A real symbolic noise – as well as the three gaps that can be disrupted star-news.press/wp

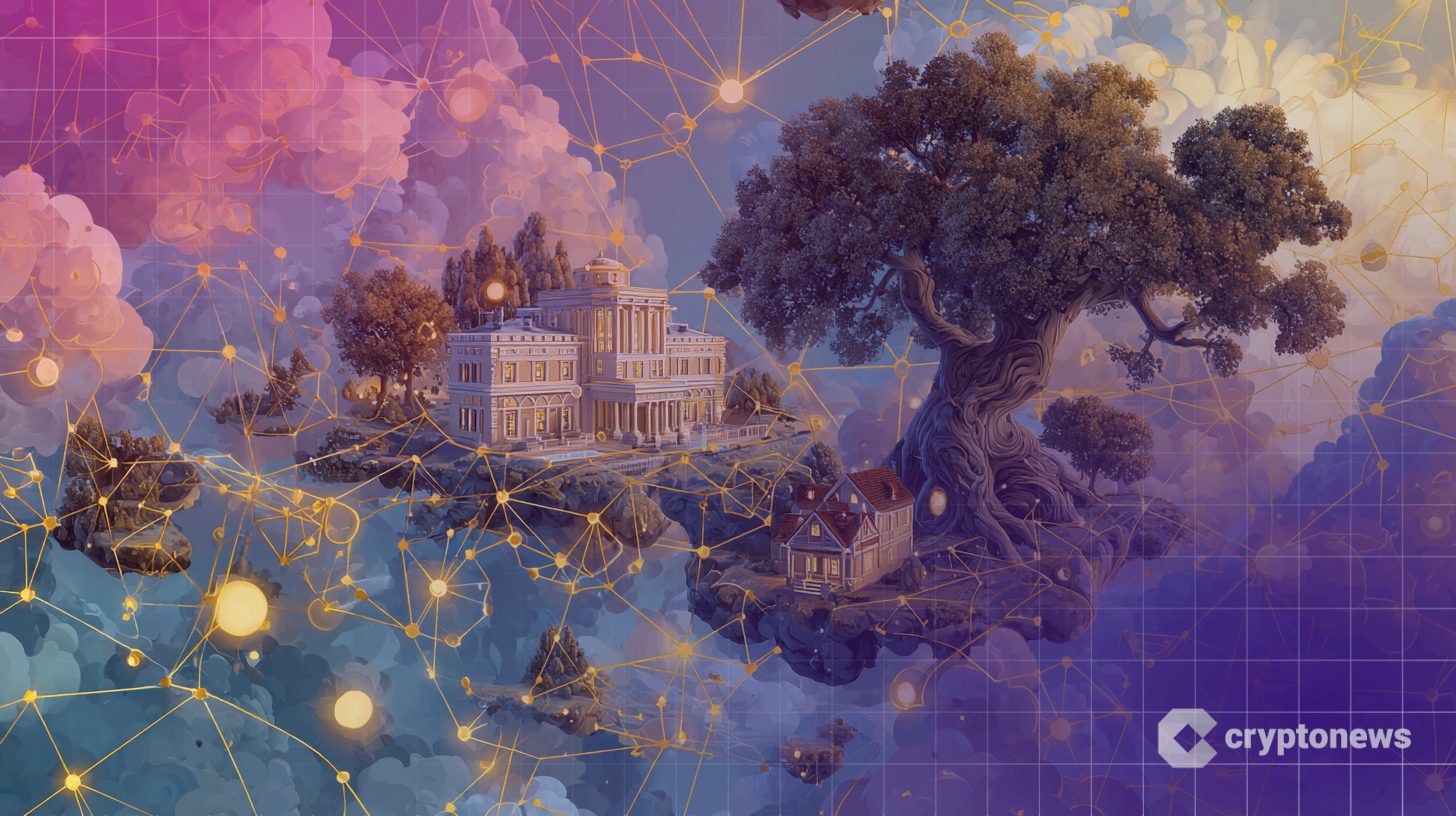

The asset symbols in the real world (RWA) has become a favorite Blockchain story. 24 billion dollars It is worth – now sitting on the book of the General Professor.

In fact, the value on the chain grows rapidly, but what really matters is what is still missing under it. Endowment legal, technology bottlenecks, and blind custody spots – any of these can bring the entire experience to a dead end.

While monitoring the billions you already see for players on the series and institutions, the distinctive symbol exceeded theoretical, but its foundations are still fragile. If we do not reform the basics, the momentum may stop before this thing really starts. Who has what? How does the system speak with itself? Is there any person bearing the real origin?

Let’s dismantle the three largest challenges that hinder the sector and what should happen if we want to mean this market of 24 billion dollars more than another “Flash-The-Pan”.

The symbols without address

The largest blind spot in the distinctive symbol mutation is also the most basic: the distinctive symbol is not ownership, it is required for ownership that does not concern unless the legal system agrees.

In some aspective judicial states, such as Luxembourg, digital securities Now you have a legal statusBut most of the world is still dealing with symbols on the chain as acting, not rights. Confidence may hold bonds or basic property, and the distinctive IOU symbol becomes digitally. On paper, it’s elegant. In court? Not guaranteed.

