Mantle (MNT) Rally Rally hit the wall despite the control of buyers: Here is what happens after that star-news.press/wp

Mantle (MNT) gathered more than 12 % in just a few hours, supported by the growing network activity and an increase in the liquidity of Stablecoin. But after the closure of a major resistance area near $ 1.12, the scarf price ravage appears to be cool.

The short -term momentum fades, and the risk of movement in prices turns to the side. However, data on the series show that buyers have not yet been accomplished; At least it is not even turning one key sign.

Buyers remain in control, while net flows remain negative

Despite the last temporary suspension of the MNT gathering, pure exchange flows have been negative since its launch. This means that more MNT codes leave the stock exchanges instead of entering, which is a strong sign that merchants still choose to keep it instead of selling. This trend remained intact even after the last +12 % increase, indicating that the retail conviction was not faded.

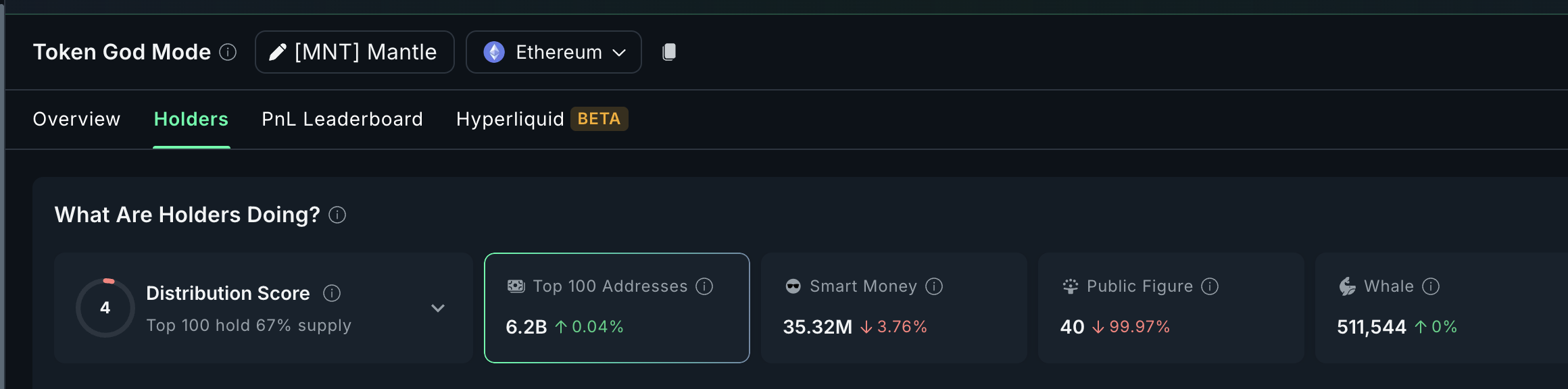

However, smart money portfolios showed signs of caution. Over the past 7 days, they have decreased 1.33 million MNT, which led to 3.76 % trimming property, according to Nansen.

In contrast, it added the best 100 titles 2.48 million MNT. This step indicates that the holders of the largest are still confident despite some of the profits with smart money in the short term.

This division puts the stage for monotheism. If smart funds continue to trim and exchange external flows, we may see side procedures instead of acute correction. However, if the profits are occupied by the lead center with increased flows, while smart money continues to trim it, the deeper decrease on the cards may be.

For distinctive symbol updates and marketsDo you want more distinctive symbol visions like this? Subscribe to the Daily Crypto Daily Crypto Newsletter Harsh Notariya here.

Rooming price pools, but warns momentum

The Mantle (MNT) price has seen some local summits in recent weeks, where each of them is in line with a rise in the Williams % R.

On July 27, Williams % R is about 12, indicating strong conditions in the peak. The MNT price decreased sharply in the following sessions.

Between 4-5 August, the scarf price rose to more than $ 0.94 (local summit). Williams % R for a local top here as well. This upper part was less than that witnessed on July 27. This means that MNT entered a side stage after a short period, not a corrective stage.

Now, after the last gathering race on August 7, Williams % R is near levels that were touched on July 27. This creates familiar preparation; Similar readings have preceded more clear corrections.

Williams % R is an indicator of momentum for rapid reaction that detects levels in the peak purchase area in the peak or selling in the short term. Unlike RSI, it responds faster to local summits, making it perfect for tracking sudden gatherings like Mantle.

If this style is repeated, the MNT can re -visit $ 0.94 or $ 0.84 before its next major move. However, in the case of the profit kicks, the Netflows is positive (which indicates that the symbols move to the exchanges), the withdrawal may be more slope. A break less than $ 0.67 nullify the boarding structure.

Although the broader market morale is still optimistic, these momentum transformations suggest that the MNT may need to calm, at least temporarily, before making another attempt in a constant outlook over $ 1.12.

Post Mantle (MNT) runs on the wall despite the control of buyers: Here is what happened after that first appeared on Beincrypto.

[og_img]

2025-08-08 16:30:00