Solana slip 11 % this week amid declining pressure star-news.press/wp

Solana has decreased more than 11 % over the past seven days, as multiple technical indicators indicate twice the momentum and increase the declining pressure. The RSI (RSI) index has decreased sharply, indicating a shift towards the most cautious market position.

Meanwhile, Ichimoku Cloud and EMA structures show Haboodi settings, with major resistance levels in support and support areas at risk now. Unless the clear reflection is formed, Sol may continue to face the short pressure in the short term.

Solana RSI decreases to less than 45 years old with momentum fading

Solana’s relative strength index (RSI) decreased to 40.77, a noticeable decrease from 64.25 only two days ago.

This acute transformation reflects the weakness of the bullish momentum and indicates that the last sale pressure has outperformed the interest in purchase.

The movement refers to a possible transition from neutral or upward conditions to a more cautious or low -minded feelings, as merchants begin re -evaluating the short -term expectations of Solana.

RSI is a widely used momentum an indicator that measures the speed and volume of changes in recent prices. It ranges from 0 to 100, with readings higher than 70 usually indicates excessive conditions in the peak – the decline in the previous prices – while values of less than 30 excessive conditions indicate and may control prices.

Reading is placed near 40.77 Solana in a neutral area abroad, hinting that the assets lose an ascending momentum, but it has not yet reached the sale area.

If the RSI continues to decrease, this may indicate more risks of the negative side, while stability above 40 may indicate uniformity before the next step.

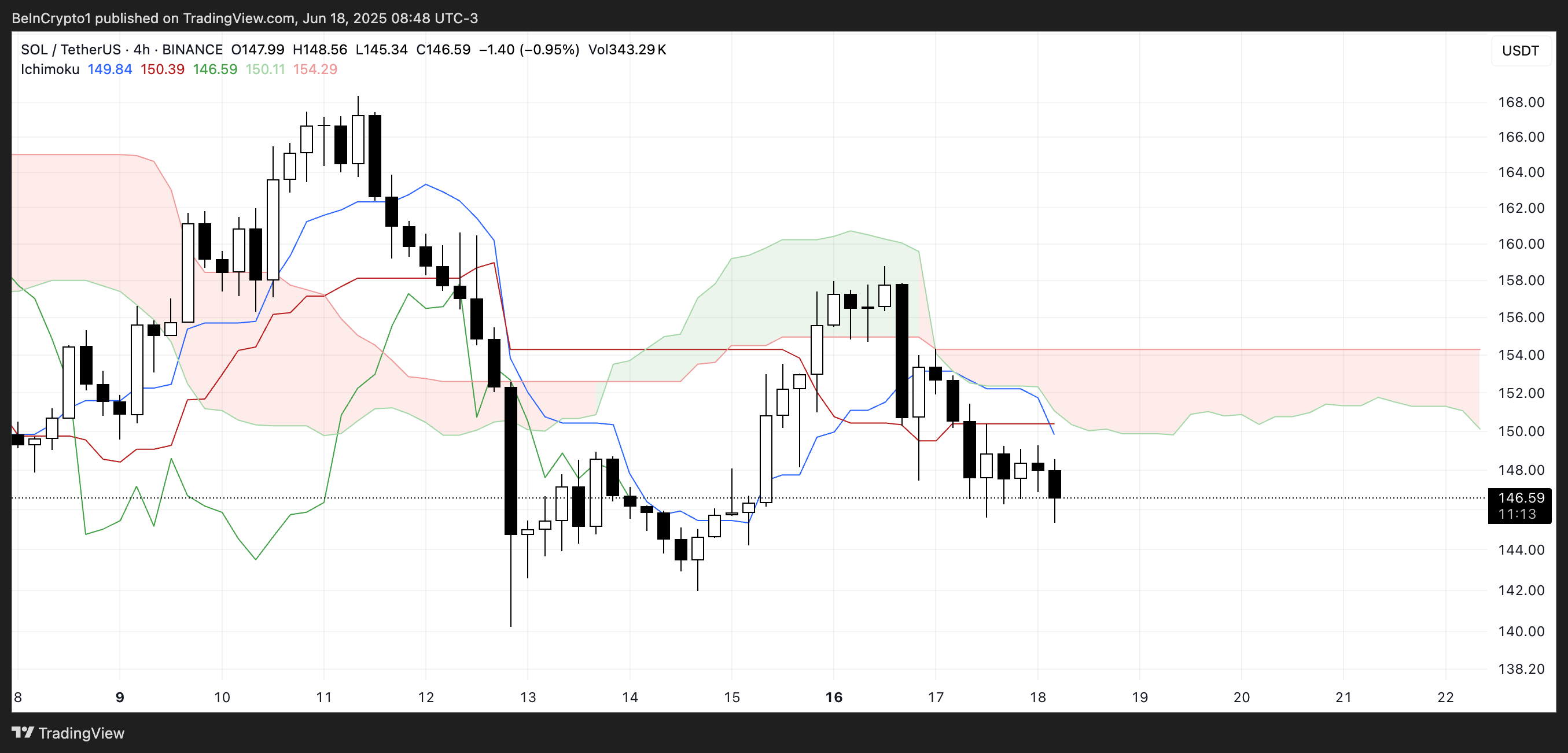

Ichimoku rolling structure remains Sol under pressure

The Somana Cloud Solana Cloud scheme reveals a declining setting. The price movement is currently trading under the kumo (Cloud), which is shaded red.

This red cloud refers to the prevailing momentum and acts as a dynamic resistance. The leading period A (the green line that forms the top edge of the cloud) remains the bottom of Span B (the red line that forms the lower edge), which enhances the declining structure.

The next cloud also remains red and relatively thick, indicating strong resistance in proximity and makes reflection ascending more difficult unless it builds a big momentum.

Tenkan-Sen (Blue Line) is currently located below the Kijun-Sen (Red Line), which is another classic landmark. These two lines also settled, indicating unification instead of any strong directional movement.

With candles struggling to fracture over Tenkan-Sen, the short-term momentum looks weak.

Unless the bullish intersection occurs or penetrates the cloud price procedure, Solana remains under declining pressure from Ichimoku’s point of view.

The Solana EMA structure is still downward despite the recent reversal attempt

The Solana EMA structure is still downward, as the short-term transmission averages have been placed in a long-term position-continuing the declining momentum.

This preparation appeared after a failed emerging attempt two days ago, as Seoul tried to reversed the direction but faced rejection. If the alignment of landing continues, the asset can test the level of immediate support at $ 141.53.

The collapse below can open the door for more negative aspect, and may push Sol to less than $ 140 for the first time since April 21.

On the other side, if the trend is reflected and the short -term EMAS starts at the top, Solana can re -test the resistance area of about $ 150.59.

The clean rest above this level will be the first sign of the potential trend. If the purchase of momentum exceeds this, the higher resistance goals are located at $ 163.64 and 168.36 dollars.

In the event of an extended march, Sol may aim at $ 179.41 as the following main bullish level.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2024/09/bic_solana_ETF-covers_neutral_1.jpg.optimal.jpg

2025-06-18 19:00:00