Nvidia Stock Decrum 6% because US ban in China and exports costs $ 5.5 billion star-news.press/wp

In this story

The US-China Tech War was just claiming another high profile period.

Nvidia (Nvda+ 0.54%), The American third-largest company in the market, on Wednesday, that it would be charged $ 5.5 billion after the US government has passed into blocking their H20 and Chips in China – citing national security risks related to their potential use.

The H20 is designed to respect the earlier determinable limits of the Biden-era and has become a key product for Nvidia in China, one who quickly gained tow. But the sudden reversal of the Trump Administration, after a multimen-channel conversation, signals another difficult turning policy – and lies naked games of high shares from Valley, Washington and Beijing.

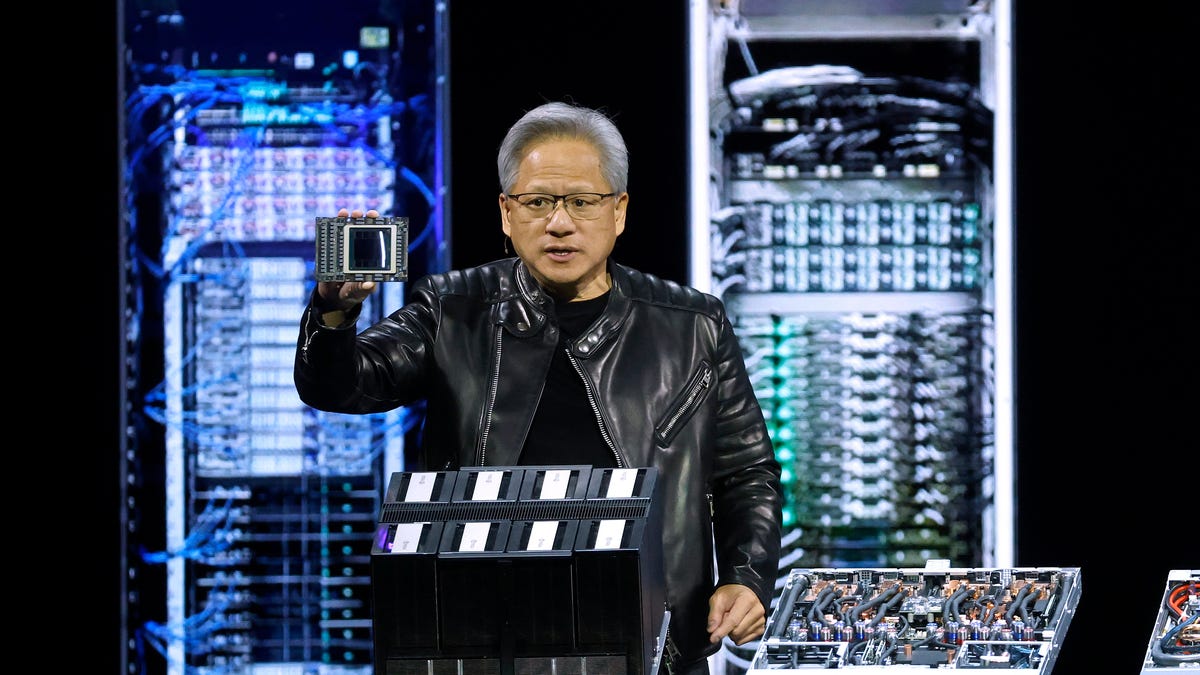

We prove to rewind: 9. April, General Manager Nvidia Jensen Huang attended Dinner of 1 million e-million-a-lago with the President Trump, in which he reported exports and the topic of conversation. Events from the dinner went to Maga Inc., Adut-aligned Super Pac that can increase unlimited funds, but is not allowed to directly coordinate in the campaign. Five days later, 14. April, now informed Nvidia, she should be a permit for exporting H20 chips abroad. NVIDIA was 16. April announced a charge of multibillion dollar – and markets flowed.

Meanwhile, asml (ASML+ 1.37%), Dutch semiconductor equipment Powerhouse, reported that the first quarter of 7.7 billion euros – slightly below the forecast – and denote “greater insecurity” due to trade tensions. ASML makes the machines necessary for superior chip production, which gives it a huge impact on global supply chips. The company has warned that new tariffs and technical constraints could strive for the appearance for 2025. and 2026. year.

Investors did not like what they saw.

Nvidia Stock Slid 6% on the market open on Wednesday and withdraws further afternoon before closing about 7%, and AMD (AMD+ 2.02%) and other chipmers falling in tandem. The wider Nasdaq fell over 3%, because Wall Street review the extended, an escalating technical condition could mean for supply chains, development and semiconductor development and industry.

Wednesday, Jefferies (Jez+ 2.36%) Analysts said that the ban on H20 was expected – but the size of Nvidia’s record was not. The signals stopped demand from Chinese customers, which allegedly amounted to 16 billion dollars to order H20 this year. Still, Jefferies says China probably stored enough GPUs for current training AI and increasingly relies on local chips for locking tasks.

Markets may be the prices of some pain, but they did not see the last blow.

2025-04-16 20:36:00