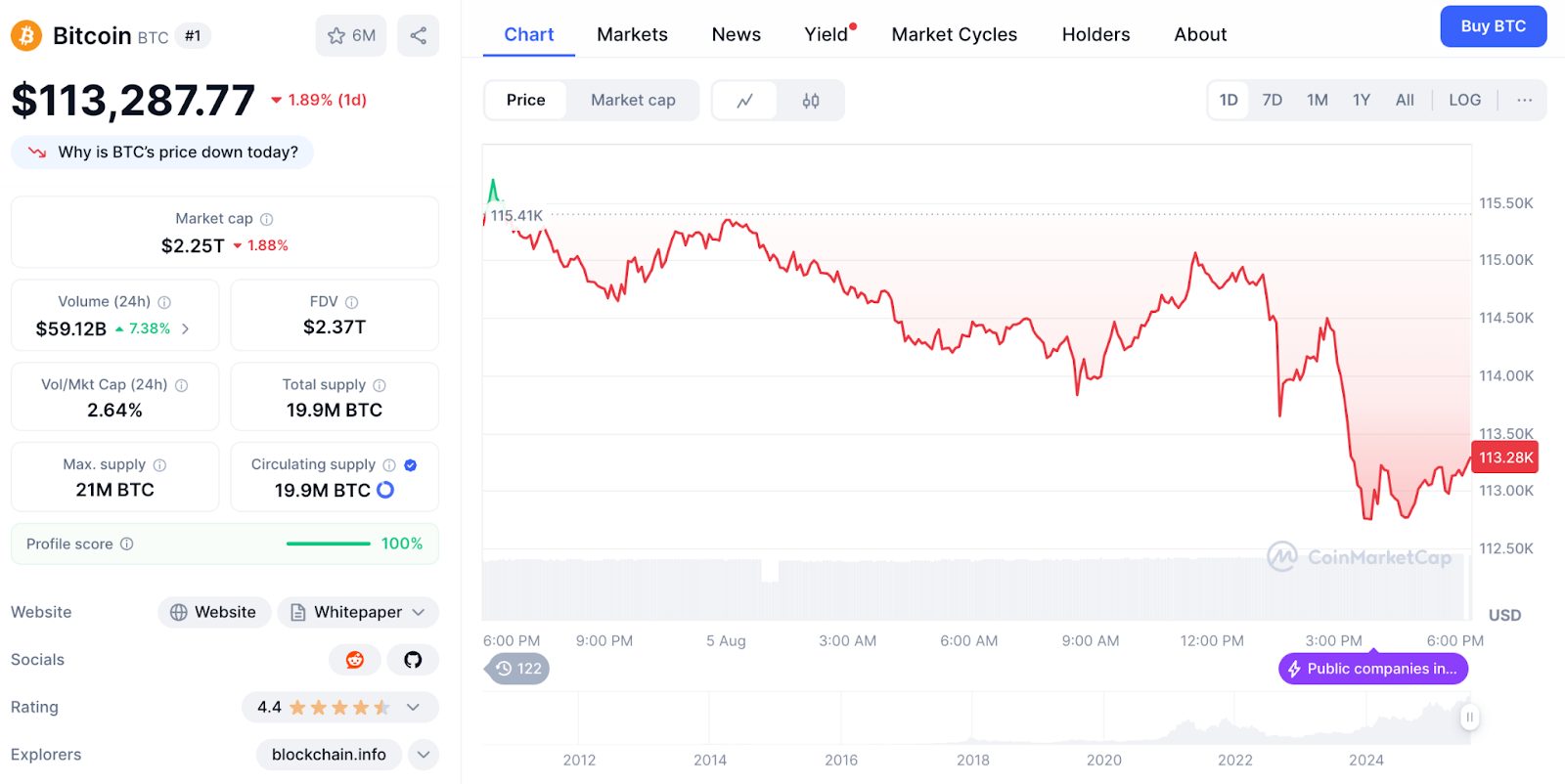

Tests 112 thousand dollars on an exit of $ 333 million from ETF star-news.press/wp

BTC’s BTCPT analysis shows that Bitcoin tests the key 112,650 dollars Support with -1.46 % to retreat 113,155 dollars Also, huge traded investment funds were recorded $ 333 million External flows while Indonesia explores the adoption of the national reserve.

