Ethereum exceeds $ 4,300 where markets are waiting for the pivotal consumer price index data star-news.press/wp

Welcome to the MORINING Asia Pacific summary – your primary digestion of encryption developments overnight to form regional markets and global feeling. On Monday’s edition is the conclusion last week and the expectations of this week, which Paul Kim gave you. Get green tea and see this space.

With the deterioration of the US employment situation significantly, the conflict between the Trump administration and the federal reserve on interest rate discounts is increasing intensifying. Interest rates are fluctuated during the next three months daily, with inflation and employment indicators. The market shows severe sensitivity signs.

Stagnation fears arose in the United States

Last week’s fluctuations in the cryptocurrency market began with the issuance of ISM service management managers on Tuesday. The index indicated a slowdown in the American services sector. In addition, I stated that the prices in the services sector have risen and the employment has decreased since April, when Trump’s “tariff war” began.

The situation in which prices rise during the low labor RecessionOne of the most difficult economic crises that must be dealt with, as it prevents central banks from lowering or raising interest rates. Fears in the market are increasing that the Trump administration’s tariff policy pushes the United States.

At the same time, the possibility of three interest rates this year has been reduced to two. Last week, the prices of most of the origins of market liquidity risk fluctuated, including cryptocurrencies, in line with the constantly changing interest rate expectations. When the probability of reducing the price was twice during the year, the prices decreased, and when it changed to three times, the prices rose again and again.

The news that was distinguished by the weekend was that Stephen Miran, the head of the Economic House of Economists at the White House, was appointed to fill the vacant position of the Federal Reserve Governor Adriana Kogler. Miran is one of the closest economic advisors of President Trump. The market explained this appointment as a sign that President Trump is strongly pushing to low interest rates. The US Securities Market closed with three interest rate discounts this year.

Ethereum recovers from the Blackrock external flow

During the weekend, the observations of the Vice -President of the Federal Reserve led to the increased surprise of Ethereum. in letter To the Kansas Bankers Association, Bowman frankly stated that “three price discounts are necessary.” She emphasized that modern recruitment data shows that pre -emptive measures are necessary to prevent further weakness in economic activity and employment conditions. Then, the price of ETHEREUM temporarily exceeded $ 4,300.

On the contrary, Blackrock took a move that was not significantly expected on the market. The main player in the industry in the American Stock Exchange (ETF) withdrawn large funds from both ETF Spot Spot (Ibit) and Ethereum Spot ETF (ETHA) on Monday, where they injected the uncertainty in the market.

A net flow of $ 292.21 million in IBIT on that day, which represents the largest flow for one day since May 30, more than two months ago. Market analysts began to speculate that Bitcoin prices fell to the level of $ 111,000.

Ethereum Spot ETF, Etha, has seen a clear flow of $ 375 million. This represents a 3 % decrease in ETHEREUM holdings in Blackrock in one day. Stop the huge flow from the Blackrock Investment Funds in Blackrock.

Tom Lee: “Buy Ethereum the most important trade in the next ten years.”

Fortunately, the net flow of ETF boxes stopped two days later. Among the main encrypted currencies, Ethereum showed a faster recovery. ETH strategic purchases by companies listed in the United States were an incentive to recover ETHEREM prices. Bitmain has also updated its record as the world’s largest listed company in the world, which includes more than 830,000 ETH.

Tom Lee, a famous teacher for Wall Street, confirmed that the purchase of Ethereum will be the most important trade he does in the next ten years. Jeff Kendrick, head of digital asset research at Standard Chartered Bank, explained that the shares of companies that buy ETHEREUM can be a more attractive investment goal than Ethereum Spot Etf.

This week was when President Trump signed new executive orders to prevent Debanking for legal encryption companies and open the pension fund market. ETHEREUM has seen 25.01 % in its weekly price, while Bitcoin rose only by 5.44 %, although it regained $ 119,000 during the weekend. Solana (SOL), which has a fee of market less than ETH, has seen 15.04 %. It was a week in which Ethereum showed his clear existence.

