Sol PRICE RALY faces pressure – is 206 dollars the penetration point? star-news.press/wp

Solana (SOL) increased by approximately 25 % over the past week, as it installed a gathering momentum in the broader encryption market, which sparked his upward feelings across the main entities.

Trading now at the price levels that were last seen in February, Sol attracts a renewed benefit from merchants and investors. However, the data on the series indicates that everyone is not convinced that the gathering will continue. What does this mean for Altcoin in the short term?

Solana merchants were divided between hope and caution

According to Glassnode, the net profit/loss (NUPL) (NUPL) is placed in the “optimism and anxiety” area.

The NUPL scale measures the difference between the total unreasonable profits for all holders and unrealized losses in relation to the maximum asset market. It offers an insight into whether the market, on average, is in a case of profit or loss.

The market is considered in optimism and anxiety when most investors sit on modest profits. They hope, but they are not fully convinced of a constant gathering.

Sol has published two numbers during the past week and is now trading at $ 198.43, and a flowing closer to the level of $ 206 with psychological value, which is the price of his contract in February.

While some investors keep a company in anticipation of decisive penetration that exceeds $ 206, others are still skeptical that this main resistance will be breached. This tension began to appear in the behavior of the market as reflected in readings of the daily graph.

Sol climbs higher, but merchants start quietly selling the summit

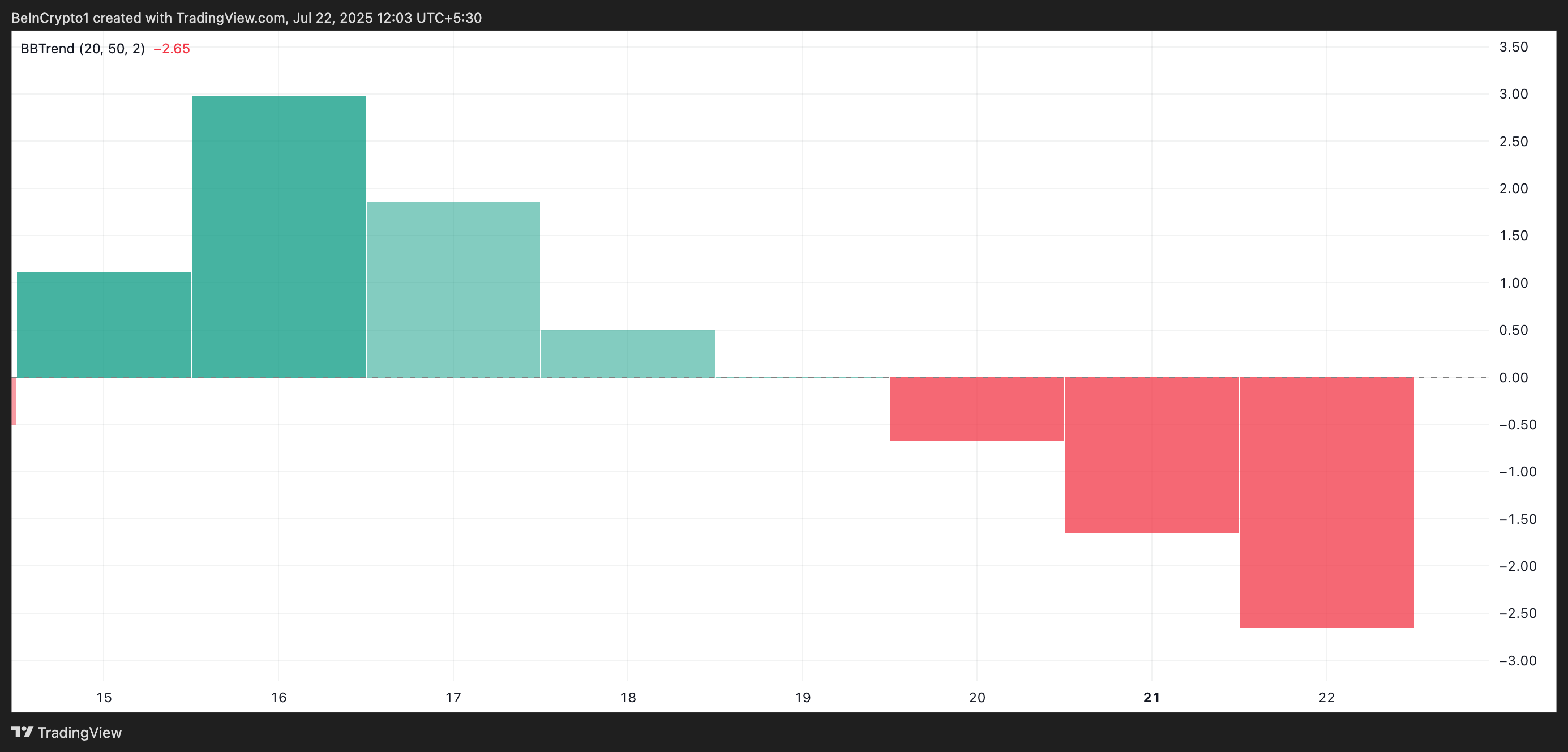

Despite the high sharp prices and increased activity on the chain, BBTRand from Sol indicates the persistent mild sales pressure. Over the past three days, the momentum has spread a red graphic bars that have gradually increased sizes, reflecting the height of the sale pressure.

BBTRand measures the strength and direction of the direction based on the expansion and contraction of the Bollegerer teams. When red bars are restored, the original price is constantly closed near the Bollinger Lower domain, reflecting the continuous and hint pressure pressure to the possibility of increasing the downside.

This indicates that, even with the growth of bullish feelings, a slice of the Sol market began to lock profits, which is a possible early sign of reluctance.

Solana’s fate is suspended between $ 206 and $ 183

The resistance level stands 206 dollars now as a decisive level for Sol. If purchasing pressure is intensified and managed to separate from this threshold, this may turn into a strong support zone, which paves the way for a possible transfer of about 219.97 dollars.

However, in the event of an escalation of the sale activity, Sol can get rid of some of its recent gains, which leads to the price withdrawal towards the support area of $ 183.75.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/05/pump-fun-solana.png

2025-07-22 13:00:00