Amsterdam based Pollster Capital Zero-nephew has announced the launch of the € 500 million Debt O Fund, the Polester Capital E-Mobility and Infrastructure Fund (PCEIF) designed for money to change.

Funds will increase the loans on e-mobile and logistic projects, suppliesNecessary financing which is urgently necessary but difficult to find somewhere else“. With the launch of the PCEIF, the total committed capital in the capital of Polester will increase to $ 1 billion, to reduce the funds gap for the effect will strengthen its position as a top asset manager.

Jan-Wailem KingPolester Capital CEO explains: “Transfer to vacant logistics is one of the largest opportunities to accelerate decorbonization. We see growing demand for financial solutions that companies help convert their business models without compromising. Through our various funds, we have already issued a record of $ 490 million in the impact loans in 2024. With PCEIF, we are now expanding our impact on the zero-elaborate mobility sector, confirming that businessmen ensure that they have financial support to accelerate their conversionThe “

Established by January-Welime Konig, Pollster Capital is an impact investment agency that focuses on the notification economy, renewable energy and biodiversity transition to reduce funding. The firm specializes to structure the personal debt solutions that enable the systemic effect when providing financial return.

According to the Polester, the mobility sector makes the second largest CO2 emiter after the industrial sector, to meet the climate goals and to ensure the effectiveness of the business.

However, this transformation requires more than $ 120 billion investment in Europe by 20 to charge infrastructure, electric vans and trucks.

Despite the economic and environmental benefits, financing remains difficult to protect. Banks are hesitant to provide long-term capital and Venture Capital is often inappropriate for these capital-intensive projects. PCEIF enables North Western Europe’s companies to make it effectively, effectively adding to the structural Debt financing created at the growth or transfer phase.

Originally renewable power projects are focused on structural and management, the company has recently received an AIFM MIFID top -up license and has developed as a complete licensed fund and resource manager dedicated to environmental initiatives. With PCEF, the Impact Investment Farm is now bringing its skills to the mobility sector, including a specialized e-progressive team.

The purpose of the PCEIF is to make sustainable investment that combines with environmental goals, issuing loans to active orrow interactions in mobility, which contributes to decreasing GHG emissions and reduce air pollution. The fund has been classified as a SFDR paragraph 9 fund and focus on financing:

- Charges Point Operator: Installing and operating companies are universally available charging infrastructure for cars, vans and trucks.

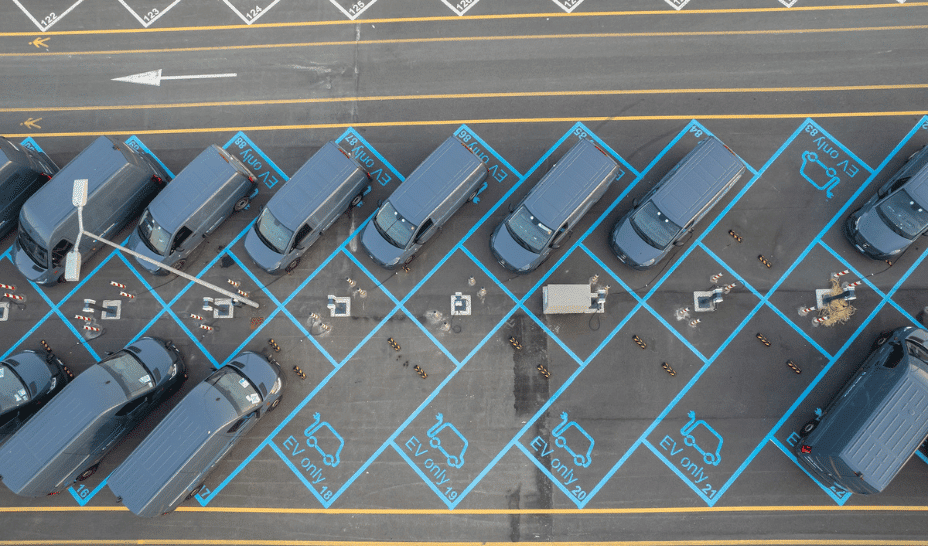

- Depot Charging: Charging infrastructure in distribution centers and industrial regions for logistic agencies.

- EV Fleet Operator: Logistics and lease companies transferred to electric vehicles across light and heavy transport.

The demand for debt financing in the zero-prone sector is more than what the traditional finances can supply, PCEIF can play an important role in accelerating this transformation. Funds already have a pipeline of potential investment and involved with institutional investors interested in having a clear effect.

[publish_date