Breaking News

Trump Slams Walmart after a warning to a rental price star-news.press/wp

IE 11 is not supported. For optimal experience, visit our page on another search engine.

-

At least 28 dead after heavy storms devastated south, middle west

02:30

-

The FBI calls the California fertility clinic bombing ‘the act of terrorism’

02:01

-

Biden diagnosed with ‘aggressive’ shape prostate cancer

01:13

-

Good news: Mom honoring the late son, takes friends on a journey of life

02:25

-

Pope Leo XIV chaired over the inaugural mass

01:43

-

Now playing

Trump Slams Walmart after a warning to a rental price

01:56

-

Next

2 dead, more than a dozen injured after a ship for Mexican Navy crashes in Brooklyn Bridge

02:01

-

Biden strives for treatment options after cancer diagnosis

01:41

-

The emergency search for Louisiana escaped the prisoner

02:52

-

Israeli planes kill more than 250 in Gaza, officials say, like a hunger

01:30

-

Executable Tornado Hits St. Louis

02:26

-

Chamy faced with an investigation due to a trump setup

01:00

-

Cassie Ventura cross-examined in the trial of Sean ‘Diddy’ Combs

01:55

-

One on one with WNBA Zvezda Paige Bookers

01:31

-

Mother says the pregnant daughter on the fan maintains the living for the Law on Georgia abortion

01:36

-

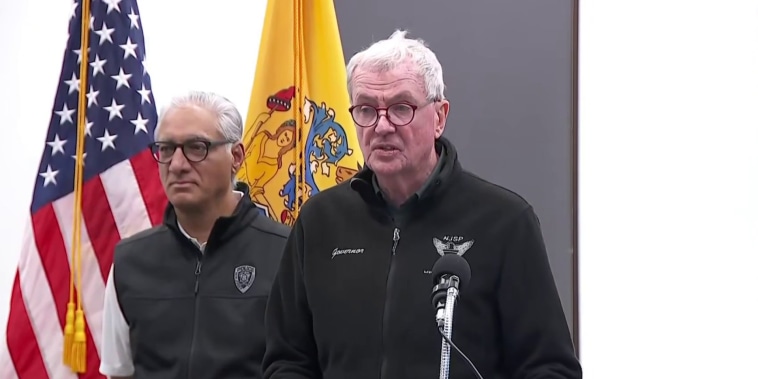

Commuter Chaos as NJ Transit Engineers Go Strike

01:40

-

The missing woman found in California after missing weeks

01:29

-

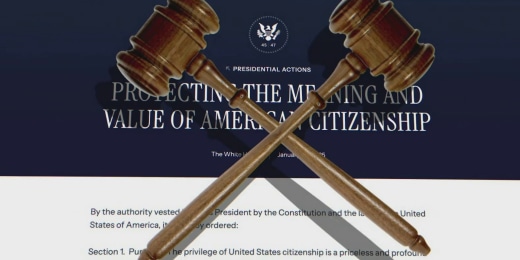

Only heard arguments in the case of citizenship in birth

02:03

-

Mosus Xi supercomputer refers to some memphis residents

03:42

-

Walmart says it will have to collect some prices as a trade war continues

01:44

Night news

-

At least 28 dead after heavy storms devastated south, middle west

02:30

-

The FBI calls the California fertility clinic bombing ‘the act of terrorism’

02:01

-

Biden diagnosed with ‘aggressive’ shape prostate cancer

01:13

-

Good news: Mom honoring the late son, takes friends on a journey of life

02:25

-

Pope Leo XIV chaired over the inaugural mass

01:43

-

Now playing

Trump Slams Walmart after a warning to a rental price

01:56

Night news

Play everything

2025-05-18 23:06:00