The distinctive assets amounted star-news.press/wp

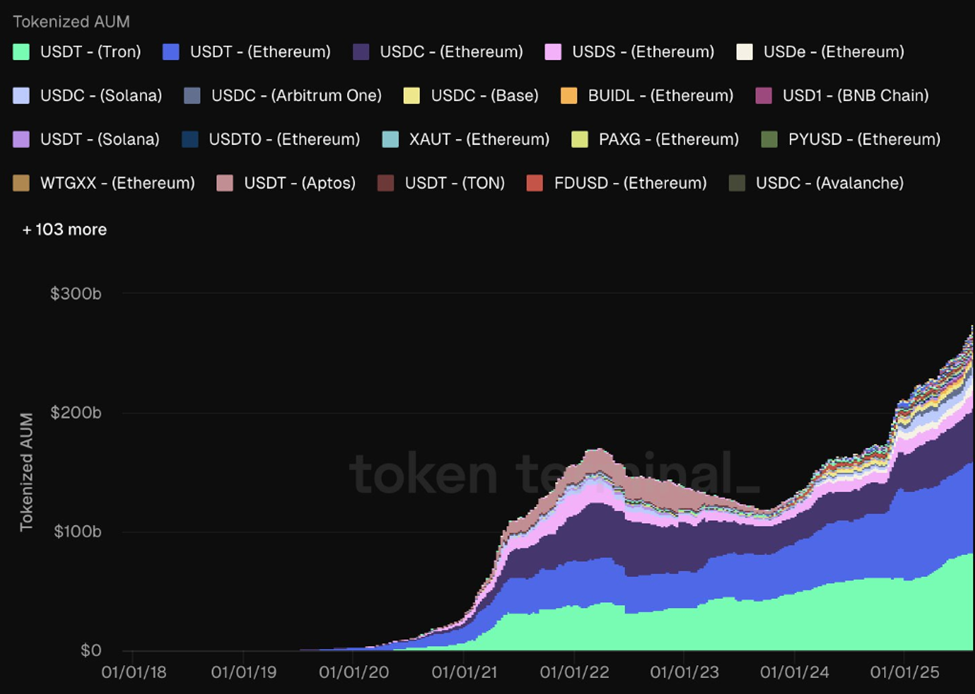

The distinctive assets market quietly reached a new landmark, with the rise of assets (AUM) to the highest level ever.

This increase highlights how ETHEREUM’s infrastructure increases in the preferred settings of Stablecoins and the distinctive code of institutional class.

The symbol reaches the historical range

The Terminal reports that AUM is one of the most distinctive assets at the highest level of about 270 billion dollars.

The data platform on the chain highlights the distinctive assets that extend to a wide spectrum, from currencies and commodities to treasury bonds, private credit, private shares, and investment capital.

Much of this growth is called by institutions that adopt Blockchain’s bars for efficiency and access, with Ethereum appeared as a dominant platform.

ETHEREUM hosts approximately 55 % of all the distinctive AUM assets, which are attributed to its ecological system, the smart nodes and the standards of the distinctive code accredited widely.

Symbols such as Usdt (Ethereum) and USDC (ETAREUM) and the Blackrock Buidl box are some of the largest value pools, designed on the ERC-20 frame.

Meanwhile, specialized standards such as ERC-3643 allow the asset symbol in the real world (RWA) such as real estate and fine arts.

With already 270 billion dollars, its continuous momentum can see the distinctive asset markets in trillions as Ethereum enhances its role as the backbone of distinguished financing.

The financial giants are quietly returning Ethereum

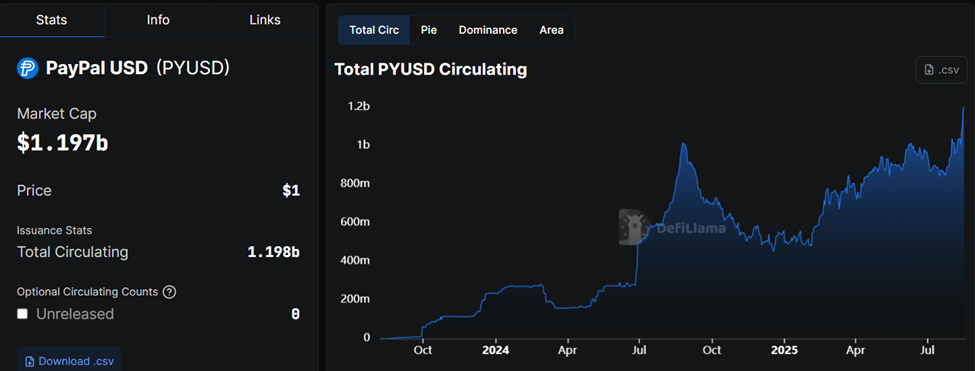

One of the most important signs of this shift is the rise of Pyusd Stablecoin from PayPal, which exceeded the market $ 1 billion in supply while it is fully released on ETHEREUM.

For institutions, the rapid growth of Pyusd proves that ETHEREUM bars are liquid, safe and reliable enough for the global Fintech leader to expand it.

“Pyusd from Paypal exceeds one billion dollars to seize ETHEREUM as the main financing layer. Stablecoin scale such liquidity and interest. Institutions quietly unify ETH,” Note In a post.

Besides PayPal, traditional asset managers also tend to ethereum. The Windl, the distinguished Blackrock Market Fund, was cited as a historical case of institutional adoption. This explains how traditional financial tools (Trafi) can be issued smoothly.

Meanwhile, the ethereum dominance in the distinctive symbol is due to the effects of the network and the ecosystems of developers. The ERC-20 standard has become Lingua Franca for digital assets, ensuring compatibility across portfolios, exchange and Defi protocols.

Meanwhile, security, liquidity improvements and expansion of ETHEREUM through promotions such as POS and Rollups enhance institutions’ confidence.

Ethereum flexibility allows to meet retail and institutional needs. Stablecoins such as USDT, USDC Fuel Global Payments and Defi liquidity. Meanwhile, locker bonds and credit tools resume directly for the institutional governor that seeks to obtain return and efficiency.

However, analysts urge to be careful to Ethereum merchants, with the largest altcoin on the maximum market scales facing the second highest sale. Likewise, warning signs though 98 % of Ethereum supplies sit in a profitable condition.

Distinguished assets reached 270 billion dollars, as institutions appeared on Ethereum first on Beincrypto.

[og_img]

2025-08-17 22:22:00