Kimchi metal currencies on stablecoin news star-news.press/wp

Kimchi currencies, the low metal coins, have witnessed some sections of the encryption community in South Korea, rapidly growing in the past few days.

Experts say this is mainly due to the tanna throughout the country’s new plan to win the winning Stablecoin.

However, the informed urged investors to deal with the rapid rise in symbols with caution, noting that the high prices of the previous Kimchi currency proved this.

Kimchi Currency: StabelCoin wave ride?

South Korean media I mentioned the Biz watch Stablecoin from the new government has become a “hot topic” in both the financial sector and the Blockchain industry, where “relevant” currencies attract attention.

The port noted that although highly cloudy cryptocurrencies such as Bitcoin (BTC) and XRP are stagnant in prices, “only some local currencies are the ones that show abnormal prices for prices”.

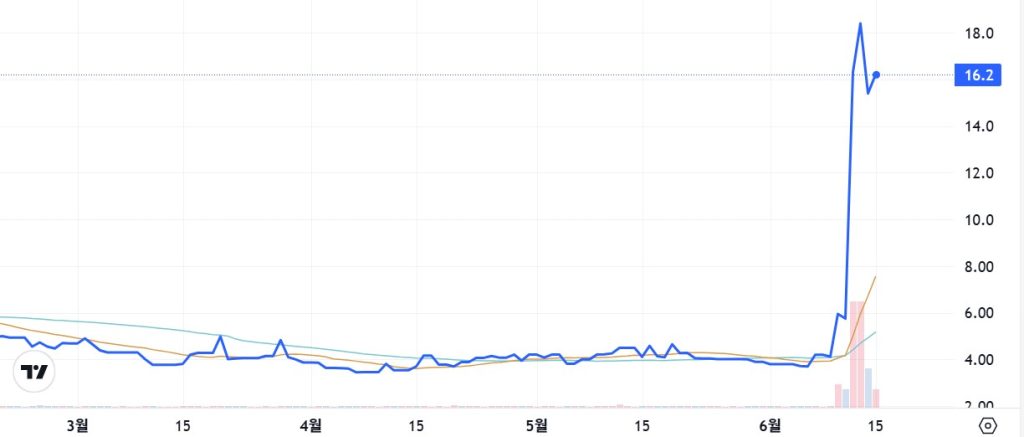

Examples include mever (MEV), which rose from about KRW 3 to KRW 20 Won, as well as FANC (FANC), which rose from KRW 5 to KRW 13 Won.

In the same period, nine Gold Gold (WNCG) wrapped from about 29 KRW Won to 57 Won.

The symbols such as Bora and Storm X (STMX) have seen a price increased more than 60 % over local encryption exchange.

Currencies are still common in South Korea

The port explained that MEV is a currency issued by the Me2on listed in Kosdaq.

Meanwhile, FANC has been released by Celebe, a Seoul -based emerging company specialized in mobile applications and social media services.

Either way, 99 % or more of the global trading volume of operations on local stock exchanges such as Bithumb and Coinone are done. Biz Watch Books:

“Many of these coins have been ignored by investors for a long time. Trading sizes and market prices were at the bottom of the rocks. With the marketing of the market, it has become difficult to find information about the levels of project activity and technological capabilities.”

Experts, warning

APYWA is an analyst in South Korea provides evaluation degrees for local and international projects. You study in cWith 41.48 points out of 100.

On the contrary, it is classified by BTC at A+ by about 95 points. MEV 45.83 points (row C), with STMX A B-and Bora A B.

APYWA specializes in coins points that show relatively low levels of societal activity and development activity.

Although it is unclear whether any of the projects have any relationship with government Stablecoin plans, experts believe that high prices may be attributed to potential relations with Stablecoins abroad such as Tether (USDT) or USA (USDC).

In other cases, the currencies of these projects may have some payment functions and/or the settlement that caught the attention of some merchants.

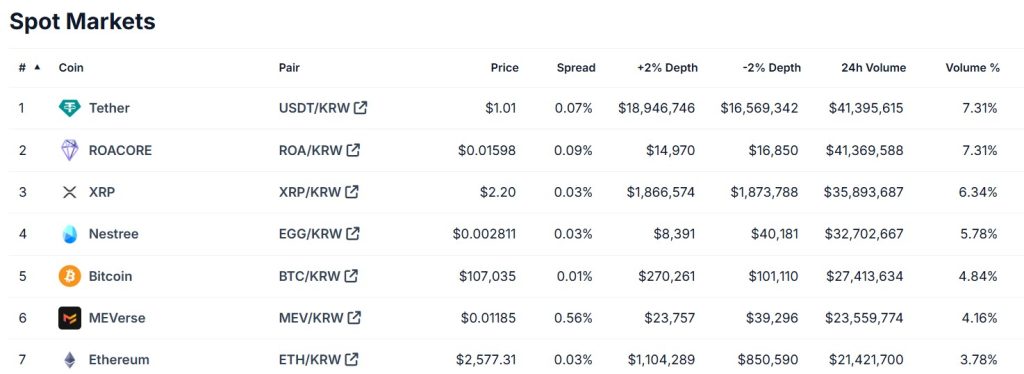

At the time of writing this report, the MEV trading volumes on Bithumb were outperforming those in ETHEREUM (ETH) and Solana (Sol).

Lessons from the past?

However, experts told the same media that they were concerned about market confusion and the risk of possible investor damage. The Securities Company, whose name was not revealed, said:

“With the government pushing to issue a stablecoin that is offered and offered, Fintech and Blockchain companies announce action plans, one by one. It claims importance, and its prices are rising.”

The coding industry added to the following:

“In the past, projects such as Paycoin (PCI) increased when the local sages stablecoins were a big thing. Then they continued to decrease by more than 30 % within a few days. In the same way, the WON Stablecoins coin can also decrease at any time. Investors must look carefully in the event of operation and business rights for projects.

https://cimg.co/wp-content/uploads/2025/06/15142756/1749997676-image-1749974419398_optimized.jpg

2025-06-15 23:30:00