In bankruptcy, the judge can deal with a symbolic bond like any other not guaranteed claim, while folding it in the estate without a special priority. Even in the main markets, the registration systems for property or securities are still PaperThis means that there is no clean way to reconcile digital claims with the ownership of the real world. As for cross -border operations, the problem is getting worse. Implementation is implemented on conflicting legal doctrines, not a symbol.

In this case, I am sure that the organizers must build mobile definitions of digital -boundary digital assets and can be implemented in court. Until this happens, the distinctive symbol remains fragile. So far, we only give the financial infrastructure a new front deal that still depends on confidence in the ancient world.

Feiled technology and compliance

Even when the law is not an obstacle, technology is still. Distinguished assets move on the infrastructure that is never designed for exchange, and this appears.

Ethereum is still the main axis, but it is rarely cheaper or more efficient. Transactions can cost several dollars each, and while Layer-2 solves such as helping expression, they provide other problems. Which? Liquidity is fragmented, adds the risk block, and users must manage separate environments that do not talk to each other clean.

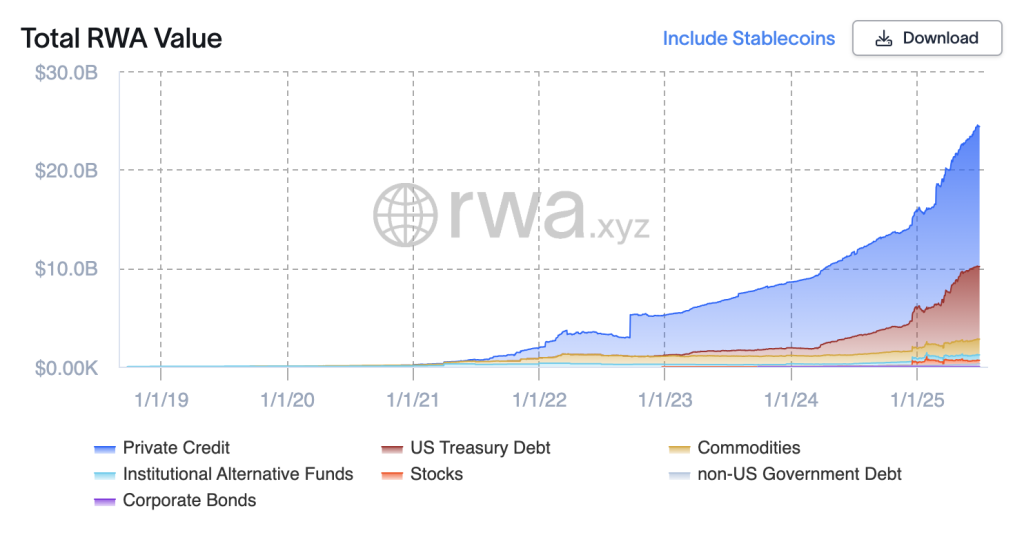

Compliance is just a break. Most of the symbolic exporters run their own permission systems – who can hold a distinctive symbol, who can recover it, and under the rules. This means even if your Kyc has passed for one of the origins, it may have to pass the operation again to another. The result is a disjointed market where every interaction on the chain becomes a new event on the plane.

What will change that? Common compliance bars, such as Erc-3643If it is adopted widely and in line with the organization, it is a viable way forward. Otherwise, we just rebuild old silos using more elegant tools.

Data risks and custody

The digital symbol may be digital, but it still tends to the facts that are not connected to the Internet. Each symbol related to the bond, property or warehouse needs a person (or something) to verify that the original is real and is still supposed to be. This is where things become unclear.

Oracles feeds external data in smart contracts: prices, ownership changes and payments. But these extracts can be backward or fail, and smart contracts have no idea what is happening outside the series. If the update is late or wrong, the penetration can be freezed or disturbed, and in volatile markets, even small delays converts old data into real requirements.

The nursery, in turn, brings its own risks. You may keep the distinctive symbol, but another person holds the real origin. If this trustee lacks transparency, appropriate audit, or legal accountability, the distinctive symbol becomes a digital receipt without evidence behind it. Outside of the banks are well -organized, the nursery standards are everywhere, and investors often have no idea about the type of protection, if any, they already have.

To fix this, distinctive markets need backup evidence, stronger Oracle criteria, transparency, accountability and review. Some infrastructure is already.

The distinctive symbol works only if it is approaching

From my point of view, the distinctive symbol already proves itself – in controlled pilots, closed systems, and sandy passes. But this is not the way the financial infrastructure measures are done. Without legal alignment and joint compliance bars, this space risks a mixture of “gates” corridors.

I do not see the next cheerful protocol. I am currently watching rapprochement – legislators who clearly determine digital property and platforms that stop re -invention of KYC from scratch.

Release responsibility: The opinions mentioned in this article are the king of the writer and do not necessarily represent the views of Cryptonews.com. This article aims to provide a wide perspective on its topic and should not be considered a professional advice.

https://cimg.co/wp-content/uploads/2025/07/04142915/1751639354-rwa_optimized.jpg

2025-07-04 14:31:00