The FOMC report causes Bitcoin: Will pressure withdrawal prices decrease from the sale side? star-news.press/wp

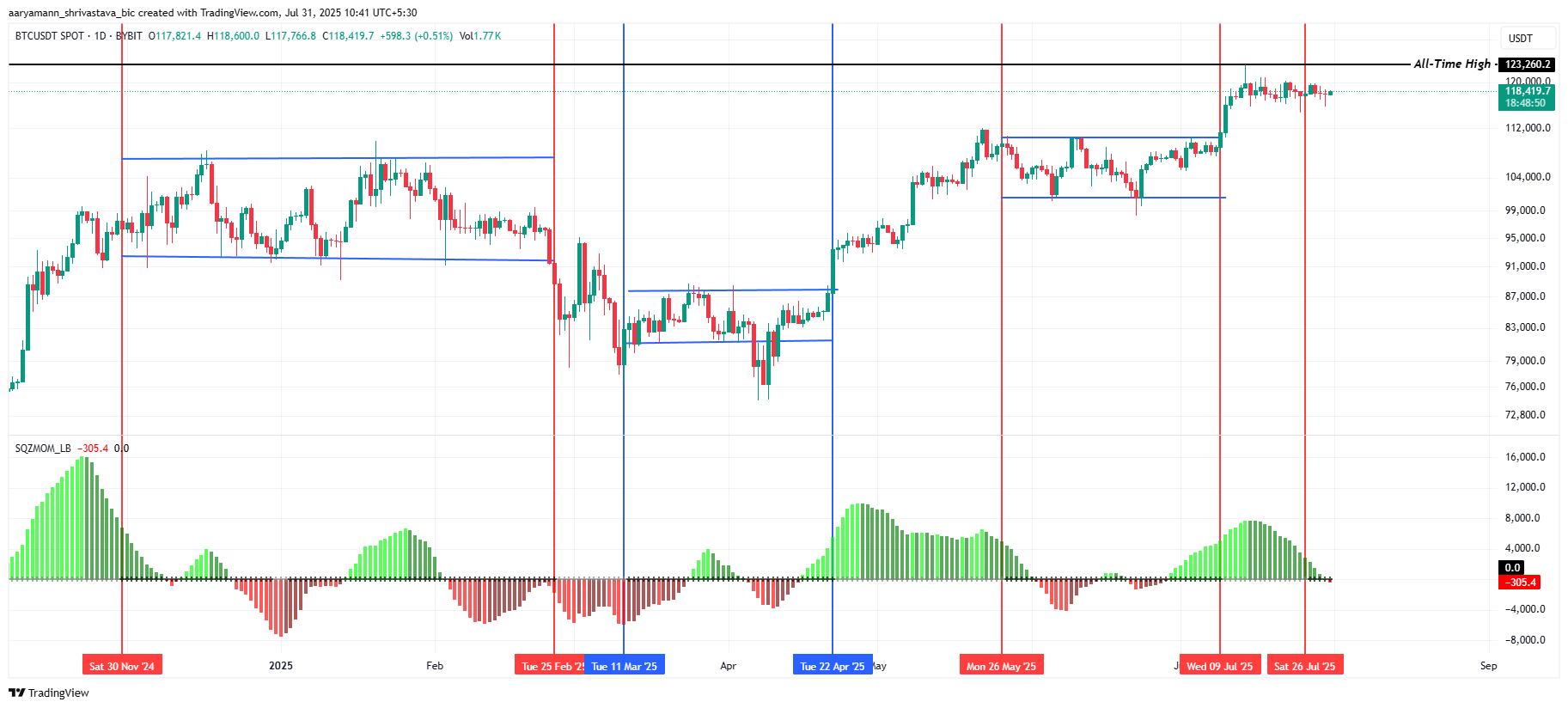

The price of Bitcoin Rangebox has been in the past few days, and it was combined between $ 117,261 and 120,000 dollars. However, the recent market conditions and external influences, such as the FOOC Open Market Committee (FOMC) on Wednesday, caused a temporary decrease.

As of now, the bitcoin price is 118,419 dollars, and it recovers a little after dipping it to $ 115,700. Despite this recovery, the Bitcoin path remains uncertain, due to factors such as pressure on the sale side.

Bitcoin showcases decrease in the future

RUP has recently broken the range above the range +2σ, a level often associated with the exhausted market stages. Historically, this preparation preceded the market peaks, indicating pressure from the underlying sale, which may eventually lead to low prices.

The current situation of reference indicates that the withdrawal may be likely to be in the coming days, which may push the price of bitcoin from its unification range. Given the previous patterns, the transformation towards the sale may lead to more downward pressure.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

The pressure momentum (SMI) indicates that Bitcoin enters a standardization stage. Historically, these monotheistic periods, where the price movement becomes more limited, has preceded significant prices in the price as soon as the pressure is launched.

As construction continues, the Bitcoin price is preparing to move sharply in one direction. If the broader market remains a decline, Bitcoin may see a sharp drop, especially if SMI confirmed this negative trend in the coming days.

BTC price needs jumping

Bitcoin is currently trading at 118,410 dollars, after declining to $ 115,700 on Wednesday with the FOMC report. The market response to the federal reserve decision to maintain interest rates unchanged has led to BTC recovery, but the basic market conditions are still risks.

The price of Bitcoin is vulnerable to increasing declines if investors start to reserve profits, which may push an encrypted currency less than the level of support of $ 117,261. The decrease in this support may lead to a bitcoin price to $ 115,000 or even less.

The only way to nullify these hippos is if Bitcoin can seize $ 120,000 and recover $ 122,000 in support. It is possible to provide a higher increase in these levels the momentum needed to push Bitcoin towards its highest level. However, until this happens, the bitcoin price remains vulnerable to fluctuations and market pressure.

POST FOMC report causes Bitcoin to decline: Will pressure clouds drop on the sale side decrease? He first appeared on Beincrypto.

[og_img]

2025-07-31 08:30:00