Tottenham in order to sign up to 195k-7 million in French loan star-news.press/wp

Tottenham Hotspur and presidents Daniel Levy have key decisions in the near future, which further extends to the director of Ange Postecoglou.

Tottenham’s transfer plans between Ange Postecoglou Uncertainty

With Levy, it still needs to be pasted or twisted with Postecoglou, the minimum minimal, for a season, LilyWhites leaders must commit to the direction as the summer transfer window.

Linked

Tottenham offered ange nightmares to pay £ 68 million at Arsenal Gem

They could also propose players plus cash.

Postecoglou will determine how spurs deal with Spurs with their procurement strategy and the first mini-window now – Open June 1 to 10 – Auxiliary will be to resolve the future of Australia as soon as possible.

There are reports that Johan Lange has identified Levy and Technical Directors Objectives, among players who attract Lottenham’s hard interest.

|

Tottenham regular regular regulars at the Premier League – 2024/2025 |

Average match rating |

|---|---|

|

Son heung-min |

7.00 |

|

James Maddison |

6.98 |

|

Pedro Porro |

6.95 |

|

Dominic Solanke |

6.84 |

|

Deja Kulusevski |

6.83 |

|

through Whoscored |

|

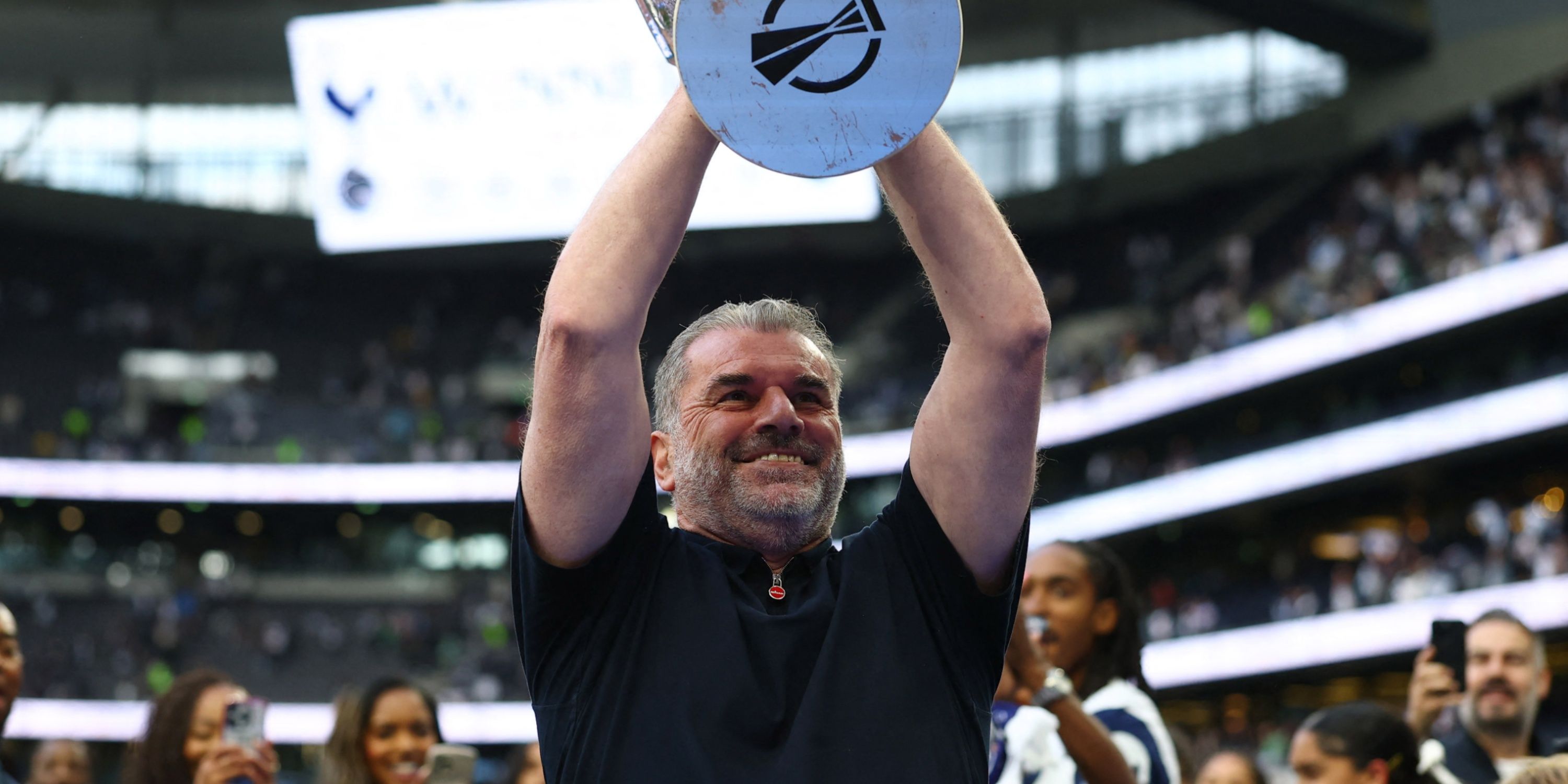

However, it is difficult to have serious movements to have clarity about Postecoglou, who led the club about the first trophy in 17 years, but Tottenham’s record has been different in a single season (22).

An attacker firmly in Spurs, Ezen and links to Bayern Munich with Leroy Sané Spurs leaders think to add more experience to their youngsters team.

“Spurs should not buy it to buy, with the Qualification of Champions League for the club,” said Sky Sports Reporter Michael Bridge Q & an, giving club transfer plans for some answers.

“All fields, in addition to the goalkeeper department, will be seen. It would be in the middle of the field and the priority stops Cristian Romero.”

They are interesting markets to know, one of which Wantway comes from £ 195,000 to £ 195,000 by Chelsea Winger Christopher Nkunku.

The French international entered 14 goals according to Enzo Maresca, although I hardly start, and can play in attack duties, namely from the left side, second striker, second striker and center.

Tottenham borrowed Christopher Nkunku in order to sign

Spurs recently conducted research on Nkartu, as reliable Journalists of Givemesport reported Ben JacobsSo it seems to be a real target.

Now, Chelsea News, Simon Phillips has been reported by another reliable journalist Tottenham are making Nkunku’s loan offer with a purchase option 27-year-olds.

The last allowance of the last price of Leipzig stars would lead to £ 55 million, but both Spurs and Newcastle will want to take the initial temporary agreement before paying anywhere about this amount.

While Chelsea would prefer direct sales, there is acceptance within Stamford Bridge, that they can have such green movements so that the blues will want to get rid of his books.

Nkartu Totenham could be an excellent work provided by its quality, experience and variability, it is also an attractive option to stay in London for players.

2025-05-31 16:35:00