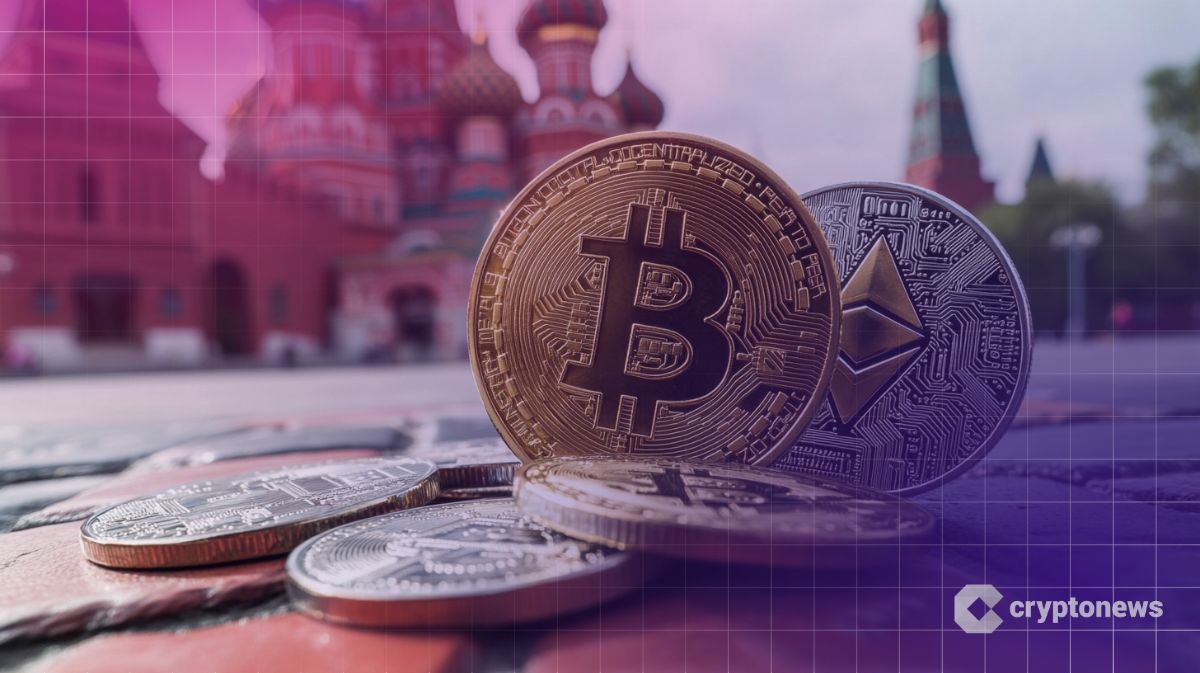

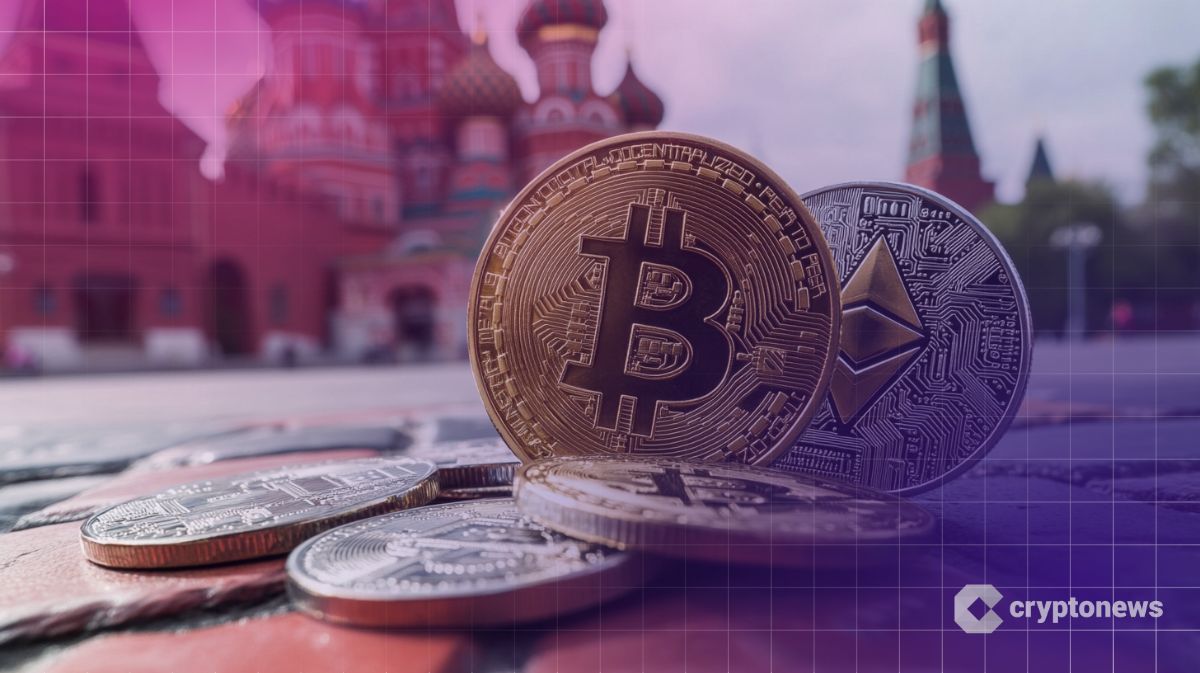

The Exchang Moscow is set to launch the new Bitcoin (BTC) index, as well as the structured encryption boxes and bonds.

The administrative director of Russian exchange, Vladimir Kreikotin, said that the launch of a new derivative tool from BTC was “imminent”.

Speaking to RBC Investments, Krekoten explained that the product will be a future contract on a new Bitcoin index.

Moscow exchange: BTC Bullishness continues

He explained that the accounts on the index that will become the basic principle of the contract started on June 10.

This hot step follows in the wake of the first Bitcoin future contract in Moscow, which first appeared on June 4.

This product is available for eligible investors only. Cash is expanded in rubles and is linked to ISHARES Bitcoin Trust (IBIT).

Krekoten suggested that the popularity of the first Bitcoin Futures contract has inspired the exchange to accelerate the release of more encryption derivative products. He said:

“We are planning to launch trading in the tools based on Cryptoasset indicators or investment funds traded as soon as the demand starts from the industry.

Organizational approval is still pending

Krekoten added that the stock exchange discussions with the administration companies were ongoing with the approval of the organization.

The CEO said that the parties are discussing the launch of investment funds and structured links that focus on Cryptoasset indicators. Clear:

“We believe that the industry will soon be prepared to provide customers by accessing the structured bonds for encryption. We are technically and legally ready for this.”

The CEO explained that since the launch of June 4, trading volumes in the BTC Futures contract reached a total of 7 billion rubles (89,455,660 dollars).

Krekoten said that more than 10,000 investors have already traded with the product, adding: “These are very good indications that the tool was only on the market for a short period.”

It is clear that the numbers are not comparable to future contracts on the Moscow exchange index. However, this is still a very high character. “

Curry investment grows in popularity in Russia

The administrative director rejected the allegations that the stock exchange lacks technical ability to launch more encryption products, and concluded:

“I think there are no basic differences between money for any basic assets. This is definitely true if these assets are tools that are circulated on properly organized platforms.”

Earlier this week, an executive official predicted the Russian bitcoin mining process that BTC prices would rise to the highest new level ever for more than $ 115,000 this summer.

He suggested that the momentum could lead to an increase in the currency price or more than 130 thousand dollars in a moderate positive scenario. “

Also this month, the Russian Energy Generation Company announced the launch of the first joint investment fund focusing on bitcoin mining.

https://cimg.co/wp-content/uploads/2025/06/25151401/1750864441-image-1750834966600_optimized.jpg

2025-06-25 23:30:00