Will Jackson Hall lead to Bitcoin? Analysts weigh star-news.press/wp

Bitcoin (BTC) traders watch this year’s Economic Jackson Hall’s Economic Symposium.

Market accounts are close to the possibility that the annual gathering of central bankers will be a pivotal moment of risk origins, such as bitcoin.

Jackson Hall to influence Bitcoin and liquidity markets

The Jackson Hole symposium has a long record of shaking global markets. However, with liquidity dynamics, inflation pressures, and policy expectations this time, some analysts see the Federal Reserve Bank in Wyoming as a potential bi -up to Bitcoin.

Ben Bernanke used it in 2010 to refer to quantitative dilution (QE), while Jerome Powell’s speech 2022, with his honesty, sent shares.

Analysts argue that such historical precedents highlight why encryption markets should pay attention to.

“Jackson Hall was a place for the important data that turned the markets. Make up.

In the follow -up analysis, Kerem added that Powell’s speech on August 22 would be pivotal in determining the extent of the Federal Reserve’s proximity to the reduction of September prices.

Besides the release of the basic PCE data later in the month, the event can help draw the risk assets path in the fall.

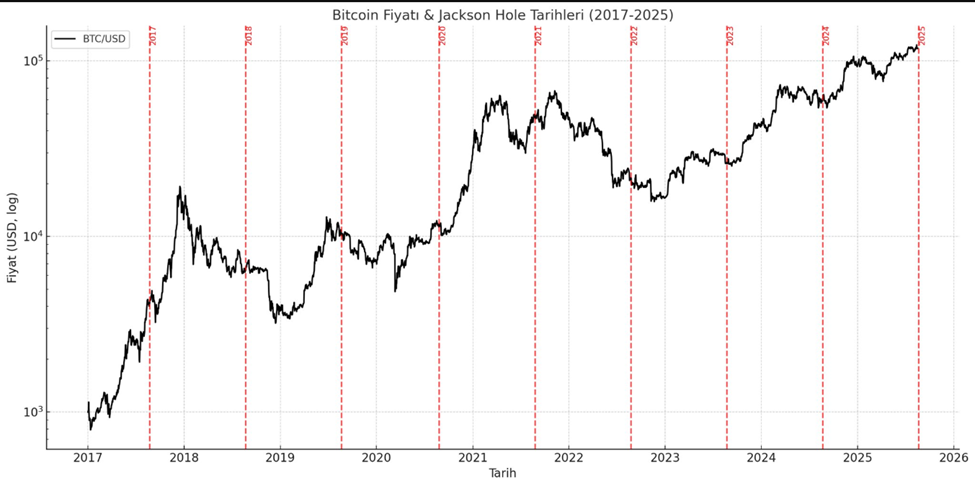

Historical patterns around Jackson Hall add additional weight to the market anticipation. Oraclum Capital has highlighted that almost every meeting of Jackson in the past seven years has followed a correction, with a single exception in 2023.

That year, Powell announced an victory over inflation and indicated that price discounts are approaching and raising the markets instead of sinking them.

“FOMC’s repetition in July and a somewhat honest message is not priced on the market. This may be a incentive for a regular sale in Aug-Aug. However, if Powell turns to Dovish, this may be a big boost to stocks; there is another certain in such a case.” books.

The issue of the upcoming result

Not all analysts are preparing for turmoil. Some argue that the conditions of macroeconomics can make Jackson Hall this year a bullish event for Bitcoin.

Capital flows indicated that the direction of non -cultivated salaries for a period of three months (NFP) is still positive, and shows a constant creation in job opportunities.

Meanwhile, all inflation indicators such as PCE, CPI and PPI were surprised in all the upward trend, while inflation bodies sit over 3 %.

At the same time, credit differences narrowed to the lowest point in the cycle, indicating that the markets are far from pricing in stress.

“Growth and inflation are accelerating … The Federal Reserve allowed 50 basis points of price cuts in the front markets,” books Capital flows.

He argued with capital flows that this represents a policy error that creates a positive motivation for liquidity, which causes high asset prices.

The implicit meaning is that as long as the Federal Reserve avoids the reflection of acute charity in Jackson Hall, liquidity dynamics can continue to support bitcoin and shares.

The Federal Reserve Chair will face tension in finding a balance between reassuring markets and maintaining credibility to inflation.

On the one hand, if the Federal Reserve is the one that may rise, long rates may rise with the benefit of investors whether the policy is excessively equal. However, if it is very hawk, the markets may quickly restore the risks, which leads to fluctuations through stocks, bonds and encryption.

The result can depend on the tone. FOMC risk repetition is repeated in July, which sparked “normal AUG-SeP sale.

Bitcoin’s direction may stop in the short term on its basics and more on Powell’s words in Wyoming on Friday.

Will the Jackson Post a hole to the Bitcoin gathering? Analysts weigh first weighing on Beincrypto.

[og_img]

2025-08-19 07:35:00