Solana bond bonds grow – but they hardly walk star-news.press/wp

A new tracker displays Solana Dat (Treasury Digital Asset) amazing data point. These are the owners of companies hardly enter any Sol. The 13 companies that control more than $ 1.73 billion in distinctive symbols do not exceed 7 % of them.

Treasury bonds in ETH show that stokeing can provide solutions that affect their need and new risks. Only two Sol companies direct large holdings, and thus its performance can be a useful measure in the market.

Most Dats will not participate in Solana

Solana Dats is very modern now; Last week, three companies announced plans to buy one billion dollars, and the shares of another company jumped after the treasury investment plan of $ 400 million.

Through this type of acquisition, Sol Sold Reserve built a follower to evaluate the holdings of these companies and their behaviors:

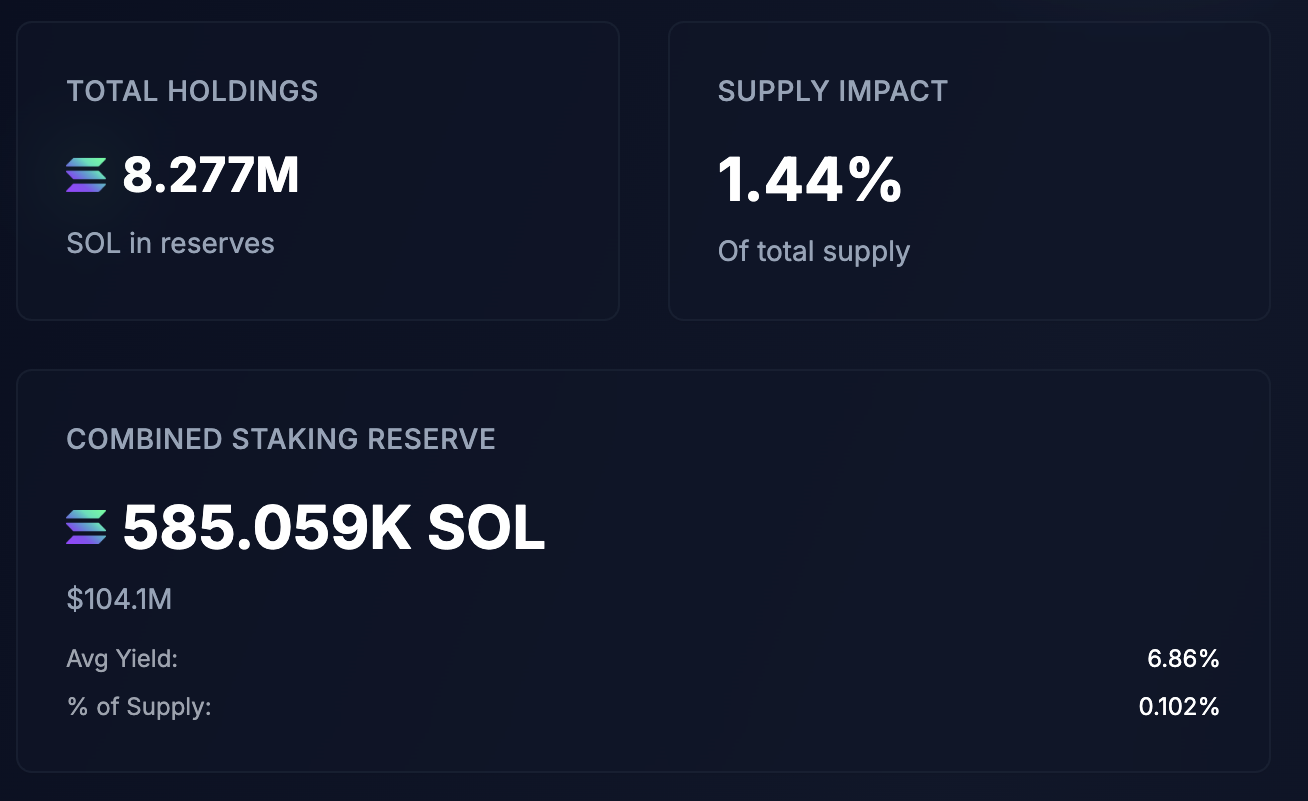

this tool It is not comprehensive, but it currently notices 13 SOL holders who collectively represent 1.44 % of the fully distinctive symbol supply.

In the collection of this data, the project discovered an interesting data point: This dats barely flow any of Solana. Despite the occupation of $ 1.73 billion in Sol, less than 7 % of this is currently.

Moreover, only two of 13 Dats tracked to any Solana at all. Both companies, Defi Development and Sol, started buying Solana before the process of acquiring companies became a direction.

Sol strategies have started to make purchases more than a year ago, and it raises a large share of its holders.

So, why do not the other nine companies flow any Solana? Do they miss a great opportunity, or is this a reasonable action plan?

Comparisons with ethereum

To collect more data, it may be useful to compare the distinctive symbol using ETHEREUM, which is witnessing a large flow of dat.

On the one hand, it can reduce some basic problems with the DAT strategy. The Ministry of the Assets Treasury needs fixed cash flows to buy more distinctive symbols, but it is often to collect donations exclusively through stock offers.

Many rounds can cause fears to relieve shareholders, and this recently caused Ehsella problems. Staking generates negative income, which may reduce this anxiety.

If DATS is able to raise money through other ways, it will give them more space to work freely. But this is not a risk -free proposal. During the past few months, minor changes in prices have sparked a significant unstable increase that ETH has not been able.

Its Blockchain has not been designed for this work at the corporate level, so technical congestion can be mixed with the pressure pressure and creates a dangerous position.

So, if the distinctive symbol has positives and negatives, what can you learn from this? Currently, the largest two Dat makers can be a critical bell.

However, the transactions of these companies while reducing shareholders or slowing prices can inform the rest of the market.

This second problem, at least, must provide a lot of data. Only yesterday, the Dat Sol did not prevent the sliding by 10 %. TV encryptions are very volatile, Solana bonds will need to adapt their exciting plans accordingly.

Currently, observers have trends to study before they decide whether this plan is worthy of attention.

Post Solana’s wardrobe grows – but they barely head to any Seoul first appeared on Beincrypto.

[og_img]

2025-08-27 17:43:00

New checking sources ⁰

New checking sources ⁰ Record the full stock price and plans

Record the full stock price and plans Driving files with professional wallpapers

Driving files with professional wallpapers Historical Sol purchase data

Historical Sol purchase data