BTC Chatgpt Analysis 22 Technical indicators in actual time, ETF external flow dynamics, institutional adoption developments, and organizational progress standards for bitcoin evaluation 90 days The track amid a major turning between the continuation of the bull and the phase of deeper correction.

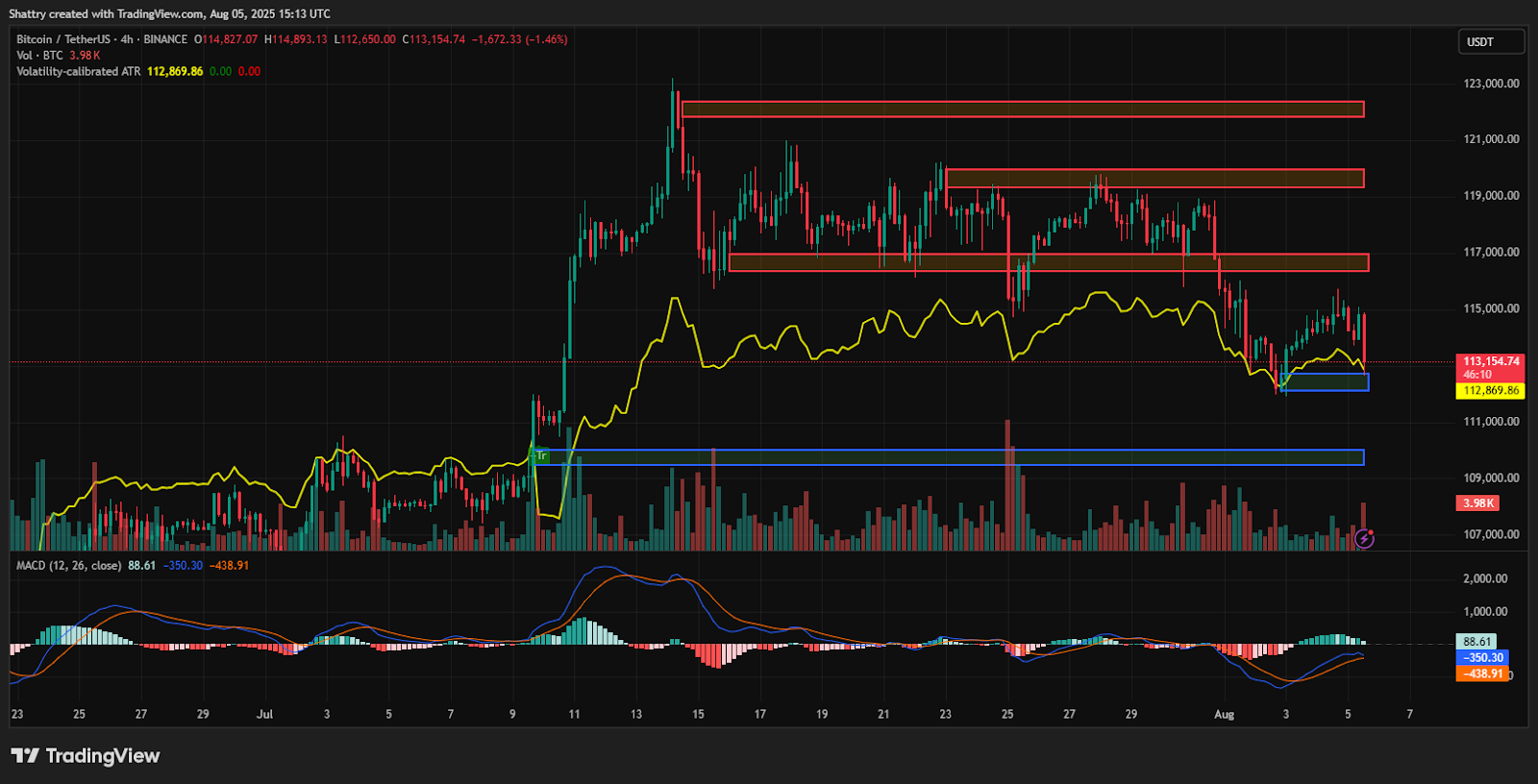

Technical Analysis: Less declining collapse than all Emas

The current bitcoin price for 113,155 dollars It reflects what is related -1.46 % The daily decrease in the opening price 114,827 dollarsCreate a trading range between 114,893 dollars (High) and 112,650 dollars (a little).

this 2.0 % The INTRADAY scope shows the typical censorship pressure pressure for the institutional distribution stages.

