Silor of Microstrategy says that the security of the institutional tanks will help Bitcoin star-news.press/wp

Amid the emergence of the treasury companies that focus on Altcoin, Microstrategy, Microstrategy, confirmed that he is still committed to bitcoin.

Away from anxiety, Silor looks at the increasing dependence of Altcoins as part of the broader “innovation explosion” in the area of digital assets – and it is believed to eventually enhance the entire sector, including Bitcoin.

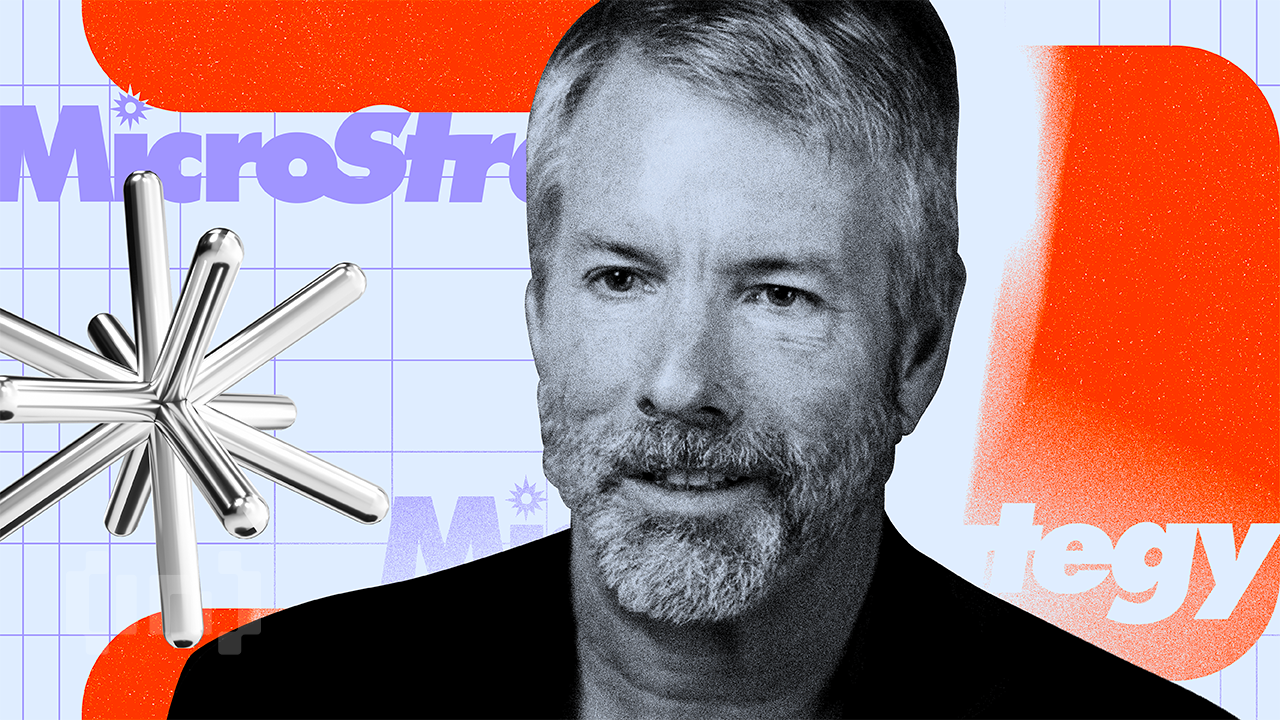

Bitcoin above everything: Michael Celor’s focus in the Alcin group

In an interview with Bloomberg, Al -Aqsa Al -Aqsa, an adult by Bitcoin, confirmed that despite the increasing interest in Altcoins, most of the capital still goes to Bitcoin.

“So I am a laser like focusing on bitcoin,” he said.

The co -founder of the strategy revealed that the number of companies that add Bitcoin to the treasury bonds may double more than twice in only six months, as it jumped from approximately 60 to 160. Moreover, Silor Bitcoin described it as “digital capital”.

He predicted that S&P 500 will exceed long -term performance

“I think it is the world’s clear monetary commodity at the present time. So it is the lowest dangerous, higher returns and more strategy directly if you want to outperform the S&P and if you want to pump vitality and performance in your public budget,” he added.

His latest remarks came after the strategy announced the third largest purchase of Bitcoin. Between July 28 and August, the company bought 21,021 BTC for $ 2.46 billion. The company, the largest general holder in BTC, has 628,791 BTC with a value of $ 74.33 billion.

Bitcoin Bet also has also proven profitable. In the second quarter, the company informed a net income of $ 10.02 billion, a transformation from the losses published in the first quarter.

The end of bitcoin bonds only? How eth steals the lights

Although Silor’s condemnation in Bitcoin is still unexpected, Ethereum has become the following favorite option for many institutional players. Moreover, their conviction is not without.

Industry leaders refer to their ability to adapt, the advanced ecosystem, and various applications-from the distinctive symbol to the solutions of institutions-as factories that drive confidence in the long term. In fact, Jeff Kendrick of Standard Charterd argued that the treasury companies that focus on Ethereum are “more logical” than their counterparts in Bitcoin. He explained that the reason is

“Because of the return on the return, the Defi leverage. From the perspective of organizational arbitration, it is more logical than their BTC equations as well.

In addition, Sean Young, the chief analyst of Mexc Research, recently told Beincrypto that this industry has only exceeded the institutional treasury of bitcoin.

“Companies are increasingly via ETH, Sol, BNB and ton, and treating them as strategic assets that are in line with the advanced structure of digital financing. This represents a great exit from the traditional institutional financing book.

He explained that companies publicly reveal the holdings of digital assets specify a new standard. According to Young, companies that integrate cryptocurrencies into treasury bonds today can help form the new companies standard in the coming years.

Silor of Post Microstrategy says that the institutional cabinet in Altcoin will help Bitcoin first appeared on Beincrypto.

[og_img]

2025-08-10 13:41:00