IRS gets a powerful new tool ‘to avoid review, gorsuch disagreements star-news.press/wp

NewNow you can listen to Fox News articles!

Justice Neil Gorsuch wrote the authority of the U.S. Court authority to limit the limit on limiting limits in certain internal entry services (IRS), indicated that the Federal Tax Service may prevent the Federal Service.

Gorsuch wrote the opinion of the High Court V. Train Commissioners of Internal RevenueJennifer Zuch started in 2012 with the case with the issue with IRS in the late 2010 decent about federal tax return.

“On the way, the Court decisions have a powerful new IRS tool, to make mistakes in future cases,” Gorsuch wrote in his disagreement.

In this case, Zuch said the IRS made a mistake, instead of $ 50,000 instead of his son instead of his son. The IRS did not agree and managed to collect unpaid taxes to seize and sell his property.

The Supreme Court can access Social Security information

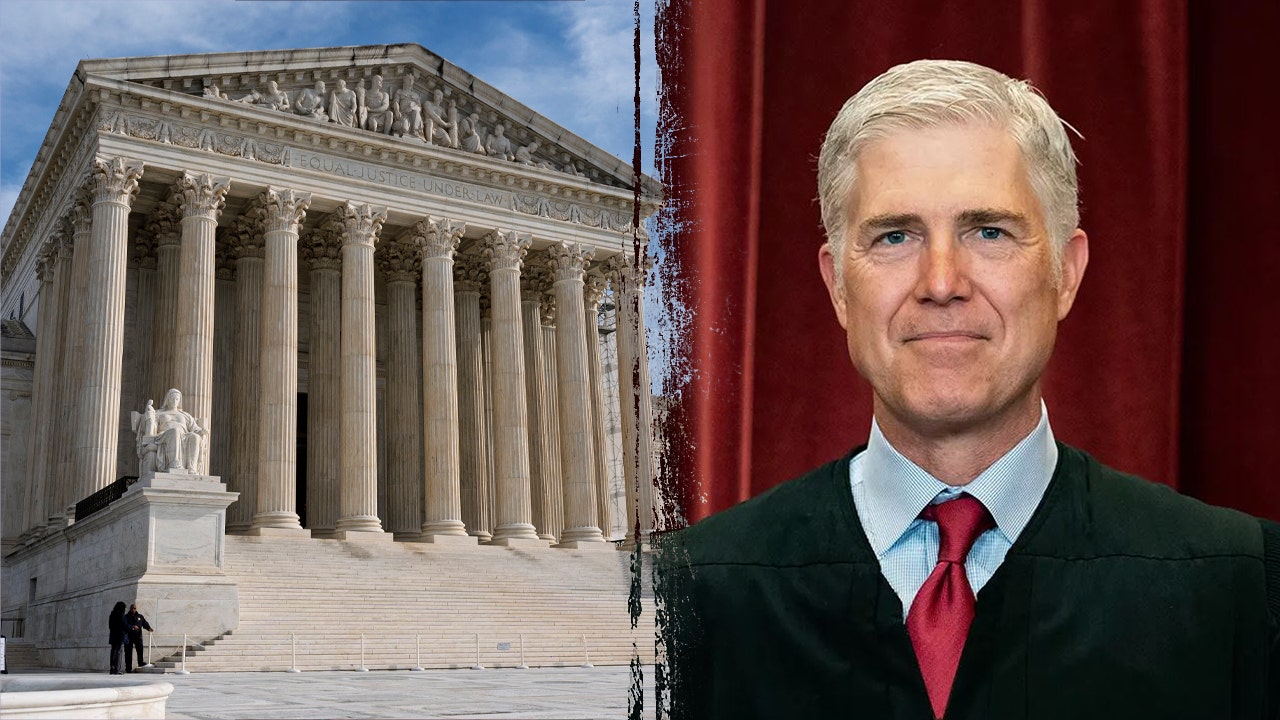

Justice Neil Gorsuch is a photograph in the group in the Supreme Court of Washington on 23 April 2021. (Erin Schaff / The New York Times Via, Pool, File)

In the end of the conflict and within a few years, the juices presented annual tax returns that show annual surcharges. Instead of refunding, IRS applied the most notable tax responsibilities of 2010.

After consolidating the outstanding amount of the IRS Zuch, his responsibility came to zero, and the IRS had no reason to scare his property.

The Supreme Court is seen at Capitol Hill in Washington, DC, December 17, 2024. (AP photo / J. Scott Applewhite, file)

Then the IRS decided to release the Zuch’s tax court, arguing that the tax court had lacking jurisdiction, because he was no longer a property. The tax court agreed.

Trump admin requires the Court of the Supreme Court of the Administration of Education Department

The Supreme Court has no jurisdiction anymore the tax court.

“There was not a proposal, the tax court properly concluded that Jurisdiction was lacking Jurisdiction to solve the questions about the Court Tax responsibility,” read the opinion of the High Court.

Signage in Washington, including DC Internal Ticket Service (IRS) (Samuel Corm / Bloomberg Getty Images, via file)

The decision does not prevent the recovery of excessive payments you believe Irs It has been wrong, but given the responsibility of the IRS to avoid responsibility, Gorsuch wrote in his disagreement.

Click here to get Fox News app

“The IRS searches, and the Court must be able to avoid a review of the tax court and never respond to the taxpayer’s complaint,” he wrote. “

2025-06-12 16:53:00