Rsi in 38.63 It approaches the sales lands, indicating a possibility that is short -term if support continues.

Moving averages reveal a challenge with bitcoin below all of the main Emas: 20 days in 114,708 dollars ((+1.4 %), 50 days in 115380 dollars ((+2.0 %), 100 days in 115,926 dollars ((+2.4 %) And 200 days in 114,714 dollars ((+1.4 %). This EMA structure indicates a clear declining prejudice that requires a restoration of reflection.

MACD displays mixed marks in 88.61 Above zero, but a negative graphic drawing in -438.91 Strong landmarks are suggested despite the determination of bullish sites.

Size analysis shows moderate activity in 3.58k BTC during the decline, indicating a decrease in institutional participation.

ATR in 112,870 It indicates a very high fluctuating environment with the possibility of huge movements as soon as the current integration is resolved.

Historical context: The support test after July peak

Bitcoin August’s performance shows weakness after July’s peak in 123,218 dollarsWith the current levels that represent 8.22 % Correction of the highest level ever. The withdrawal is tested by institutional determination after the gains of the first explosive half.

January 93,576 dollars The beginning followed the February of Mars to 81,976 dollars -82,381 dollars, Create a base of spring accumulation.

April to July showed consistent strength with May 104,730 dollarsJune 107,199 dollarsAnd the July arm 119,447 dollars Close.

The current August decrease in peak tests in July whether institutional demand can absorb the pressure pressure at high levels.

The correction remains relatively modest in the context 232 million percent Gains from 2010 The lowest level.

The current pricing maintains a great allowance 2024 The levels during the psychological support test in 112 thousand dollars -113 thousand dollars The area that can determine the direction in the medium term.

Support and Resistance: The Moftah Defense is 112 thousand dollars

Immediate support appears at the lowest level today 112,650 dollarsIt represents the main defense for psychological 112 thousand dollars level. This region provides basic support of the main psychological importance, which requires defending the continuation of the bull market.

The main support clarifies major importance with 110 thousand dollars -111 thousand dollars It represents a major historical accumulation area. Below 112 thousand dollars The sale will lead to this main support set, as institutional purchase may appear.

Resistance begins immediately in 20 days EMA about 114,708 dollarsFollow it 50 days EMA in 115380 dollars and 100 days EMA in 115,926 dollars.

The EMA group creates this great general resistance, which requires expanding the size of an achievement.

The preparation indicates more from the negative side 110 thousand dollars -111 thousand dollars If current support fails, while recovery above 114,708 dollars It can lead to short coverage towards 117 thousand dollars -119 thousand dollars Resistance area.

ETF external flow crisis: $ 333 million from daily exit

Bitcoin’s investment funds recorded destroyed $ 333 million Daily external flows, which represent the largest institutional sale this month.

This massive withdrawal from the increasing capital reflects uncertainty about the sustainability of the bull and the erosion of institutional confidence.

The sale of ETF contrasts sharply with the previous stages of accumulation, indicating the transformation of institutional positioning from the purchase to distribution.

According to Blackrock Prepare for sale 2544 BTC (292 million dollars), In addition to concerns about sales pressure.

However, there is more than this sale outside the initial reaction, as it creates an opportunity to accumulate smart money to move to.

In this regard, note with Cryptonews, Sean Young, chief analyst at Mexc Research, specifically “that”.Despite the sales of the broader market, buyers intervene to defend the main support levels strongly, allowing Bitcoin to apostasy over $ 118,000.“

Ethereum etfs recorded larger 465 million dollars External flows, indicating the sale of the broader institutional cryptocurrency across asset categories.

