Japanese Metaplanet up to 20,000 BTC holdings after a new purchase, stock reactions star-news.press/wp

Japan’s Metaplanet continued the aggressive bitcoin accumulation strategy, announcing another major purchase. The company now owns 20,000 BTC in its wardrobe. The company’s shares’ reaction was after the announcement.

Metaplanet crosses 20,000 Bitcoin teachers

In the latest DetectionMetaplanet confirmed that it had received 1,009 Bitcoins for about 16.48 billion yen (about 112 million dollars). With this addition, the company is now 20,000 BTC now. This represents a new milestone for the company, which enhances the treasury strategy.

The symbols were purchased at a cost of 15.1 million yen per currency, equivalent to about $ 102,700. The company’s cumulative investment is now 302.3 billion yen (about 2 billion dollars).

This new acquisition is closely followed by a precedent purchase Metaplanet 103 BTC added At $ 11.6 million. At that time, the company reported the average purchase price of $ 113,491 per code.

The Japanese company relies on the rapid accumulation strategy to remain able to compete with other cabinet in Bitcoin. Recently, The strategy revealed that it was She got 3,081 BTC for $ 356.9 million. This raised its total reserves to 632,457 BTC, which represents more than 3 % of the total offer.

Metaplanet reaches 20,000 BTC and puts it firmly between prominent bitcoin bonds in the world. Its aggressive strategy also highlights how companies are increasingly dealing with the leading cryptocurrency as a strategic reserve origin.

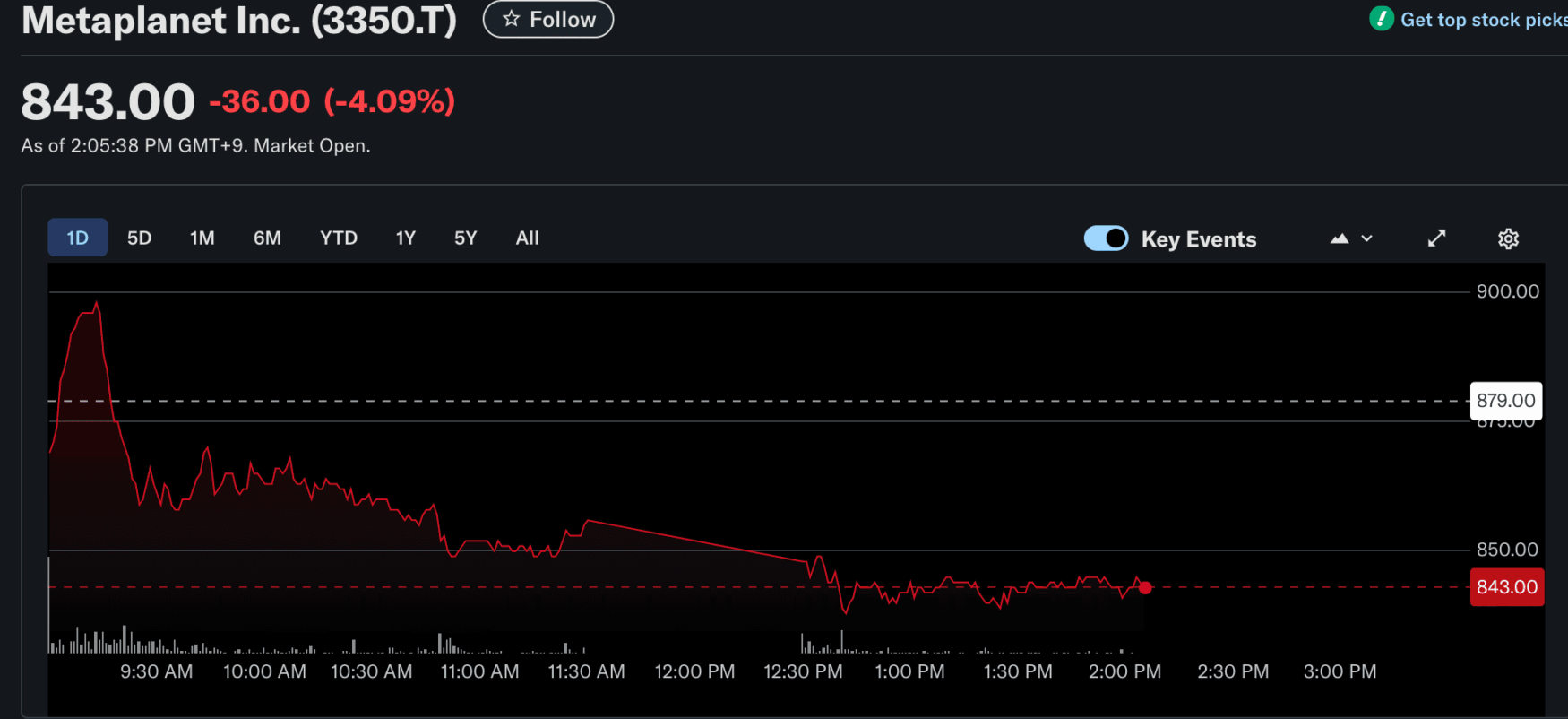

Securities market reaction to buy bitcoin

Despite its purchases, the company’s shares showed mixed performance. After the announcement, its shares Decline 4 % to 844 yen, a decrease of approximately 7 % from the previous week. Analysts attribute the weakness to a broader shrinkage.

Bloomberg Reports The shares of the company, which increased more than 400 % earlier in 2025, have been nearly half of its value since mid -June. This decline threatens the company’s ability to rely on an unusual financing strategy.

In response, Metaplanet has revealed plans to raise $ 884 million By selling shares abroad through a written offer, with flexibility to expand the deal. The company will also seek to obtain shareholders ’approval to issue favorite stocks. This aims to improve its financing options for more BTC in the future.

In addition, the investment company Eric Trump granted 3.3 million shares in the company through the rights to acquire stocks. This links Bitcoin’s vision to the company with international financial and political departments.

Although its shares fluctuate, the company is still committed to expanding Bitcoin’s bodies and enhancing its public budget by financing stocks.

At the same time, and Bitcoin price It decreased, 5 % decreased last week. Since the market morale is still down, many of this is due to large output flows of investment funds circulating in Bitcoin.

<!–

–>

<!–

–>

Leave responsibility: The content and the personal views of the author and the current market conditions reflect. Please do your own research before investing in encrypted currencies, because the author and the post is responsible for any financial losses.

AD disclosure: This site may feature content with care and subsidiary links. All ads are clearly marked, and advertising partners have no effect on our editing content.

<!–

View all

–>

https://coingape.com/wp-content/uploads/2025/06/Metaplanets-Big-Bet-on-Bitcoin-5.4B-Raise-To-Fuel-210000-BTC-Ambitions.webp

2025-09-01 05:26:00

partner: