The Japanese company Remixpoint is securing a $ 215 million financing to buy 3000 bitcoins star-news.press/wp

The Japanese Energy Consulting Company REMIXPoint raised about 31.5 billion yen (215 million dollars) through a specific financing round exclusively for bitcoin investments.

The company announced that its short -term goal is to get 3000 BTCAlthough this goal may be modified based on the price of the Bitcoin market and the stock performance for Remixpoint (3825.T).

On July 9 statement Remagcote, translated from Japanese, explained, “,”We have become more convinced of the Bitcoin future, and this decision is the result of extensive discussions to enhance the value of companies from the perspective of risk, while maintaining future options open as well.“

Japanese Remixpoint building on the current Bitcoin strategy

Remixpoint Bitcoin has been accumulating since September 2024, as she has created herself as an important holder for the company in the coded currency area.

according to Bitcoin bonds Data, REMIXPoint occupies the 30th company inserted by Bitcoin Holdings with 1,051 BTC, companies like Nano Labs and the most intelligent web company at the time of writing this report.

The company’s commitment to Bitkeen was shown earlier this year when it agreed to purchase Bitcoin 1 billion yen ($ 7 million) after the board’s decision in May.

Beitcoin, Remixpoint has expanded digital asset holdings to include ETHEREM (Eth), Solana (Teller), Avalanche (Avax).

In September 2024, the company invested about $ 351,700 to get 130.1 ETH, 2,260.5 Sol and 12,269.9 Avax icon.

The Japanese encryption company’s commitment extends to executive compensation, as the company has become the first entity listed on the Tokyo Stock Exchange to pay the CEO and the entire president in Bitcoin.

According to the report, CEO Yoshiko Takahashi described this decision as “A clear signal“From his commitment to the value of companies and governance that focuses on shareholders.

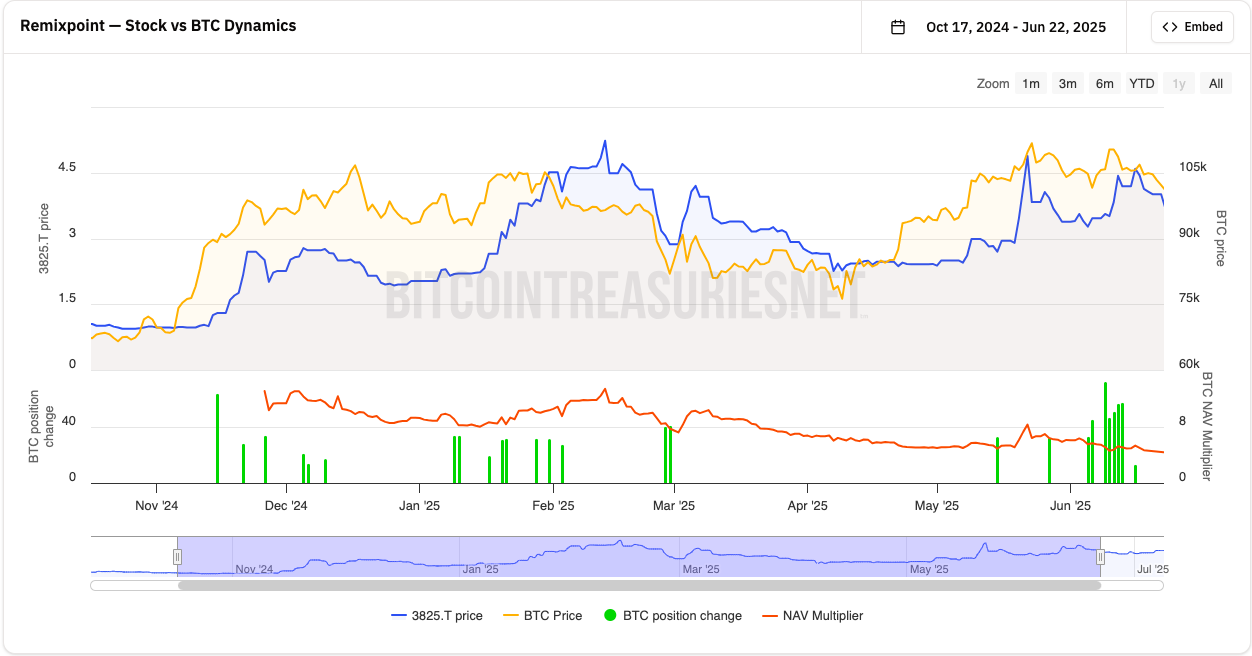

Moreover, the REMIXPoint share price showed a strong association with the performance of Bitcoin, as it benefited from the success of the encrypted currency.

When Bitcoin reached its lowest level of $ 77,000 in April, 3825.T was traded at $ 328 ($ 2.26). With Bitcoin rising above $ 109,000 in May, the share price increased more than twice to 701 ¥ ($ 4.88).

At the time of the press, Remixpoint is involved in trade at 592 yen, which reflects an increase of 3.86 % in the past 24 hours and more than 64 % of gains on an annual basis, According to Google’s funding.

Japanese bitcoin adoption

The RemixPoint strategy is in line with the emerging trend between companies listed to the public that integrates Bitcoin into its public budgets.

While the US -based companies marvel at their headquarters Microstrategy circulated this approachRemixpoint joins a growing list of Japanese companies that adopt similar models.

Metaplanet, another Japanese company that focuses on Bitcoin, has constantly expanded BTC holdings.

On Monday, Metaplanet bought an additional 2,205 BTC, with Bitcoin’s total biotoes reached 15555 BTC, at a value of 225.8 billion yen ($ 1.7 billion).

In April, SBC Medical Group Clinic Medical Group Holdings, the Medical Group Medical Clinic, which is worth more than $ 418,000.

Moreover, the advanced organizational scene in Japan supports increased accreditation of cryptocurrencies.

The country is preparing to formally recognize encryption assets as financial products under its financial tools law and exchange them and move towards approval of the investment funds circulating in Bitcoin.

These developments are expected to encourage more Japanese companies and citizens to embrace Bitcoin and Cryptocurrency investments.

Government officials also consider bitcoin as a backup asset.

Satoshi Hamada, a member of Parliament from the party to protect the people from NHK, called for the creation of a national bitcoin reserve, similar to the recent proposals submitted by legislators in Argentina, Russia and other countries.

https://cimg.co/wp-content/uploads/2025/07/09144339/1752072218-image-1752072168799_optimized.jpg

2025-07-09 14:47:00