This simultaneous sale refers to systematic disposal instead of bitcoin concerns.

BTC Analysis from Chatgpt: Organizational progress in sale

Chatgpt BTC analysis reveals mixed signs with organizational progress that compensates for institutional sale.

Preparing the White House to work against banks accused of Crypto Debanking provides a supportive regulatory background.

Talk to Cryptonews, Ray Youssef, CEO of Nones, confirmed: “The condemnation of the long -term value of bitcoin remains solid. Bitcoin and institutional demand continues to provide a solid floor below her work.“

This is clear with Explore the latest Indonesia From Bitcoin as a national reserve origin, which represents a main catalyst for sovereign adoption.

This follows a growing trend for the accumulation of the nation -state, providing basic support for demand.

Market basics: dominance under pressure

Bitcoin maintains the overwhelming market dominance 61 % with 2.24 trillion dollars The maximum market, which indicates flexibility despite the institutional sale. the 1.66 % It is accompanied by an exceptional maximum market 12.65 % Increase the size to 59.33 billion dollars.

the 2.62 % The CAP ratio indicates the size of the market to a moderate trading activity, indicating the controlled sale rather than distributing panic.

Distribution of the offer from 19.9 million BTC represents 94.8 % From the maximum 21 million Provide the distinctive symbol, with mining rewards, creating minimal inflation.

The scarcity of the offer provides this basic support during the sale periods.

Maintenance of the market dominance above 60 % Despite the sale of pressure, it shows the continuous institutional Bitcoin preference and relative strength against alternative cryptocurrencies.

Lunarcrush data reveals a decrease in social performance with a decrease from Altrank from Bitcoin to 701Noting the community’s concern during the correction.

The degree of galaxy from 63 The construction of negative emotions about external flows and low prices reflects.

Participation scales show a great activity with 80.08 million Total connections though a 21.24m Decline, and 259.31K Reminded.

Social domination 19.4 % It indicates continuing attention during uncertainty.

Feelings records in 75 % Positive despite the recent decline, which reflects the elasticity of society during the correction.

Modern topics focus on defense support, Elliot wave patterns, and 150 thousand dollars Predictions.

BTC price scenarios for three months

Defense support Rally (40 % probability)

A successful defense 112 thousand dollars Support can be pushed alongside organizational progress, recovery 125 thousand dollars-1330 thousand dollarsHe represents 10-15 % The upward trend of current levels.

This scenario requires the installation of the ETF external flow and the restoration of institutional participation.

Extension unification (35 % probability)

Continuous external ETF flows can unify 105 thousand dollars -115 thousand dollarsAllowing technical indicators to reset it during the sovereign purchase provides support.

This scope associated with the scale can extend 8-12 weeks.

Deeper correction (25 % probability)

Below 112 thousand dollars Support can lead to sale towards 100 thousand dollars -105 thousand dollars A main support area, represented 10-15 % The downside.

This scenario will require sustainable institutional sales and organizational setbacks.

BTC Analysis from Chatgpt: Institutional test meets sovereign support

BTC analysis of Chatgpt reveals a major turn between institutional sales pressure and emerging sovereign demand.

The next price goal: 125 thousand dollars-1330 thousand dollars within 90 days

The immediate path requires a decisive defense 112 thousand dollars Support to verify the correct institutional confidence in the distribution pressure.

From there, Bitcoin’s acceleration can push Bitcoin towards 125 thousand dollars The psychiatrist, with a continuous sovereign adoption that drives his car towards 130 thousand dollars+ It represents the highest new degrees.

However, failure to keep 112 thousand dollars It will indicate an expanded correction to 100 thousand dollars -105 thousand dollars The extent accelerates with the acceleration of institutional sale, which creates an ideal sovereign accumulation opportunity before the next bitcoin adoption is paid towards 150 thousand dollars+ Goals, verify the healthy thesis of the digital gold reserve.

https://cimg.co/wp-content/uploads/2025/08/05192813/1754422091-chatgpt-image-aug-5-2025-02_27_17-pm_optimized.jpg

2025-08-05 19:29:00