NVIDIA Q4 FY2025 earnings beat the expectations of the request and chip star-news.press/wp

In this story

Nvidia’s (Nvda+ 3.34%) Revenue and Outlook analysts’ expectations of analysts, guided by demand for new Blackwell chips. Stock went on time trading after closing 3.7%.

Chipmaker reported $ 39.3 billion for his fiscal quarter – 78% increases from the previous year and high. The consensus was $ 38.1 billion. Net proceeds amounted to 22 billion dollars for earnings per share of 89 cents, also beats. Nvidia The whole annual income more than doubled the year during the year to $ 130.5 billion.

Revenues for the first quarter of the current fiscal year is set to $ 43 billion, plus or minus 2% – also above the expectations of Wall Street of $ 42 billion.

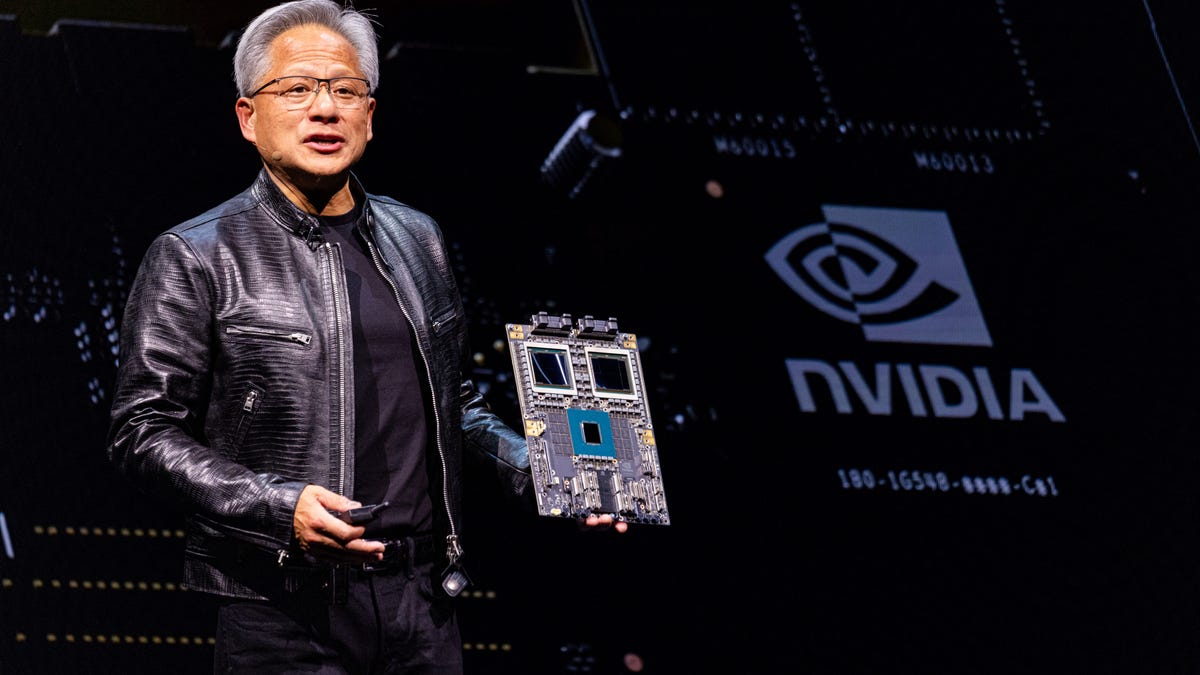

“We have successfully increased mass production by Blackwell Ai supercomputers, achieving billions of dollars in the first quarter,” said General Manager Nvidia Jensen Huang UA statement. He called the demand for the new chips “amazing” as companies typing a resonance of the AI models.

The company’s gross margin will be in low 70s, but it is expected to be fully ramed in the fiscal year in the fiscal year, said CFO Colette Cress on the invitation to Nvidia.

Income from NVIDIA data center increased by 93% in the year in the record $ 35.6 billion last quarter. However, the sale of data in China remains low due to the limitations, the Cress states, adding that the company will continue in accordance with the export controls.

In front of earnings, Analysts were optimistic In order for Laphaker to win expectations and raise their prospects while the production of its Blackwell chips is increasing – despite the shock waves from Chinese artificial intelligence Startpeek.

In December, the Hangzhou-based duppek published a model that said that only $ 5.6 million Train and development On Nvidia’s captured capacity H800 chips. This Cheaper but still a powerful reasoning model Flat investors, causing nvidia Stock to descend 17%Wiping nearly 600 billion dollars values - record loss for US company.

“Nvidia’s upcoming earnings will crush deep anxiety,” Kevin Cook, older shares for investment research Zacks, said in quartz in front of the results. The company dominates “the technology that companies want and the next bunch do not yet know they need.”

Encouraging updates on the production and shipment Blackwell platforms is likely to move inventories, Kunjan Sobhani, lead semiconductor analyst in Bloomberg’s intelligence, said in quartz in front of earnings. Investors are careful of potential “air pockets” in the growth between the first and other fourth current fiscal years, because customers are moving to Blackwell from Hopper, he said.

“It’s a place when the container shipments could really be lowered, and Blackwell Ramp – from a quarter to a quarter of the perspective – it may not be enough to show a significant sequential growth”, adding to Blackwell “to catch in second half.”

For Nvidia’s reputation and evaluation “, consecutive expectations,” Sobhani said. “If they say something that disturbs this concern that could imply temporary volatility in feeling and stock.”

2025-02-26 22:45:00