Trump Tariffs run the fastest decline for us shares from 2020. years as China, the EU vows star-news.press/wp

BBC Business Reporter

Global stocks are sunk, a day after President Donald Trump announced the deletion of new tariffs that were forecasted for prices and weighing growth in the US and abroad.

The stock exchange in the Asian-Pacific region fell for the second day, hot on the U.S. S & P 500, which had their worst day since Codic crashed the economy 2020. Years.

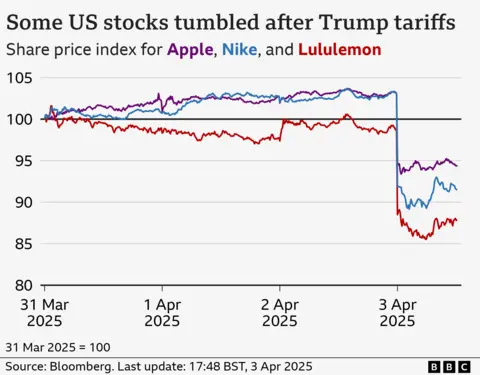

Nike, the apple and the target were among the great consumer names that are the worst hit, all those who sink for more than 9%.

In the White House, Trump told reporters that the American Economy “Boom” would thanks to a minimum of 10% of the tariff plans to import global imports to strengthen federal revenues and bringing the production house.

The Republic President plans to guess the products of dozens of other countries with far larger levies, including trade partners such as China and the European Union.

China, which faces an aggregate of 54% by tariff, and the EU, which faces duties of 20%, promised Thursday.

French President Emmanuel Macron called on European companies to suspend planned investments in the United States.

Tariffs are taxes on goods imported from other countries, and the Trump plan announcing on Wednesday would attend such duties to some of the highest levels in more than 100 years.

The World Trade Organization said it was “deeply worried,” an estimate of the amount of trade could be reduced as a result of 1% this year.

Traders have expressed concern that the tariffs could knock in inflation and stalemate.

In the morning store on Friday, the Japanese Benchmark Nikkei 225 index fell by 2.7%, and ASXS ASX 200 has been reduced by 1.6%. Kospi in South Korea was an apartment to a little lower.

Markets in the mainland China and Hong Kong are closed for the Qingming Festival.

On Thursday, S & P 500 – which records 500 largest American companies – trapped 4.8%, shedding approximately 2TN values.

Dow Jones closed about 4% lower, while Nasdaq was approximately 6%. The American stock is sold from the middle of February in the middle of trade war fears.

Earlier, the United Kingdom’s index in the UK fell 1.5%, and the other European markets also fell, echoed from Japan to Hong Kong.

On Thursday in the White House, Trump has doubled in hanging stakes, which aimed at reverse the decades of LED liberalization in the USA formed by a global trade order.

“I think he’s going really well,” he said. “It was an operation like when the patient operated, and that’s a big deal. I said it would be so true.”

He added: “The markets will blossom. The stock will draft. The Earth goes to the boom.”

In contrast, the White House that insisted on new tariffs are not negotiating tactics, the trump signaled that it could be open to work with trade partners “if someone said we will give you something that is so phenomenal.”

On Thursday, Canadian Prime Minister Mark Carney said that the country would revenge with 25% imposed on vehicles imported from the USA.

Last month, Trump sent a 25% tariff on Canada and Mexico, although he did not announce new duties on Wednesday against trade partners in North America.

Companies are now facing the election of tariff costs, working with partners to share that load or convex consumers – and risk sales decline.

This could have a major impact as US consumer consumption amounts to about 10% – 15% of the world economy, according to some estimates.

Although the stocks fell on Thursday, the price of gold, which is seen as a safer property in the era of turbulence, touched a record high $ 3,167.57 at a time, before retiring.

The dollar also weakened against many other currencies.

In Europe, the tariffs could lower the growth of almost percentages, with a further hit if the block rests, according to the analysts on the main asset management.

In the US, the recession is likely to be achieved without other changes, such as major tax cuts, which Trump also promised, warned Seepa Shah, the main global strategist in the company.

She said that Trump’s production goals will be a long-standing process “If that happens”.

“Meanwhile, the steep import tariffs are likely to be an immediate traction economy, with limited short-term use,” she said.

On Thursday, Stellantis, which makes Jeep, Fiat and other brands, said she temporarily stopped production in a factory in Toluca, Mexico and Windsorsors, Canada.

He said a move, the response to Trump 25% of the car import tax, would lead to temporary releases of 900 people in five plants in the United States who supplies those factories.

On the stock exchange, Nike, which makes many of its sports clothes in Asia, was among the most difficult goal of S & P, with actions up to 14%.

Stocks in Apple, which are largely relied on China and Taiwan, crashed 9%.

Other traders also fell, with a view to approximately 10%.

Harley-Davidson motorcycle manufacturer – which was subject to retaliatory tariffs by the EU during Trump First term as president – 10% fell.

In Europe, shares in the sports clothing Adidas fell more than 10%, while stocks in the rival pumit are fell more than 9%.

Among luxury products, the Pandora Pandora jewelry manufacturer has fallen more than 10%, and Louis Vuitton Moet Hennessy fell more than 3% after the tariffs were imposed on the European Union and Switzerland.

“You see that traders are now destroyed because the tariffs are expanded in the countries they didn’t expect,” said Jay Woods, the main global strategy in the markets of capital freedom, appointing to be ahead of several turbulence.

2025-04-04 00:59:00