The famous Altcoin Solana has increased by 2 % over the past 24 hours, as the broader encryption market shows the flexibility.

However, in addition to the recovery of the public market, the upcoming Sol’s bullish step is driven by a hint in a renewed institutional interest in the currency and its ecosystem.

Solana preparation for the gathering? Nasdak raised fuel momentum

According to the 40 -f model presentation On June 18, the Canadian Asset Director Sol Strategies, a company that focuses exclusively on the Solana ecosystem, presented documents of compliance with the American Securities and Exchange Committee (SEC), indicating its intention to include the Nasdaq Stock Exchange.

While still awaiting approval, deposit is a bold step towards providing direct exposure to institutional investors to Solana’s assets across traditional markets. This development has sparked a renewed wave of cautious optimism between Hoodlers, which prompted its price today.

Also, the timing of this deposit is in line with increasing liquidation signals on the chain such as the filtering heat maps of the currency, which shows a thick group of liquidity formed around the level of $ 160.

Filtering heat maps are the visual tools that traders use to determine price levels where large groups of parking lots are likely to be filtered. These maps highlight high -liquidity areas, often coded in color to show intensity, with brighter areas representing larger liquidation capabilities.

These price areas are usually magnet for prices, as the market moves towards these areas to operate the references and open new sites.

Therefore, for Sol, the dense liquidity group around the level of $ 160 indicates a strong circulating interest in buying or covering short jobs at this price. This paves the stage to gather in the short term towards that region.

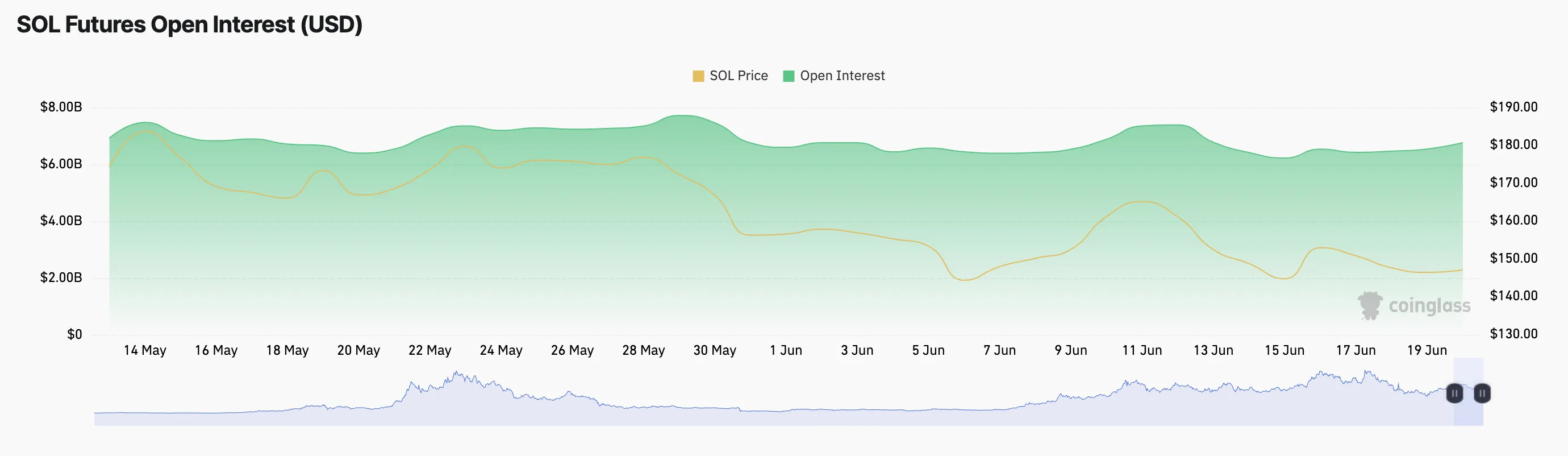

Moreover, the open interest of SOL (OI) increased by 3 % over the past day, indicating an increase in participation in the field of summons in Sol Futures.

OI’s height indicates that more capital flows into currency derivative markets, which reflects an increasing conviction among traders about the potential rising price of Sol.

Could the new demand raised the outbreak of $ 160?

Since early June, Sol has been trading within a narrow range, facing resistance of $ 153.59 and finding support at $ 142.59. A possible batch requires about $ 160 to require a decisive outbreak over this resistance, which can only occur if the new demand enters the market.

Without renewing the purchase pressure, the current momentum may stop. If buyers start to show signs of fatigue, Sol risks the opposite of its recent gains and re -testing support for $ 142.59.

The collapse below this level can open the door for a deeper correction in the Sol currency price about $ 134.68, as the Q2 ends at the end.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/05/solana-meme-coin-token-launchpad.png.webp

2025-06-20 14:30:00