Close the Ripple-SEC case followed by Rush from updated XRP ETF files star-news.press/wp

The long -term legal battle between the Ripple Labs and the US Securities and the American Stock Exchange (SEC) concluded, as it ended one of the battles of the court hall that I have seen closely at the date of encryption.

On August 22, the second department court rejected all the outstanding appeal, which confirms that the transactions involved XRP on public exchanges do not qualify as sales of securities. The referee ends a dispute that started in December 2020, when the Supreme Education Council accused the crowding of $ 1.3 billion through unregistered XRP offers.

Ripple ends a five -year battle with a fine of $ 125 million

The legal defense of Ripple has extended for nearly five years and cost more than 100 million dollars, which reflects an arduous battle it faced in light of the hostile organizational environment formed by the President of the Secret Gensler and Biden Administration.

However, the case path in July 2023 turned when Judge Angia Torres ruled that XRP retail sales were legal, while institutional sales violated securities laws.

Both Ripple and SEC initially appealed to this ruling, prolonging uncertainty.

However, the political climate has turned with Donald Trump’s return and the SEC leadership is more friendly. This development opened the door for settlement conversations.

By March, Brad Garlinghyus, CEO of Ripple, confirmed an initial deal related to a penalty of $ 50 million and withdrawing mutual appeal. Judge Torres initially rejected this agreement, while maintaining the case without a solution.

But in early August, both sides requested the chapter on the joint, and the second circle supported the proposal with a fine of $ 125 million.

It is important that the previous opinion of Torres – emphasizing that “XRP itself is not safe” – causes intact.

Market monitors believe that this precedent will affect the approvals of future products and organizational directives.

XRP ETF momentum accelerates

The clarity of the immediate judgment sparked the movement in the investment products sector.

On August 22, seven asset managers, including Gray, Franklin Timbelton, BitWise, Coinshares, Wisdomtree, 21shares, and Canary, update their files to get box on the stock exchange that focuses on XRP (ETF).

Nate Geraci, President of Novadius Wealth Consulting for Investment, described the wave of activity as evidence that exporters are in line with proposals and locations for final regulatory acceptance.

It is worth noting that SEC did not agree to the Spot XRP ETF product in the United States despite the existence of influence money.

Meanwhile, the lawyer for profit John Diton male October will be an embarrassing month, as SEC faces a series of final dates for the ETF application – with a gray position on the eighteenth and ends with Wisdomtree on the twenty -fifth.

Deaton noted that trading these products can start within days if SEC approvals reflect the investment funds circulating in Bitcoin.

However, its launch operations may take several months if SEC requested an additional disclosure, as it did with Ethereum etfs.

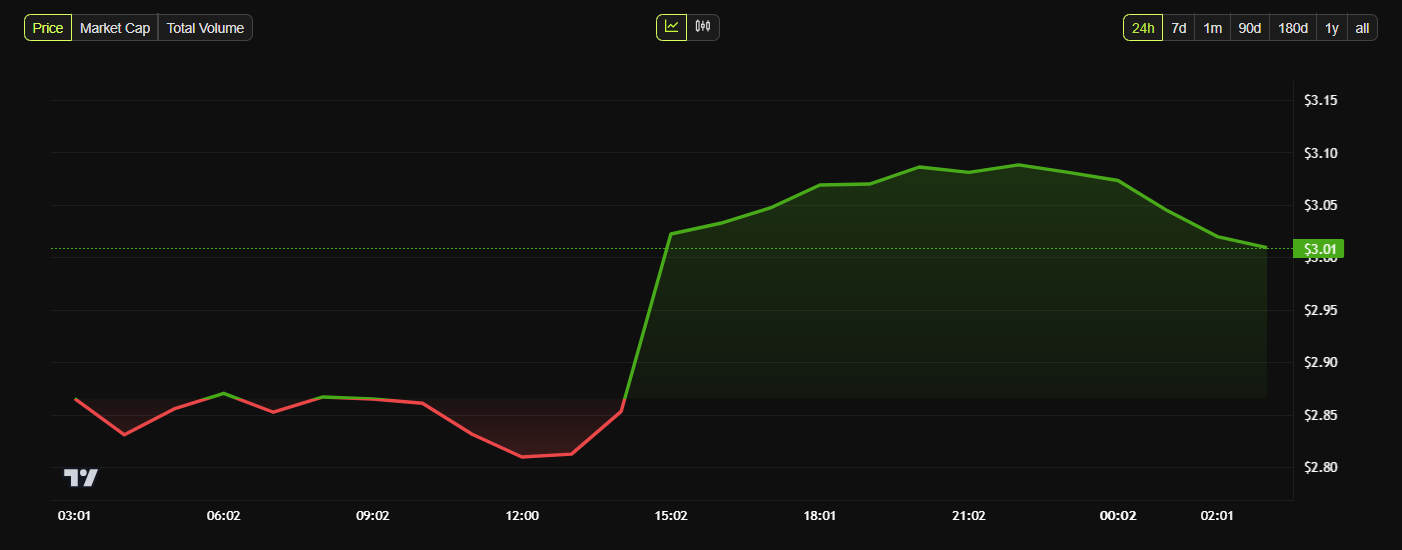

Meanwhile, these developments raised optimism in the XRP market.

According to Beincrypto data, the distinctive symbol has gained 4 % over the past 24 hours and has been circulated at $ 3.01 from the time of the press.

A post-Ripple -sec can followed by Rush from the updated XRP ETF files first appeared on Beincrypto.

[og_img]

2025-08-23 08:30:00

(Filanlaw)

(Filanlaw)