Vanguard in Japan: Metaplanet 463 BTC adds, now the total property is now $ 1.8 billion star-news.press/wp

Metaplanet, which is publicly traded by Tokyo (TSE: 3350), has expanded Bitcoin (BTC) Holdings by additional purchase 463 BTC for about $ 55 million.

This strategic investment has been implemented at an average price of about $ 119,500 per BTC. It confirms the company’s commitment to enhance the value of the shareholders through the accumulation of the large cryptocurrency.

Promoting the cabinet with bitcoin currencies

After this last acquisition, Metaplanet now has 17,595 BTC now with an average purchase price of about $ 102,800 per coin. The company’s total investment in Bitcoin is about $ 1.8 billion, and Metapanet places the largest and largest in Japan The seventh largest world in the world Bitcoin holders.

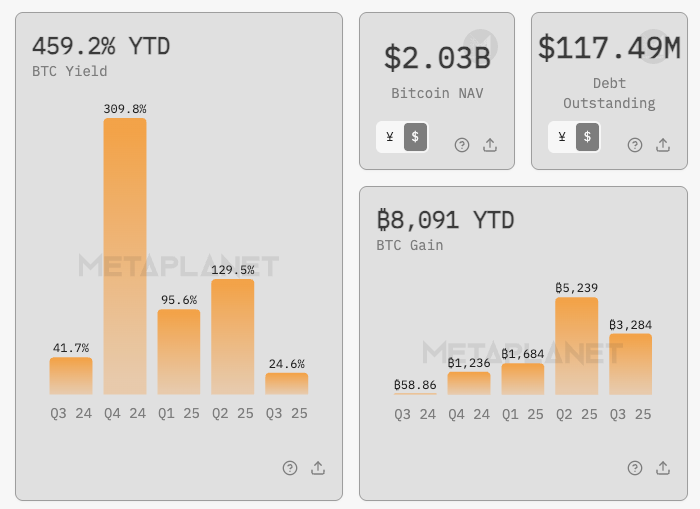

Metaplanet uses the BTCOIN crop (BTC) as a major performance indicator (KPI) to measure the success of the cabinet strategy. BTC measures the rate of Bitcoin’s possessions in relation to the existing full mitigating shares during specific reports preparation periods. Between July 1 and August 4, 2025, Metaplanet was 24.6 %, reflecting the continued aggressive accumulation.

The company also tracks the BTC and BTC Dollar gain. BTC determines the absolute growth of the company’s Bitcoin’s holdings, except for the effects of mitigating the release of new shares. BTC Dollar profit represents the market value for the BTC earnings translated into US dollars. Investors provide a clear view of the performance of the Metaplanet Treasury Department.

For Q2 2025 (from April 1 to June 30), Metaplanet was 129.4 %, which accumulates BTC from 5,237 BTC, translated into about $ 604 million. These numbers highlight the strong Metaplanet financial strategy to take advantage of the cryptocurrency investments to enhance corporate treasury.

Mobility in the risk of inflation and currency risk

Bitcoin’s aggressive acquisitions of metaplanet are consistent with increasing concerns about inflation and a decrease in continuous yen. According to industry analysts, the company’s cryptocurrency strategy is a preventive hedge against cash inflation.

“Japanese companies face a continuous decrease in the yen, making Bitcoin an attractive hedge of solid assets,” said the encryption analyst in a previous statement to Beincrypto. “BTC offers superior long -term returns, especially in the markets where real returns remain negative.”

Bitcoin’s treasury administration comes from Metaplanet in the midst of growing global inflation, especially in major economies such as the United States and Japan. With a continuous decrease, Japanese companies are increasingly viewing Bitcoin as a viable long -term protection against purchasing power.

The company’s spacious BTC’s biases contribute significantly to the value of companies. They overwhelm traditional projects such as hotels and media. These old companies are currently representing limited revenue base only.

Although the hotel sector is still stable, the profit contribution remains simple for the volume of cryptocurrency investment. During the first quarter of 2025, Metaplanet reported about $ 6 million in revenue, an increase of 943.9 % on an annual basis, which is primarily due to bitcoin sales and relevant activities.

Metaplanet shares show fluctuations that exceed Bitcoin fluctuations. This indicates amplification exposure and sensitivity to the transformations of the encryption market. The motivation behind the fluctuations in debt financing, new shares ’versions, and market installments associated with expected future property.

Reorting the value of companies through the bitcoin strategy around it

The company confirms that its KPI methodology accurately reflects the cabinet performance without exaggerating the repercussions of shares. The administration emphasizes that the BTC, BTC Gain and BTC Dollar revenue is a valuable cabinet performance. These indicators help to evaluate the event independently of the standards of traditional or profitable revenue.

The continuous constant bitcoin accumulation of metaplanet indicates confidence in the BTC capabilities in the long run. The company is a tool to protect strong inflation and attractive returns amid global uncertainty. Investors closely monitor $ 101,000 per level of BTC prices, which represents a tie in Metapanet. This level is seen as a financial “dangerous area” where possible losses can be achieved.

The post post Bitcoin Vanguard: metaplanet adds 463 BTC, property now appeared $ 1.8 billion first appeared on Beincrypto.

[og_img]

2025-08-05 00:30:00