Solana price above $ 200 faces the risk of profit star-news.press/wp

Solana PRICE was trading near $ 203 at the time of the press, as it recovers a little after it decreased to less than 200 dollars earlier in the day. This small recovery kept daily losses to about 1 %, but the wider structure remains fragile.

The bulls have managed to restore a brand of $ 200, yet the chain charts indicate that the momentum may not last for a long time.

Long -term holders sit on high gains

The first warning sign comes from the NUPL (NUPL) of long -term holders. This scale tracks whether investors are sitting on profits or paper losses. When NUPL is high, it indicates that their holders may seduce the gains.

On August 28, the Solana holder in the long term NUPL was not touched 0.44, which is higher in six months and close to the peak of March 2 of 0.4457. This was followed by a sharp decrease when Solana’s price decreased from $ 179 to $ 105 in less than two weeks, which is 41 % correction. A more modern example came on July 22, when she followed a high -slide high.

The latest NUPL reading has declined to 0.40, but it is still high compared to recent months.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

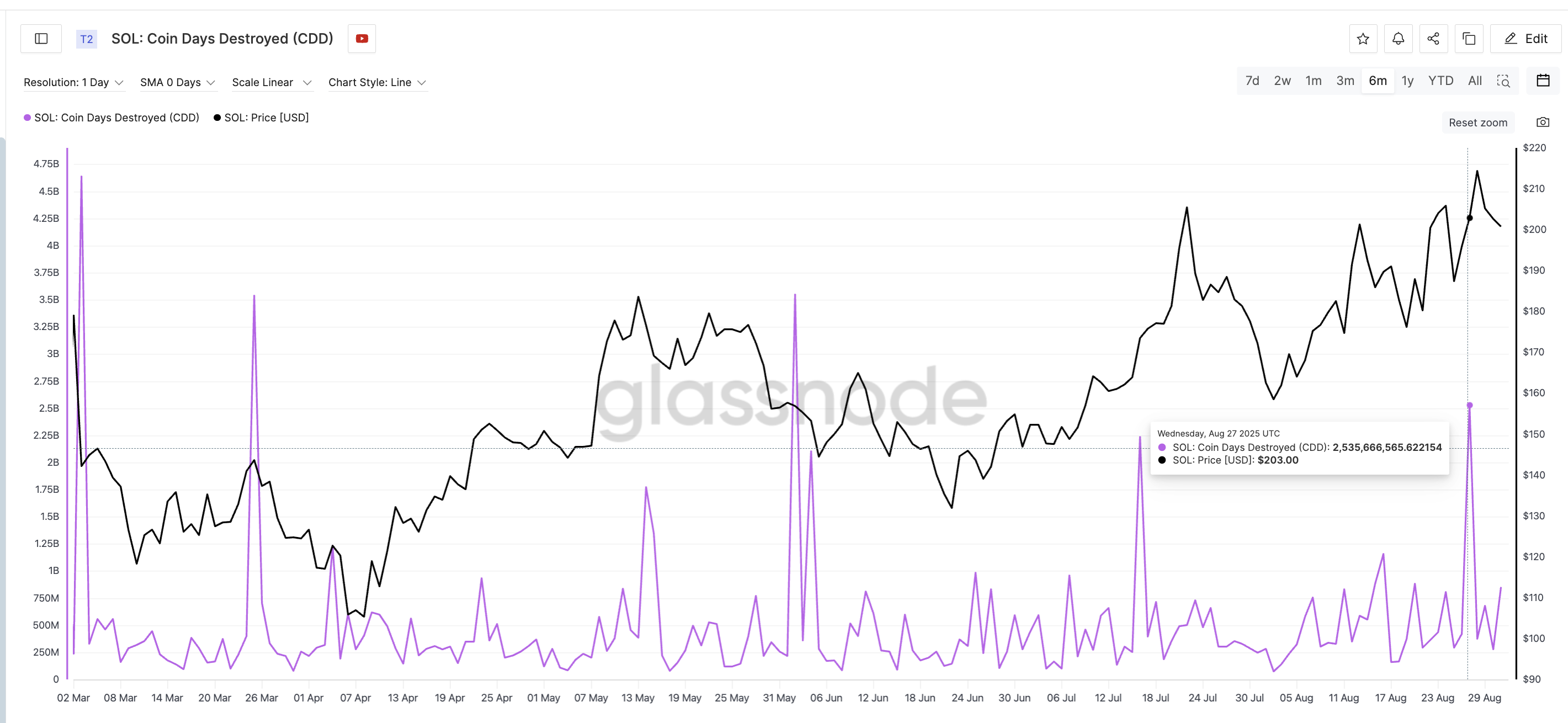

The destroyed currencies are validated by the profits

This anxiety is also visible in the scale of destroyed currencies (CDD), which tracks the number of old coins that move on the chain, and may allud off to achieve profits. Every time CDD has risen over the past six months, the Solana price has been sharply corrected shortly after.

For example, on March 3, the Solana price fell from $ 142 to $ 118, a decrease of 17 %. Another rise on March 25 witnessed the price sliding from $ 143 to $ 105. Even when this step was late, as after July 16, the final correction showed from $ 205 to $ 158 how strong the signal.

The last height came on August 27, when Solana was trading near $ 203. Although the correction has just begun, the pattern indicates that their long -term holders may already sell in strength, which leads to the validity of the NUPL data.

Solana price levels confirm the risks

The artistic chart complements the image. Solana is trading near $ 203, as the resistance for a year 201 is turned into temporary support. But the upscale issue will not be held unless the daily closure remains above this level.

Less than $ 196 or $ 191 will be momentum, and breaking $ 175 will confirm a deeper correction.

In the upward direction, bulls need to quickly restore a higher floor, but with long -term holders on the gains and CDD they explain the coins, the risk of additives remains on the negative side.

However, the downward trend will fade if Solana Price managed to restore 207 clean, with a full candle forming higher than this level. Currently, the standards indicate that the recovery of the Solana price above 200 dollars may not bear without stronger support.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/08/solana-price.png

2025-09-01 20:30:00