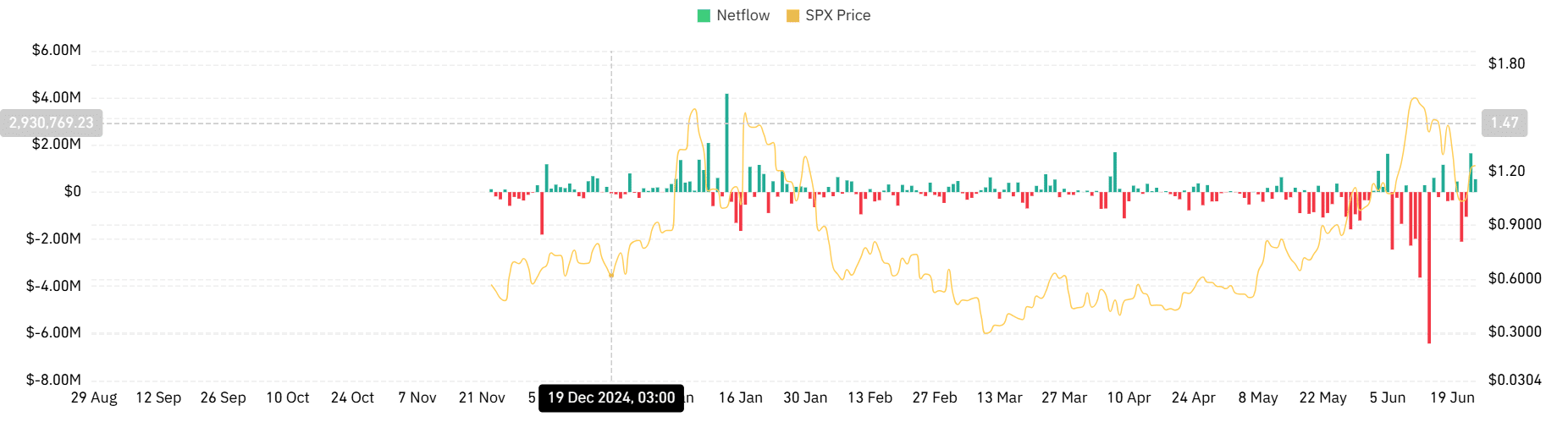

Source: Santime

After recovering the price over the past day, most of the bearers turned to the profits.

Looking at the balance of the exchange flow, it remained positive at about 25.8 thousand.

The positive value here indicates that investors and holders sell more than they buy. Thus, there is a greater flow in the stock exchanges more than the external flow, which may lead to high pressure pressure.

Source: Coinglass

Moreover, Netflow has also turned positive. This indicates that while the prices rose, investors have emptied nearly 7 million SPX icons.

The most remarkable was diving in the flow rate to the stocks. On June 23, SFR Meecoin’s SFR amounted to 21 billion. At the time of the press, he was barely clinging to 11k.

This significant decrease in SFR indicates an increase in supply while the demand is low. If the demand fails to keep pace, the decrease in scarcity leads to low prices.

Source: Santime

So … what now? $ 0.95 or $ 1.5?

Despite the dramatic bounce, there is a clear rope tightening between speculators and sellers. While the short -term traders jumped in the midst of relief on the market on a larger scale, a long -term condemnation appears to be shaken.

Unless the bulls can keep a daily closure over $ 1.20, the gathering risks steam loss. If the sellers remain dominant, SPX may return the support of $ 0.95.

But if the momentum carries and turns $ 1.2 to the company’s support, SPX may charge a fee of $ 1.5 after that.

https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-9-1-1000×600.webp

2025-06-25 00:00:00