The survey in a poll finds that the Japanese encryption tax repair will stimulate BTC BIZ star-news.press/wp

Most Japanese say they will buy more bitcoin (BTC), ETHEREUM (ETH) and altcoins if the government agrees to reform the strict coding bases in the country.

This was the main meals from A survey of 1,500 people conducted in April and assigned by the Japanese Blockchain Association (JBA).

Jaba says Japanese encryption repairs will lead to an increase in size.

In response to the question: “Do you have BTC or other encryption?” 13 % of the respondents responded in the affirmative.

However, their response to the follow -up question was saying. The question was: “Will you buy encryption/more encryption if the government would put a 20 % flat tax rate on encryption profits?”

For this, 84 % of 191 respondents who said they were carrying “yes” encryption.

12 % of the non -unpopular holders agreed that they will start buying metal currencies if the green vegetable tax repairs in Tokyo.

Request for capital profits

JBA suggested that the survey shows that tax repairs will have a very noticeable impact on trading volumes of local exchanges.

Nowadays, Japanese investors must announce their profitable profits on income tax declarations, in the “other income” category.

This means that based on their tax cutters, encryption investors may have to pay taxing up to 55 % on their profits.

In many other countries, encryption is subject to capital tax. This means that after a specific threshold, taxes are imposed on merchants at a fixed rate of 10-20 %.

Tokyo reform defenders want to agree to a plan to cancel encryption income tax laws. In their place, they want to impose 20 % capitalist gains.

JBA supports this proposal, as many major members of the ruling liberal Democratic Party, as well as opposition legislators.

However, the FSA Agency effectively has the final statement in all Japanese encryption policy.

So far, all FSA recommendations have been devoted to the Cabinet in the Law.

The association said: “The encryption changes from a way to pay the public to a means of accumulating assets.”

This is in line with the special FSA plans to re -classify the encryption as an investment car payment tool.

The Industry Authority says it “intensifies its efforts” to persuade Tokyo to agree to tax reform starting next year.

JBA is an industrial group that includes some of the country’s largest encryption companies and Blockchain companies.

JBA offers a petition

The association also announced on July 18 that it had submitted a petition to FSA to agree to the tax reform of the encryption profits.

The survey was conducted on April 24 and April 25 this year. The respondents were all Japanese population between the ages of 20 and 69. The respondents were 60 % of males and 40 % of females, with an average age of 38.

JBA also asked more questions. 75 % of the respondents said that they prefer the tax bodies over the withdrawal of their payment taxes at the source, instead of issuing separate tax advertisements.

JBA also requested to allow encryption traders to choose how to pay taxes: in the source when they sell coins, or after providing ads.

The reconnaissance authors also asked the respondents who are not currently carrying any metal currencies why they have not yet been invested.

For this, 8 % of the respondents said they believed that the tax levels were very high. But 61 % said they believed that they lack a sufficient understanding of encryption.

Japanese media Coinpost mentioned FSA is now “a proposal to transfer encryption to the framework of the financial tools law and exchange.”

“If the transition is approved, Cryptoassets will be officially classified as financial products,” the media outlet.

Most respondents said they are working in the private sector. Students make up 5.3 % of the respondents complex. And 213 unemployed individuals also provided responses.

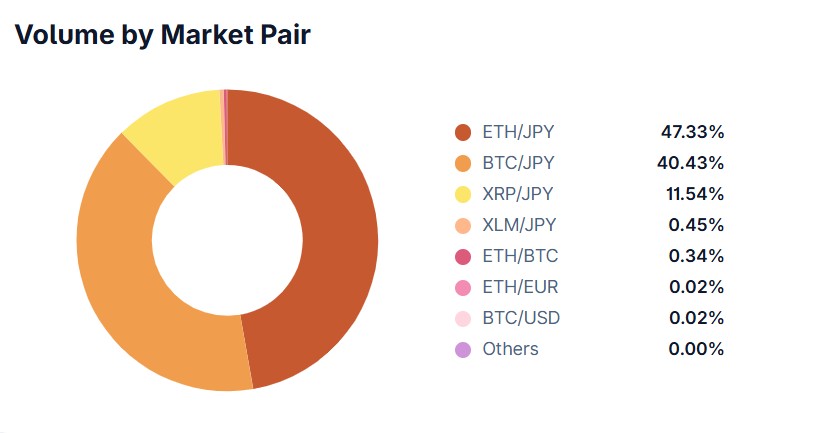

At the time of writing this report, Eth Trading represents nearly half of the BitFlyer trading volume, one of the largest encryption exchanges in the country.

https://cimg.co/wp-content/uploads/2025/07/20150459/1753023898-image-1752995951937.jpg

2025-07-20 23:30:00