2 reasons the XRP price can decrease beyond that star-news.press/wp

Attention to XRP is run, as the main scales indicate the chain to the potential weakness of the short term.

With the decline in bullish feelings across the broader market, these factors indicate a deeper price decrease for XRP in the upcoming trading sessions.

XRP traders click: $ 222 million

XRP (ELR), the pioneer on the stock exchange, emphasizes low investor confidence and a decrease in appetite for risks. According to Cryptoquant, ELR is currently located at 0.36 – the lowest week weekly week.

ELR measures the average amount of influence that its merchants use to implement trading on the encrypted currency exchange. It is calculated by dividing the open interest of the original according to the stock market reserves for that currency.

The retreating ELR of XRP indicates a decrease in risk appetite among merchants. It indicates that investors are growing careful about the distinctive symbol prospects in the short term and avoid high -level situations that can amplify potential losses.

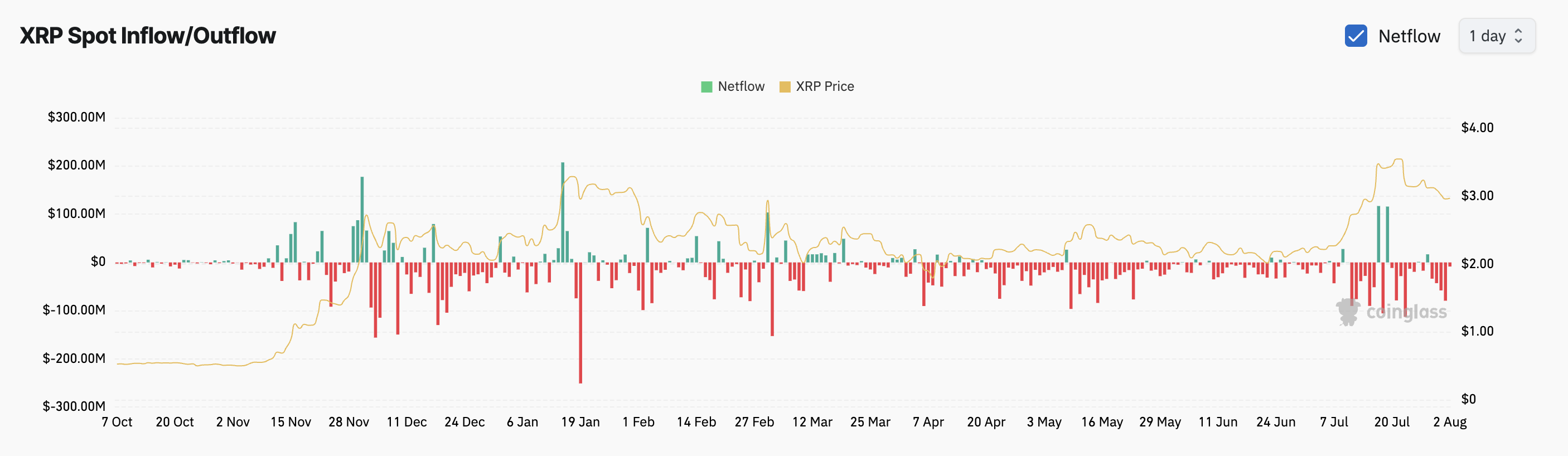

The trend between the participants in the immediate market is not different. According to Coinglass data, XRP Netflows has registered negative $ 222 million since July 29, indicating the dominance of the continuous sale and weak pressure on the purchase side.

When Netflows records negative, traders sell their holdings and consume profits, while fewer buyers intervene to replace them.

This trend may exacerbate the current lower direction of XRP, as the demand for the original decreases while the supply accumulates.

XRP Bears is close to $ 2.71 – but the outbreak of $ 3.39 remains on the horizon

With the pressure on the sale side, XRP risks finishing to $ 2.71. If this support floor fails, Altcoin may see a sharp decrease to $ 2.50.

On the other hand, the outbreak of the price of $ 3 remains possible if the purchasing momentum is strengthened. A successful step after this threshold can pave the way for a rare of about $ 3.39.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

https://beincrypto.com/wp-content/uploads/2025/07/image-244.png

2025-08-02 15:41:00