CPI should be low for a stronger market

This week is expected to follow a similar pattern for the past week. The market attention focuses on whether the Federal Reserve will implement three discounts in interest rates this year and whether a specific reduction in the interest rate will be announced at the FOOC Open Market meeting (FOMC).

Table.Event-Table {Border-COLLAPSE: CLAPSE; View: 100 %; Max-width: 700px; Margin: 20 pixels Auto; FONT-FAMILY: Arial, Sans-Serif; Font size: 15 pixels; Borders: 1 Pixel Solid #DD; } Table.Event Table Thead {background-color: #f4F4F4; } Table.event-table th, table.event tdable td {Border: 1px Solid #DD; Filling: 10px 12px; Alignment of the text: left; } Table.Event-table th {background-color: #f4F4F4; Wasef line: bold; } Table.Event-table T: NTH-Child (even) {background-color: #FAFAFA; } Table.Event-table T: Hover {background-color: #f1f1f1; }}

| date | day | It happened |

|---|---|---|

| August 13 | Tuesday | Issuing the consumer price index in July (July) |

| August 14 | Wednesday | The Federal Reserve Chairman at Chicago Austan Golsby talks about the monetary policy lunch. |

| August 15 | Thursday | Issuing the US Product Product Index (PPI) |

| August 16 | Friday | Issuing industrial production data in July |

| August 16 | Friday | Issuing retail sales data in July, USA |

In this context, the US Consumer Prices Index (CPI) in July on Tuesday is very important. If the actual consumer price index number significantly exceeds the market expectations, it is possible that interest rates expectations in the second half of the year are not sure again. If this happens, the prices of cryptocurrencies will face a modification again.

Product Prices Index (PPI) Thursday evening, industrial production numbers and retail sales in July, Friday, worth watching. This is because they will provide evidence of whether the American economy is contracting.

It is also important to comments from federal reserve officials, who have a great impact on the interest rate decision in September FOMC. On Wednesday, the President of the Chicago Bank, the Federal Reserve, Austan Fuolsby will attend a monetary policy lunch hosted by the Chamber of Commerce in Springfield. Any comments on current economic expectations or future interest rate trends can affect the market.

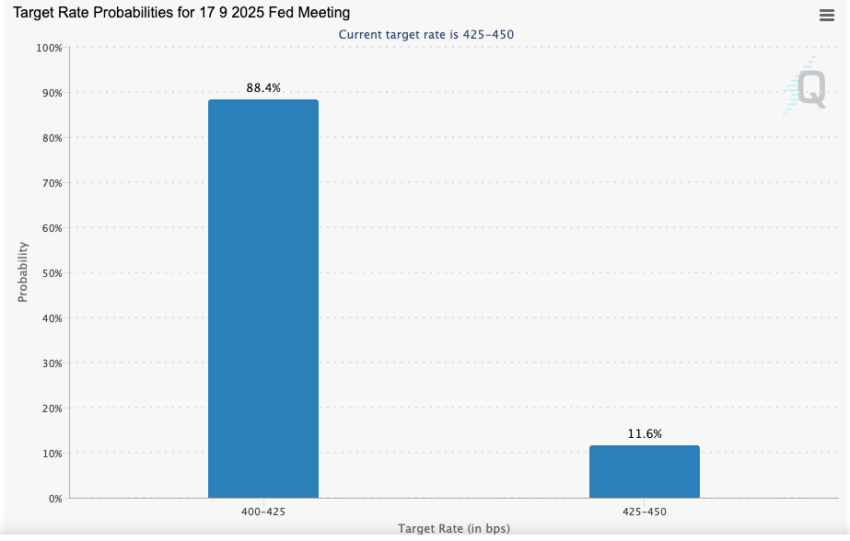

According to Fedwatch data, as of the time of publication on Monday morning, the possibility of a 0.25 % interest rate in the FOMC meeting in September 88.4 %. This possibility may rise slightly as soon as the future price market is reopened after Vice President Bowman’s observations during the weekend. However, it is difficult to confirm whether the possibility of lowering prices will remain at this level by the end of the week.

I wish all the readers successful investments this week as well.

Post Ethereum exceeds $ 4,300, as the axial consumer price index databases appeared first on Beincrypto.

[og_img]

2025-08-11 01:00:00